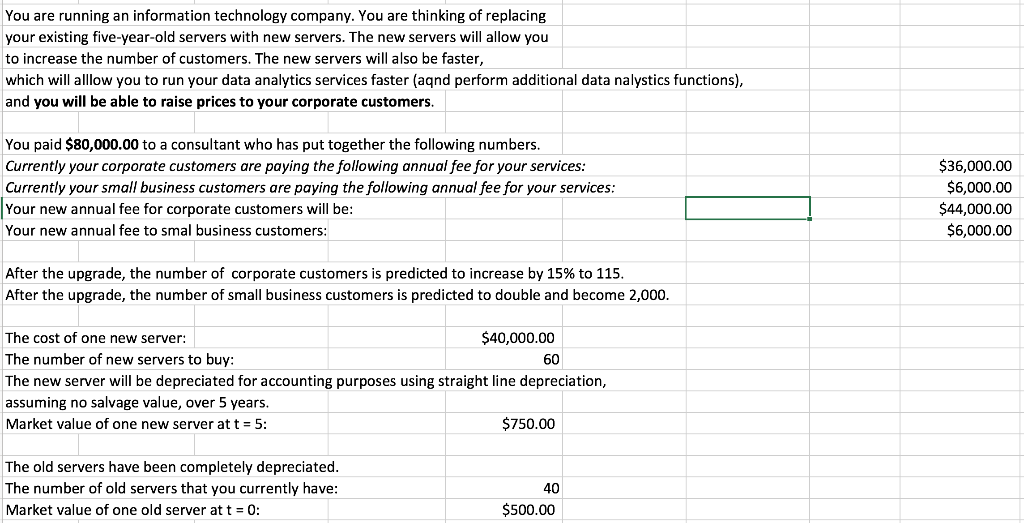

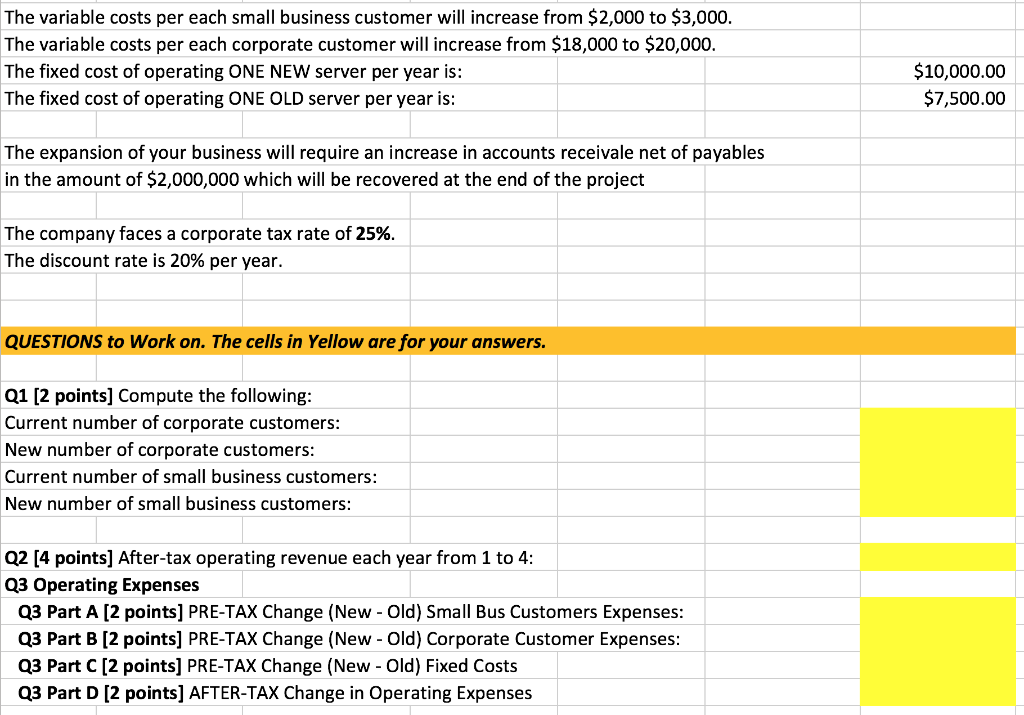

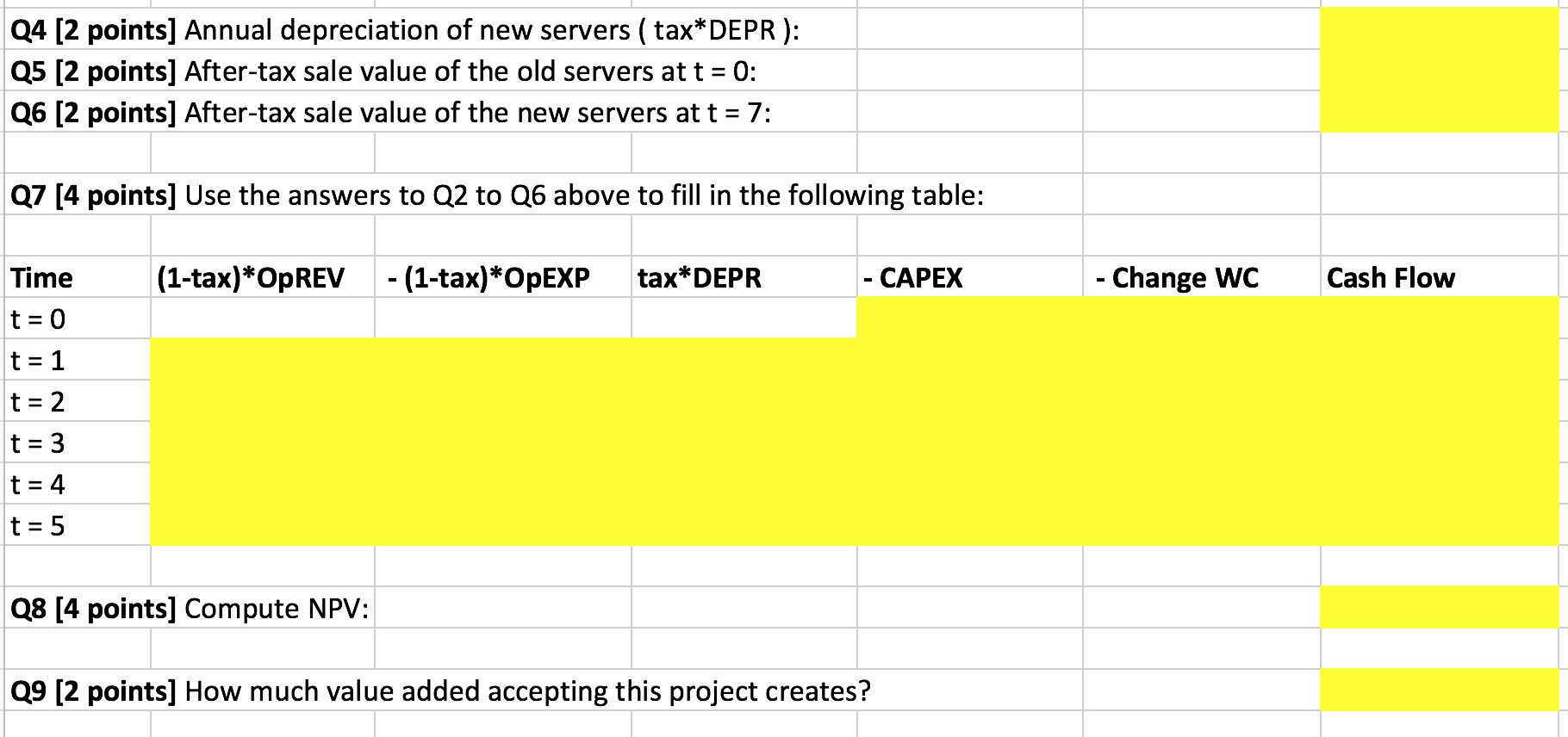

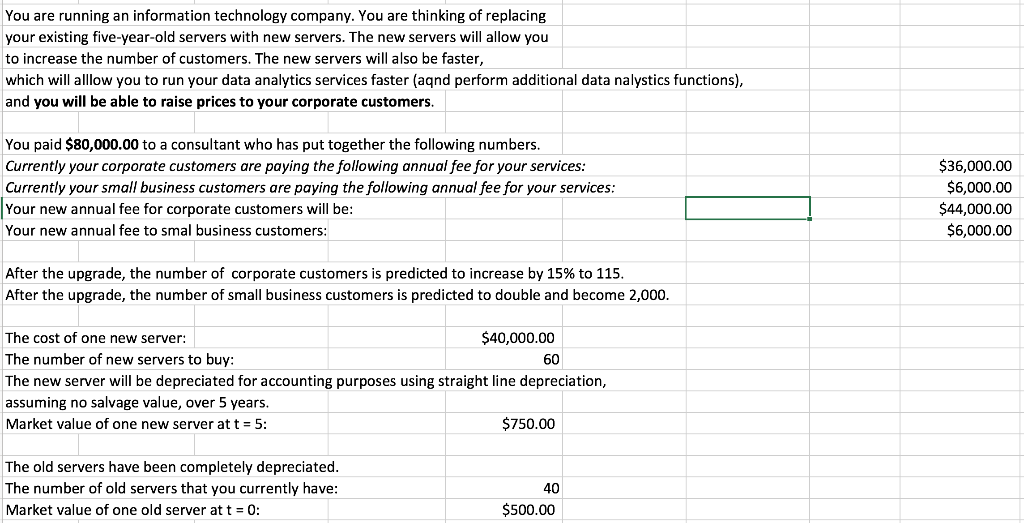

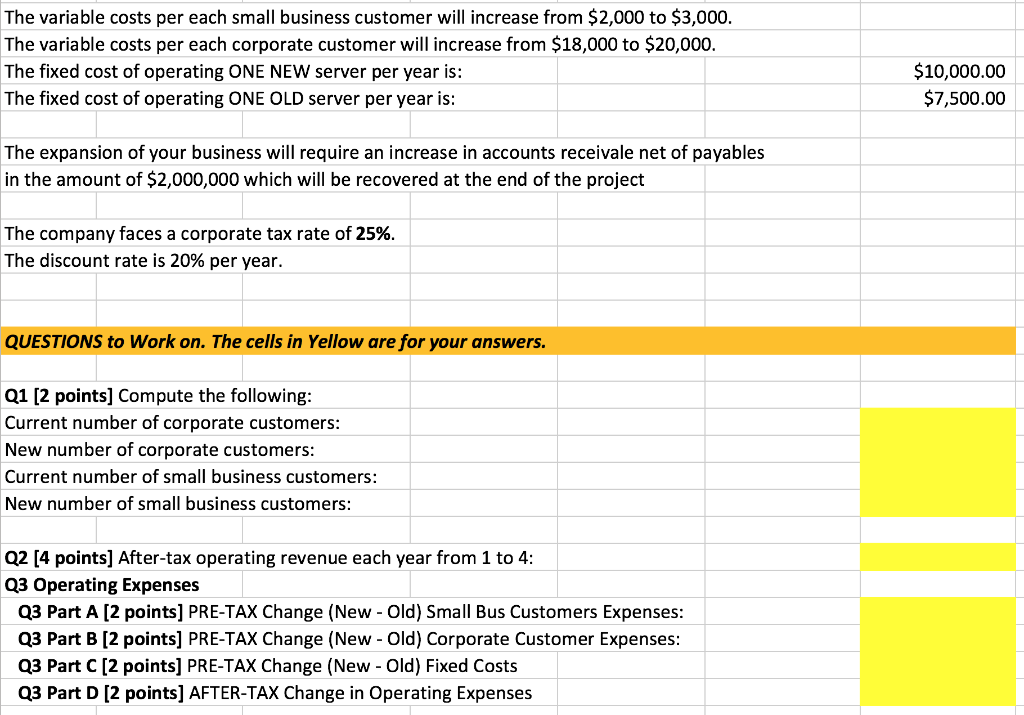

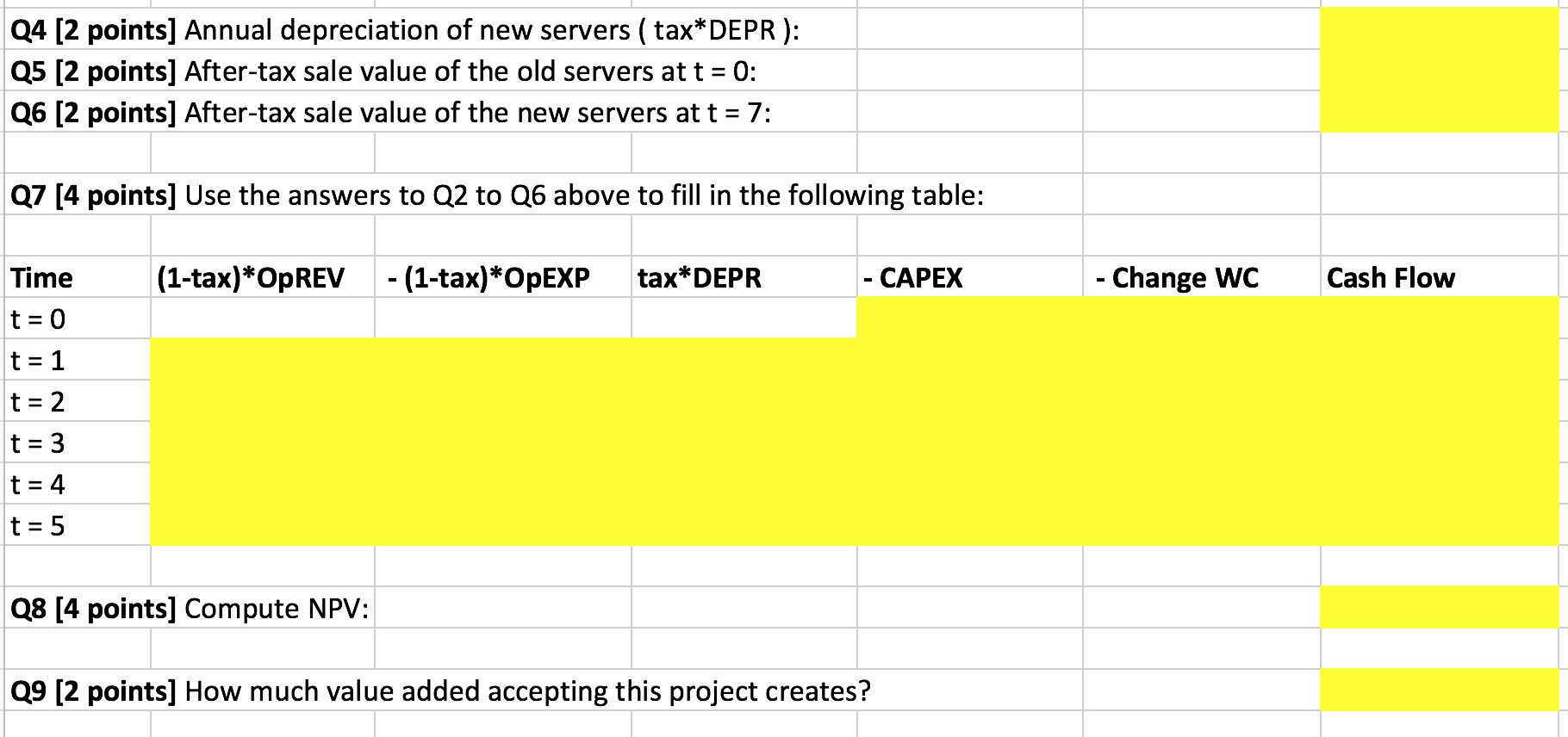

You are running an information technology company. You are thinking of replacing your existing five-year-old servers with new servers. The new servers will allow you to increase the number of customers. The new servers will also be faster, which will alllow you to run your data analytics services faster (aqnd perform additional data nalystics functions), and you will be able to raise prices to your corporate customers. You paid $80,000.00 to a consultant who has put together the following numbers. Currently your corporate customers are paying the following annual fee for your services: Currently your small business customers are paying the following annual fee for your services: Your new annual fee for corporate customers will be: Your new annual fee to smal business customers: $36,000.00 $6,000.00 $44,000.00 $6,000.00 After the upgrade, the number of corporate customers is predicted to increase by 15% to 115. After the upgrade, the number of small business customers is predicted to double and become 2,000. The cost of one new server: $40,000.00 The number of new servers to buy: 60 The new server will be depreciated for accounting purposes using straight line depreciation, assuming no salvage value, over 5 years. Market value of one new server at t = 5: $750.00 The old servers have been completely depreciated. The number of old servers that you currently have: Market value of one old server at t = 0 40 $500.00 The variable costs per each small business customer will increase from $2,000 to $3,000. The variable costs per each corporate customer will increase from $18,000 to $20,000. The fixed cost of operating ONE NEW server per year is: The fixed cost of operating ONE OLD server per year is: $10,000.00 $7,500.00 The expansion of your business will require an increase in accounts receivale net of payables in the amount of $2,000,000 which will be recovered at the end of the project The company faces a corporate tax rate of 25%. The discount rate is 20% per year. QUESTIONS to Work on. The cells in Yellow are for your answers. Q1 [2 points] Compute the following: Current number of corporate customers: New number of corporate customers: Current number of small business customers: New number of small business customers: Q2 [4 points] After-tax operating revenue each year from 1 to 4: Q3 Operating Expenses Q3 Part A [2 points] PRE-TAX Change (New - Old) Small Bus Customers Expenses: Q3 Part B (2 points) PRE-TAX Change (New - Old) Corporate Customer Expenses: Q3 Part C (2 points) PRE-TAX Change (New - Old) Fixed Costs Q3 Part D [2 points) AFTER-TAX Change in Operating Expenses Q4 [2 points] Annual depreciation of new servers (tax* DEPR): Q5 [2 points] After-tax sale value of the old servers at t = 0: Q6 [2 points) After-tax sale value of the new servers at t = 7: Q7 (4 points) Use the answers to Q2 to 26 above to fill in the following table: Time (1-tax)*OPREV - (1-tax)*OPEXP tax*DEPR - CAPEX - Change WC Cash Flow t=0 t=1 t = 2 t=3 t = 4 t = 5 Q8 [4 points] Compute NPV: Q9 [2 points) How much value added accepting this project creates