Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are saving $10,000 a year at the beginn!ng of each year from 2 through 12, inclusive, that can be used to meet your obligations.

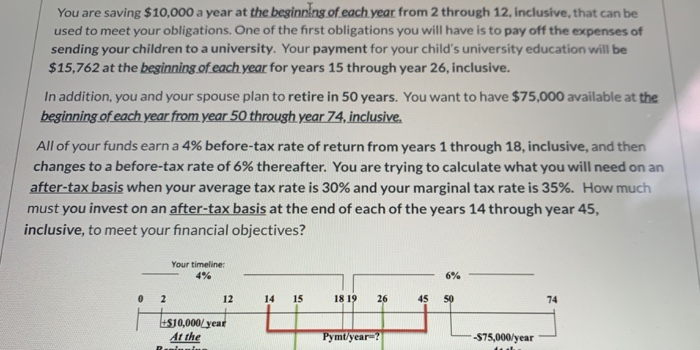

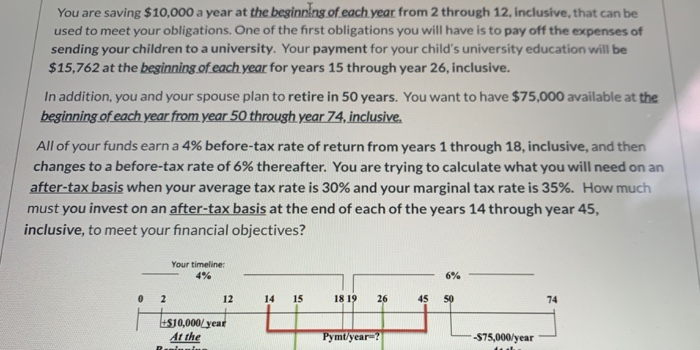

You are saving $10,000 a year at the beginn!ng of each year from 2 through 12, inclusive, that can be

used to meet your obligations. One of the first obligations you will have is to pay off the expenses of

sending your children to a university. Your payment for your child's university education will be

$15,762 at the beginning of each year for years 15 through year 26, inclusive.

In addition, you and your spouse plan to retire in 50 years. You want to have $75,000 available at the

beginning of each year from year 50 through year 74, inclusive.

All of your funds earn a 4% before-tax rate of return from years 1 through 18, inclusive, and then

changes to a before-tax rate of 6% thereafter. You are trying to calculate what you will need on an

after-tax basis when your average tax rate is 30% and your marginal tax rate is 35%. How much

must you invest on an after-tax basis at the end of each of the years 14 through year 45,

inclusive, to meet your financial objectives?

please show the work so i understand my mistake. thank you. today if possible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started