Question

You are studying a potential new chemical process where the plant cost (including off-site equipment and start-up) is estimated to be Rs 500 Crore. The

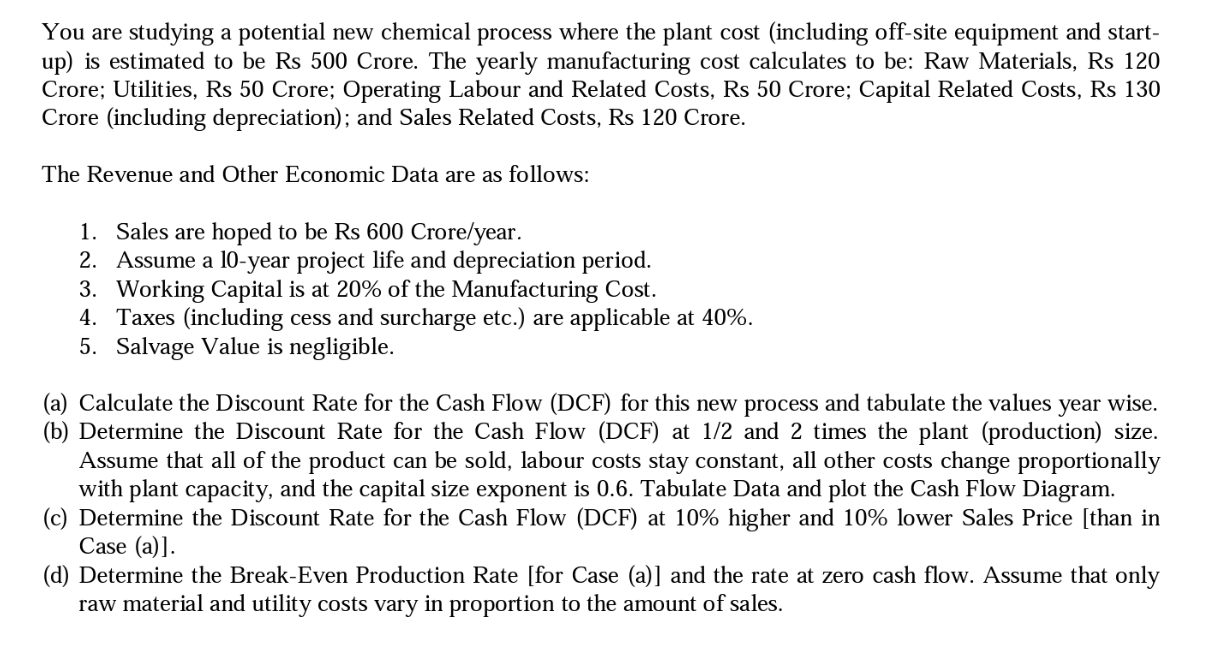

You are studying a potential new chemical process where the plant cost (including off-site equipment and start-up) is estimated to be Rs 500 Crore. The yearly manufacturing cost calculates to be: Raw Materials, Rs 120 Crore; Utilities, Rs 50 Crore; Operating Labour and Related Costs, Rs 50 Crore; Capital Related Costs, Rs 130 Crore (including depreciation); and Sales Related Costs, Rs 120 Crore.

The Revenue and Other Economic Data are as follows:

1. Sales are hoped to be Rs 600 Crore/year. 2. Assume a 10-year project life and depreciation period. 3. Working Capital is at 20% of the Manufacturing Cost. 4. Taxes (including cess and surcharge etc.) are applicable at 40%. 5. Salvage Value is negligible. (a) Calculate the Discount Rate for the Cash Flow (DCF) for this new process and tabulate the values year wise.

(b) Determine the Discount Rate for the Cash Flow (DCF) at 1/2 and 2 times the plant (production) size. Assume that all of the product can be sold, labour costs stay constant, all other costs change proportionally with plant capacity, and the capital size exponent is 0.6. Tabulate Data and plot the Cash Flow Diagram. (c) Determine the Discount Rate for the Cash Flow (DCF) at 10% higher and 10% lower Sales Price [than in Case (a)].

(d) Determine the Break-Even Production Rate [for Case (a)] and the rate at zero cash flow. Assume that only raw material and utility costs vary in proportion to the amount of sales.

You are studying a potential new chemical process where the plant cost (including off-site equipment and start- up) is estimated to be Rs 500 Crore. The yearly manufacturing cost calculates to be: Raw Materials, Rs 120 Crore; Utilities, Rs 50 Crore; Operating Labour and Related Costs, Rs 50 Crore; Capital Related Costs, Rs 130 Crore (including depreciation); and Sales Related Costs, Rs 120 Crore. The Revenue and Other Economic Data are as follows: 1. Sales are hoped to be Rs 600 Crore/year. 2. Assume a 10-year project life and depreciation period. 3. Working Capital is at 20% of the Manufacturing Cost. 4. Taxes (including cess and surcharge etc.) are applicable at 40%. 5. Salvage Value is negligible. (a) Calculate the Discount Rate for the Cash Flow (DCF) for this new process and tabulate the values year wise. (b) Determine the Discount Rate for the Cash Flow (DCF) at 1/2 and 2 times the plant (production) size. Assume that all of the product can be sold, labour costs stay constant, all other costs change proportionally with plant capacity, and the capital size exponent is 0.6. Tabulate Data and plot the Cash Flow Diagram. (c) Determine the Discount Rate for the Cash Flow (DCF) at 10% higher and 10% lower Sales Price [than in Case (a)] (d) Determine the Break-Even Production Rate [for Case (a)] and the rate at zero cash flow. Assume that only raw material and utility costs vary in proportion to the amount of sales. You are studying a potential new chemical process where the plant cost (including off-site equipment and start- up) is estimated to be Rs 500 Crore. The yearly manufacturing cost calculates to be: Raw Materials, Rs 120 Crore; Utilities, Rs 50 Crore; Operating Labour and Related Costs, Rs 50 Crore; Capital Related Costs, Rs 130 Crore (including depreciation); and Sales Related Costs, Rs 120 Crore. The Revenue and Other Economic Data are as follows: 1. Sales are hoped to be Rs 600 Crore/year. 2. Assume a 10-year project life and depreciation period. 3. Working Capital is at 20% of the Manufacturing Cost. 4. Taxes (including cess and surcharge etc.) are applicable at 40%. 5. Salvage Value is negligible. (a) Calculate the Discount Rate for the Cash Flow (DCF) for this new process and tabulate the values year wise. (b) Determine the Discount Rate for the Cash Flow (DCF) at 1/2 and 2 times the plant (production) size. Assume that all of the product can be sold, labour costs stay constant, all other costs change proportionally with plant capacity, and the capital size exponent is 0.6. Tabulate Data and plot the Cash Flow Diagram. (c) Determine the Discount Rate for the Cash Flow (DCF) at 10% higher and 10% lower Sales Price [than in Case (a)] (d) Determine the Break-Even Production Rate [for Case (a)] and the rate at zero cash flow. Assume that only raw material and utility costs vary in proportion to the amount of salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started