Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are Sue Campbell, your family has been farming this land for over 100 years and you intend to keep the farm running for

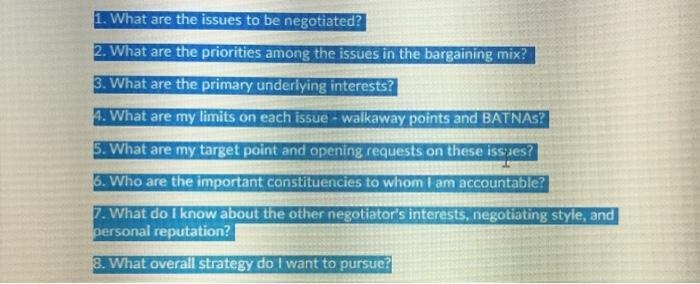

You are Sue Campbell, your family has been farming this land for over 100 years and you intend to keep the farm running for many years to come. The Campbell-Lessing farms are two multi-generational farms, owned by you and your husband, James Campbell. You and James have run the Campbell farm since the death of his father 32 years ago, and the joint farm since you inherited the Lessing land at your father's death 29 years ago. It took the two of you some time to get the hang of running the farm, and to be honest, you really struggled when your two boys were younger, but in the past ten years you and James have doubled the size of the operation. Before the boys went away to college, you weren't focused enough on the operation. At present the farm is dedicated to two specific areas of operation. The first is a crop business. Current crops include dry land wheat and grain sorghum, as well as irrigated sorghum. The second part of the operation is a cattle business. You and James own a 150 unit cow-calf herd and graze 1500 head of stocker cattle on your wheat fields during the winter months. Your oldest son, Joe Campbell, works the cattle side of the business. In addition to the Campbell ranch, your family was also involved in farming in the Perryton area. In fact, you and your brother Bob, own much of the surrounding farm area. You and Bob have recently achieved a Texas Heritage Farm designation, for family farms that have been in operation for over 100 years. Bob is farming some of the Lessing land, and is considering leasing the remainder to you and James. Bob is your older brother by fourteen years, and inherited the better sections of the Lessing farm. Bob's four-plus sections (totaling 2760 acres) have access to water and are irrigated. Bob's wife Alma passed away suddenly three years ago. This, coupled with Bob's failing health, is diminishing Bob's will and ability to continue farming. James is a good husband and a good farmer. He works hard at the operation. He doesn't always understand the financial implications of his decisions. In fact, he rarely looks at the books. James is a farmer and focuses on that aspect of the business. This sometimes causes problems with the operation. This year is a good example. This year has been an unusual year for you. Your total operating profit was positive at $270,000. However, James needed to modernize some equipment and the two of you are in the fourth year of paying off a land purchase. For these reasons, you have an operating loss after taxes of almost $100,000 (see attached financial disclosure). While you don't get rich with the operation, you rarely operate under a loss. Profits are modest, but have been positive year after year. The crops did well this year, but not great. Your feeling is that James is unwilling to try risky new farming methods or to grow crops other than the proven sorghum crops the two of you have been growing for over 30 years. You have seen other farms in the area take on crops such as cotton and corn. So you know that it is possible to grow other crops. But corn needs to be irrigated. And corn needs some expertise from the farmer that James may not possess. At least the cattle operation makes money every year. I guess you could say, it's the cash cow of the operation. N Your oldest son, Joe returned to work on the farm about 10 years ago - when he flunked out of college. Joe is a hard worker and does a good job with the cattle side of the business, an area that James never excelled in. Joe and Sara live close to you on some of the Campbell land (maybe a bit too close). But that means your grandkids live close too. Joe and Sara have three kids. They try hard to make ends meet on Joe's salary. Sara doesn't work, except chasing those kids around. But Joe has to travel to meet with breeders and buyers for the cattle. He spends a bunch of time away from the farm, in Oklahoma mostly. This gets expensive, so you usually end up helping Joe and Sara out. You give Joe $500 a month. No one knows about it except you and Joe. You don't even think Sara knows. But Joe deserves it. You never show these extra payments on the financial statements, the money comes out of your discretionary fund. You just want your grandkids to have the best. Andy (your youngest son) and his wife, Charlene, are coming home to Perryton this weekend for your birthday. You would never admit it, but Andy has always been your favorite child. Andy was always a good student and he is being rewarded for that now. You know that Andy is considering several offers for employment with various reputable companies. He worked for Monsanto in Dallas before he went back to Texas A&M for his Master's degree in Agribusiness. You Andy (your youngest son) and his wife, Charlene, are coming home to Perryton this weekend for your birthday. You would never admit it, but Andy has always been your favorite child. Andy was always a good student and he is being rewarded for that now. You know that Andy is considering several offers for employment with various reputable companies. He worked for Monsanto in Dallas before he went back to Texas A&M for his Master's degree in Agribusiness. You know that he enjoyed that job, and Monsanto would be foolish to let him work elsewhere. He does have two other offers that you know of, one with Cargill in Minnesota, and one with DuPont in Tulsa. You believe that he may want to work for Cargill in Minneapolis, for a number of reasons. He and Charlene did live in Dallas, so Minneapolis would be similar, albeit colder. The Cargill job would be a great use of Andy's talents and education. And Charlene is probably pushing him to go there. Charlene is into fashion and probably sees Minneapolis as her best chance to have a career. Charlene has travelled extensively, even living in Italy for a job one summer. However, Charlene's parents live in Oklahoma City, which is a short drive from Tulsa, so you imagine Charlene wouldn't mind Tulsa. You believe that Andy would not be likely to return to the farm for the same pay that Joe is getting now. His education commands a higher salary. You are willing to pay Andy $3500-4000 per month, gross. This may necessitate giving Joe a raise, but you hope that the money you give Joe under the table will be enough to keep him happy. Of course Andy and Charlene can move into the doublewide now that Joe and his wife Sara have moved out. You really want Andy to come home to Perryton. Even though Charlene is not the best wife for him, she is the only chance you have for more grandkids. She would be ok as a mother. But you really want the grandkids to be here. You want a hand in raising those grandkids. Your goal for this meeting is to bring Andy back home. You have put your life into this farm. You believe that Andy has always thought about returning to the farm someday. Leasing Bob's land should make this opportunity much more attractive to Andy. Your goal is for you and James to lead the operation for the next ten years. After that you will leave the farm to the boys. While maintaining control is important, you would trade almost anything to bring Andy back home, even giving him some control over the operation. 1. What are the issues to be negotiated? 2. What are the priorities among the issues in the bargaining mix? 3. What are the primary underlying interests? 4. What are my limits on each issue - walkaway points and BATNAS? 5. What are my target point and opening requests on these issues? 6. Who are the important constituencies to whom I am accountable? 7. What do I know about the other negotiator's interests, negotiating style, and personal reputation? 8. What overall strategy do I want to pursue?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started