Answered step by step

Verified Expert Solution

Question

1 Approved Answer

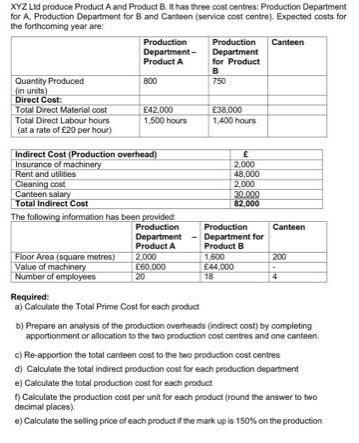

XYZ Ltd produce Product A and Product B. It has three cost centres: Production Department for A, Production Department for B and Canteen (service

XYZ Ltd produce Product A and Product B. It has three cost centres: Production Department for A, Production Department for B and Canteen (service cost centre). Expected costs for the forthcoming year are: Quantity Produced (in units) Direct Cost: Total Direct Material cost Total Direct Labour hours (at a rate of 20 per hour) Production Department- Product A 800 Floor Area (square metres) Value of machinery Number of employees 42.000 1.500 hours Indirect Cost (Production overhead) Insurance of machinery Rent and utilities Cleaning cost Canteen salary Total Indirect Cost The following information has been provided Production Department Product A 2,000 60.000 20 Required: a) Calculate the Total Prime Cost for each product Production Department for Product B 750 38,000 1,400 hours 2.000 48,000 2,000 30.000 82,000 Production Department for Product B 1,600 44.000 Canteen Canteen 200 b) Prepare an analysis of the production overheads (indirect cost) by completing apportionment or allocation to the two production cost centres and one canteen. c) Re-apportion the total canteen cost to the two production cost centres d) Calculate the total indirect production cost for each production department e) Calculate the total production cost for each product f) Calculate the production cost per unit for each product (round the answer to two decimal places) e) Calculate the selling price of each product if the mark up is 150% on the production

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Total Prime Cost for each product Prime cost Direct materials Direct labor For Product A Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started