Question

In preparing its cash flow statement for the year ended December 31, 2024, Green Company gathered the following data: Gain on sale of land

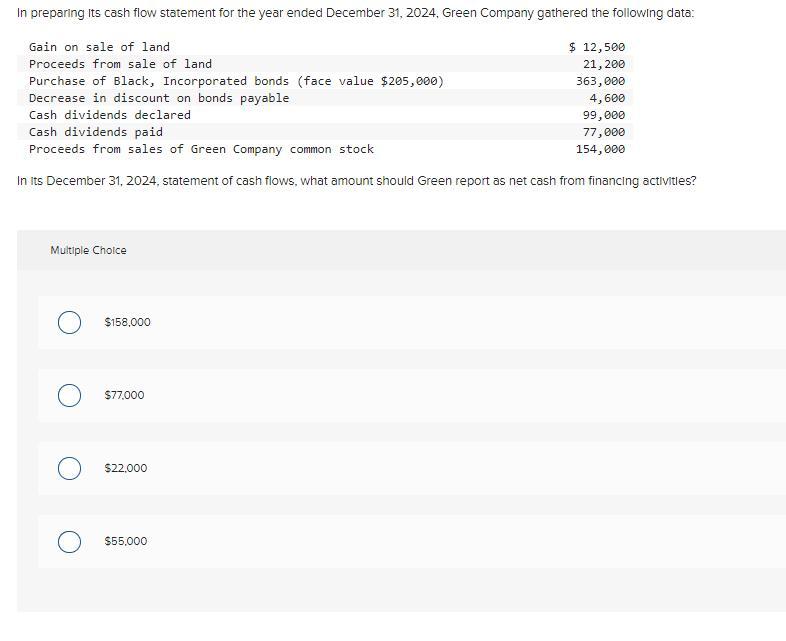

In preparing its cash flow statement for the year ended December 31, 2024, Green Company gathered the following data: Gain on sale of land Proceeds from sale of land Purchase of Black, Incorporated bonds (face value $205,000) Decrease in discount on bonds payable Cash dividends declared Cash dividends paid Proceeds from sales of Green Company common stock In Its December 31, 2024, statement of cash flows, what amount should Green report as net cash from financing activities? Multiple Choice $158,000 $77,000 $22,000 $ 12,500 21, 200 363,000 4,600 99,000 77,000 154,000 $55,000

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer 158000 Net cash from financing activities is calculated by adding cash received fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting concepts and applications

Authors: Albrecht Stice, Stice Swain

11th Edition

978-0538750196, 538745487, 538750197, 978-0538745482

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App