Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the accountant at Austin's Chew Toys Inc. (ACT) and have just received the May 31st bank statement. You note that the balance

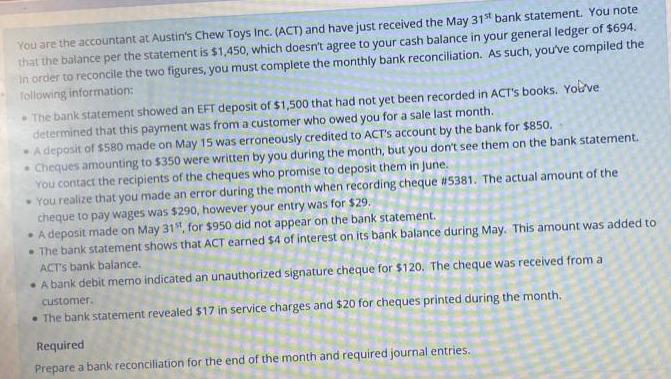

You are the accountant at Austin's Chew Toys Inc. (ACT) and have just received the May 31st bank statement. You note that the balance per the statement is $1,450, which doesn't agree to your cash balance in your general ledger of $694. In order to reconcile the two figures, you must complete the monthly bank reconciliation. As such, you've compiled the following information: The bank statement showed an EFT deposit of $1,500 that had not yet been recorded in ACT's books. You've determined that this payment was from a customer who owed you for a sale last month. A deposit of $580 made on May 15 was erroneously credited to ACT's account by the bank for $850. Cheques amounting to $350 were written by you during the month, but you don't see them on the bank statement. You contact the recipients of the cheques who promise to deposit them in June. You realize that you made an error during the month when recording cheque #5381. The actual amount of the cheque to pay wages was $290, however your entry was for $29. A deposit made on May 31st, for $950 did not appear on the bank statement. The bank statement shows that ACT earned $4 of interest on its bank balance during May. This amount was added to ACT'S bank balance. A bank debit memo indicated an unauthorized signature cheque for $120. The cheque was received from a customer. The bank statement revealed $17 in service charges and $20 for cheques printed during the month. Required Prepare a bank reconciliation for the end of the month and required journal entries.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

BANK RECONCILIATION Cash balance according to bank statement 1450 Add Deposit in transit 950 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started