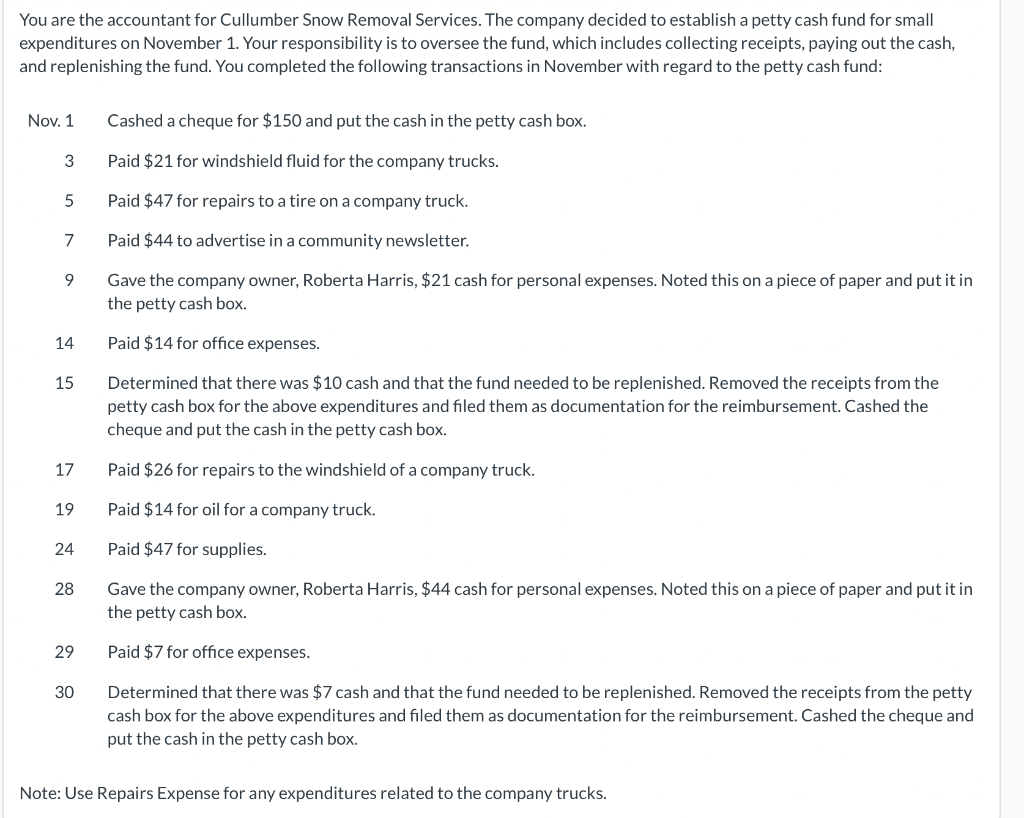

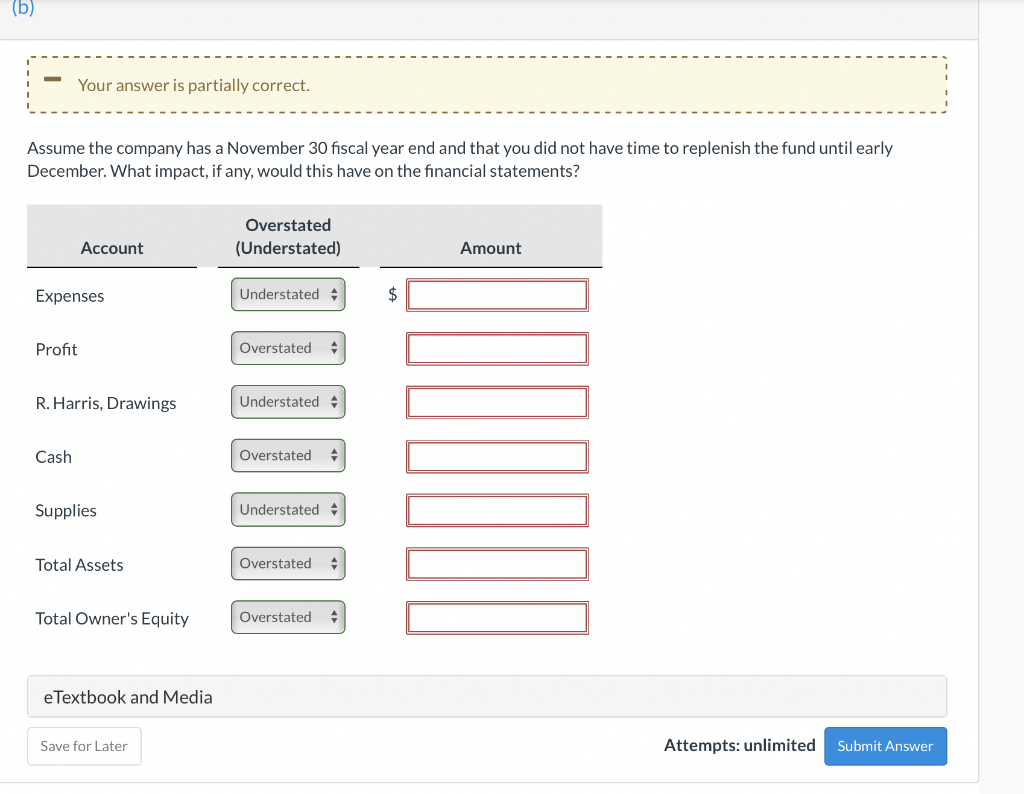

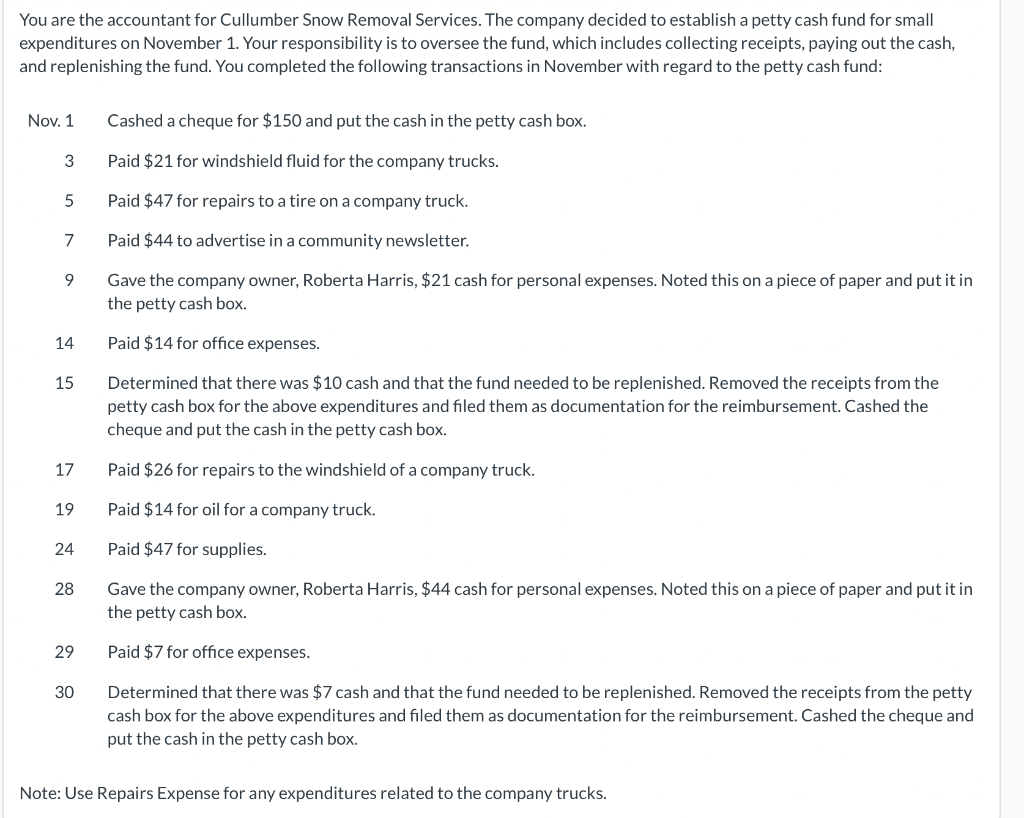

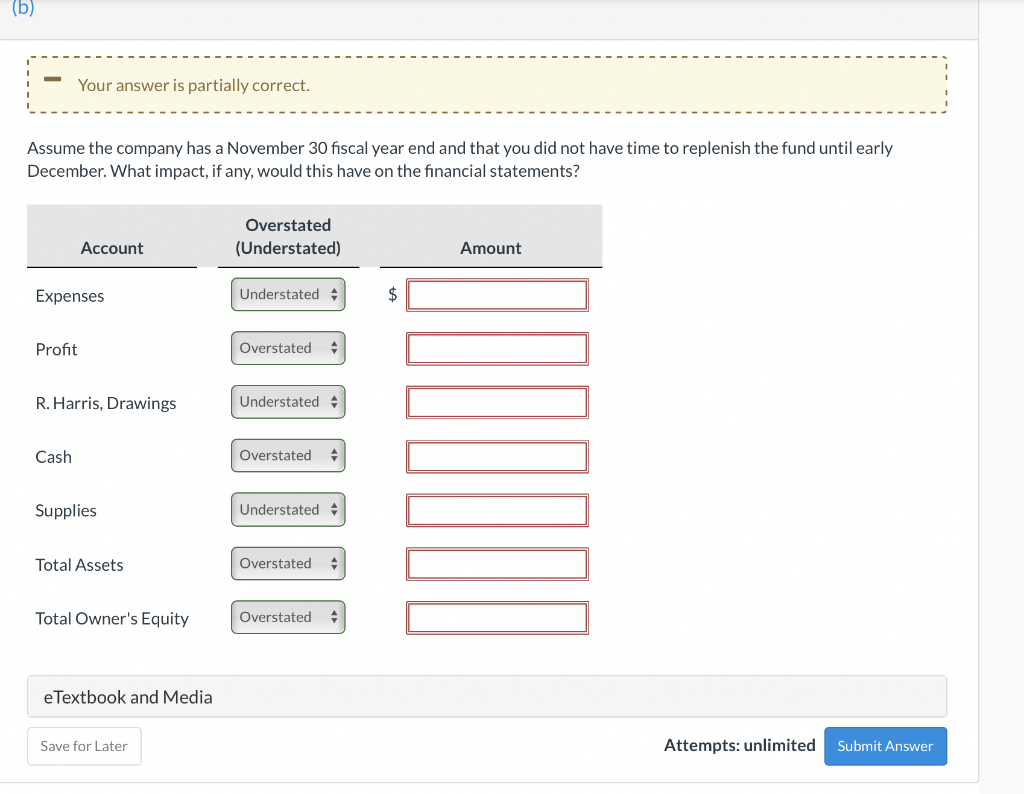

You are the accountant for Cullumber Snow Removal Services. The company decided to establish a petty cash fund for small expenditures on November 1. Your responsibility is to oversee the fund, which includes collecting receipts, paying out the cash, and replenishing the fund. You completed the following transactions in November with regard to the petty cash fund: Nov. 1 Cashed a cheque for $150 and put the cash in the petty cash box. 3 Paid $21 for windshield fluid for the company trucks. 5 Paid $47 for repairs to a tire on a company truck. 7 Paid $44 to advertise in a community newsletter. 9 Gave the company owner, Roberta Harris, \$21 cash for personal expenses. Noted this on a piece of paper and put it in the petty cash box. 14 Paid $14 for office expenses. 15 Determined that there was $10 cash and that the fund needed to be replenished. Removed the receipts from the petty cash box for the above expenditures and filed them as documentation for the reimbursement. Cashed the cheque and put the cash in the petty cash box. 17 Paid $26 for repairs to the windshield of a company truck. 19 Paid $14 for oil for a company truck. 24 Paid $47 for supplies. 28 Gave the company owner, Roberta Harris, \$44 cash for personal expenses. Noted this on a piece of paper and put it in the petty cash box. 29 Paid \$7 for office expenses. 30 Determined that there was $7 cash and that the fund needed to be replenished. Removed the receipts from the petty cash box for the above expenditures and filed them as documentation for the reimbursement. Cashed the cheque and put the cash in the petty cash box. Note: Use Repairs Expense for any expenditures related to the company trucks. Assume the company has a November 30 fiscal year end and that you did not have time to replenish the fund until early December. What impact, if any, would this have on the financial statements? You are the accountant for Cullumber Snow Removal Services. The company decided to establish a petty cash fund for small expenditures on November 1. Your responsibility is to oversee the fund, which includes collecting receipts, paying out the cash, and replenishing the fund. You completed the following transactions in November with regard to the petty cash fund: Nov. 1 Cashed a cheque for $150 and put the cash in the petty cash box. 3 Paid $21 for windshield fluid for the company trucks. 5 Paid $47 for repairs to a tire on a company truck. 7 Paid $44 to advertise in a community newsletter. 9 Gave the company owner, Roberta Harris, \$21 cash for personal expenses. Noted this on a piece of paper and put it in the petty cash box. 14 Paid $14 for office expenses. 15 Determined that there was $10 cash and that the fund needed to be replenished. Removed the receipts from the petty cash box for the above expenditures and filed them as documentation for the reimbursement. Cashed the cheque and put the cash in the petty cash box. 17 Paid $26 for repairs to the windshield of a company truck. 19 Paid $14 for oil for a company truck. 24 Paid $47 for supplies. 28 Gave the company owner, Roberta Harris, \$44 cash for personal expenses. Noted this on a piece of paper and put it in the petty cash box. 29 Paid \$7 for office expenses. 30 Determined that there was $7 cash and that the fund needed to be replenished. Removed the receipts from the petty cash box for the above expenditures and filed them as documentation for the reimbursement. Cashed the cheque and put the cash in the petty cash box. Note: Use Repairs Expense for any expenditures related to the company trucks. Assume the company has a November 30 fiscal year end and that you did not have time to replenish the fund until early December. What impact, if any, would this have on the financial statements