Question

You are the Accountant for Furniture Limited, a leading UK furniture manufacturer. The company has been fairly successful and to date has amassed a portfolio

You are the Accountant for Furniture Limited, a leading UK furniture manufacturer. The company has been fairly successful and to date has amassed a portfolio of securities from around 30 different businesses. However, they have invested in companies they liked rather than taking independent financial advice. At a recent Board Meeting they were discussing that this portfolio was becoming fairly large and that they should really investigate what sort of return they should expect from each share. Finally, the Research Director, Sue, has some questions about shares for a particular company. You have jotted down a few additional points as follows.

Is there some sort of recognised theory to guide us and is it reliable?

One of the Directors studied elementary Corporate Finance a few years ago where he learned about expected returns on equity but confesses it was not one of his strongest subjects and that he had forgotten a lot of the material. He remembers that the teacher mentioned that there were different types of risk, that you should not put all your eggs in one basket and that you could use this to calculate anticipated returns. The Sales Director is sceptical and wants to know about any pitfalls with this theory.

Favourite share is it well priced and is this even relevant?

The Research Director, Sue, likes working with cedar wood and would like for Furniture Limited to consider including some of Cedar Wood plcs shares in its portfolio in to the future. To this end, she wonders if they are priced correctly. However, she has told you she is actually not sure if this is relevant, especially as it is likely to be at least a few months before any funds are invested. She also added that she didnt know if Furniture Limiteds current portfolio has any sort of bearing on this.

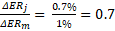

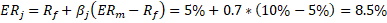

As it happens, you have just read in the latest edition of The Economist that the forecasted return for Cedar Wood plcs shares is 7%. The article mentioned that the expected return for Cedar Wood changes by 0.7% when the expected return on the market changes by 1%. You also read there that the risk free rate is 5% and the Expected Return on the market is 10%.

- Explain key aspects of CAPM Investment Theory to the Directors of Furniture Limited. The Directors need to understand the return they can expect on any given share within their current portfolio. Your answer may make reference to the different types of risk and key limitations of this theory.

- i) Calculate beta for Cedar Wood plc. Use this in the CAPM equation to find the Required Return of Cedar Wood Ltd

beta for Cedar Wood plc =

(ii) Calculate whether the forecasted Return of Cedar Woods shares is greater or less than the CAPM required rate of return as calculated in (i).

(iii) Assume that forecasted return rate is used as a discount rate to translate future share cash flows in to current share price. What does your answer in b (ii) then indicate about the current share price of Cedar Wood Limited shares are the shares overvalued or undervalued? Explain your answer.

(iv) Assume the Directors wish to incorporate some Cedar Wood shares in their new portfolio in a few months time. Is it likely that Cedar Wood Limiteds shares will still be under or overvalued in a few months time? Explain your answer.

ERmERj=1%0.7%=0.7 Rj=Rf+j(ERmRf)=5%+0.7(10%5%)=8.5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started