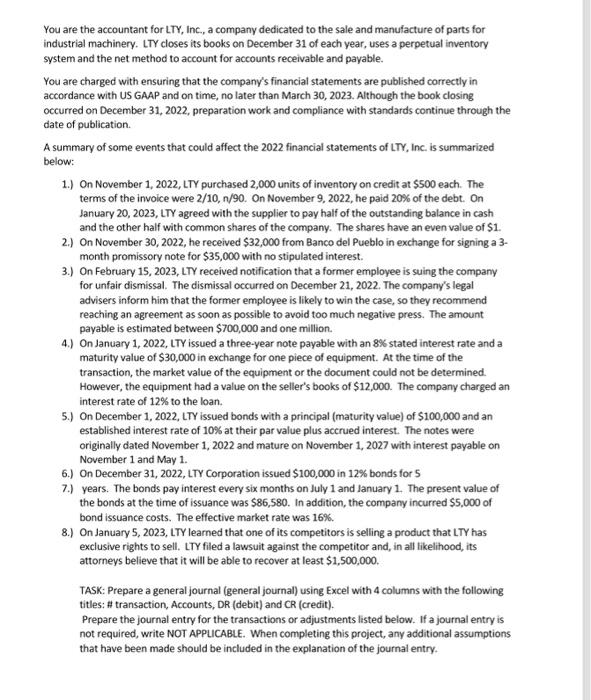

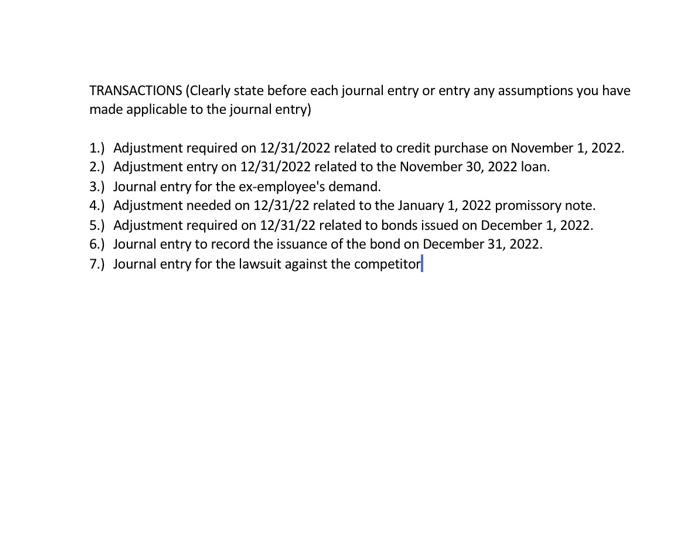

You are the accountant for LTY, Inc, a company dedicated to the sale and manufacture of parts for industrial machinery. LTY closes its books on December 31 of each year, uses a perpetual inventory system and the net method to account for accounts receivable and payable. You are charged with ensuring that the company's financial statements are published correctly in accordance with US GAAP and on time, no later than March 30, 2023. Although the book closing occurred on December 31,2022 , preparation work and compliance with standards continue through the date of publication. A summary of some events that could affect the 2022 financial statements of LTY, Inc. is summarized below: 1.) On November 1, 2022, LTY purchased 2,000 units of inventory on credit at $500 each. The terms of the invoice were 2/10, n/90. On November 9, 2022, he paid 20% of the debt. On January 20, 2023, LTY agreed with the supplier to pay half of the outstanding balance in cash and the other half with common shares of the company. The shares have an even value of $1. 2.) On November 30,2022 , he received $32,000 from Banco del Pueblo in exchange for signing a 3 month promissory note for $35,000 with no stipulated interest. 3.) On February 15, 2023, LTY received notification that a former employee is suing the company for unfair dismissal. The dismissal occurred on December 21, 2022. The company's legal advisers inform him that the former employee is likely to win the case, so they recommend reaching an agreement as soon as possible to avoid too much negative press. The amount payable is estimated between $700,000 and one million. 4.) On January 1, 2022, LTY issued a three-year note payable with an 8% stated interest rate and a maturity value of $30,000 in exchange for one piece of equipment. At the time of the transaction, the market value of the equipment or the document could not be determined. However, the equipment had a value on the seller's books of $12,000. The company charged an interest rate of 12% to the loan. 5.) On December 1, 2022, LTY issued bonds with a principal (maturity value) of $100,000 and an established interest rate of 10% at their par value plus accrued interest. The notes were originally dated November 1, 2022 and mature on November 1, 2027 with interest payable on November 1 and May 1. 6.) On December 31, 2022, LTY Corporation issued $100,000 in 12% bonds for 5 7.) years. The bonds pay interest every six months on July 1 and January 1 . The present value of the bonds at the time of issuance was $86,580. In addition, the company incurred $5,000 of bond issuance costs. The effective market rate was 16%. 8.) On January 5,2023 , LTY learned that one of its competitors is selling a product that LTY has exclusive rights to sell. LTY filed a lawsuit against the competitor and, in all likelihood, its attorneys believe that it will be able to recover at least $1,500,000. TASK: Prepare a general journal (general journal) using Excel with 4 columns with the following titles: \# transaction, Accounts, DR (debit) and CR (credit). Prepare the journal entry for the transactions or adjustments listed below. If a journal entry is not required, write NOT APPLICABLE. When completing this project, any additional assumptions that have been made should be included in the explanation of the journal entry. TRANSACTIONS (Clearly state before each journal entry or entry any assumptions you have made applicable to the journal entry) 1.) Adjustment required on 12/31/2022 related to credit purchase on November 1,2022. 2.) Adjustment entry on 12/31/2022 related to the November 30,2022 loan. 3.) Journal entry for the ex-employee's demand. 4.) Adjustment needed on 12/31/22 related to the January 1, 2022 promissory note. 5.) Adjustment required on 12/31/22 related to bonds issued on December 1,2022. 6.) Journal entry to record the issuance of the bond on December 31,2022. 7.) Journal entry for the lawsuit against the competitor