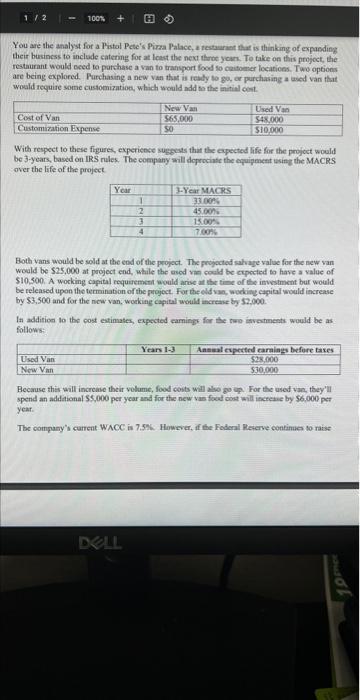

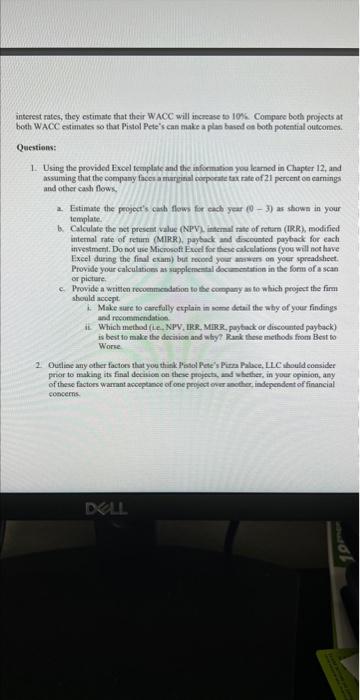

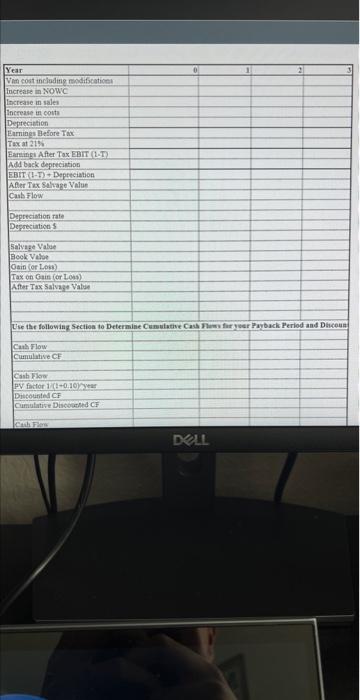

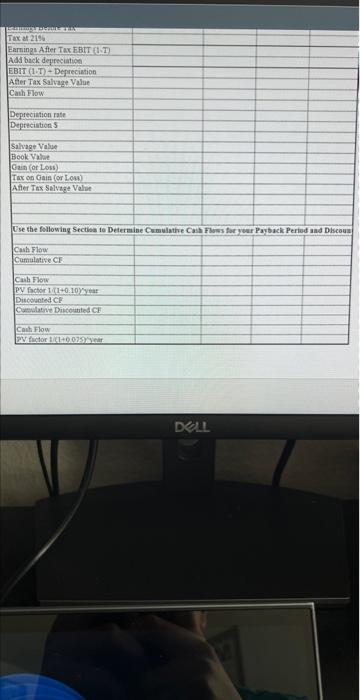

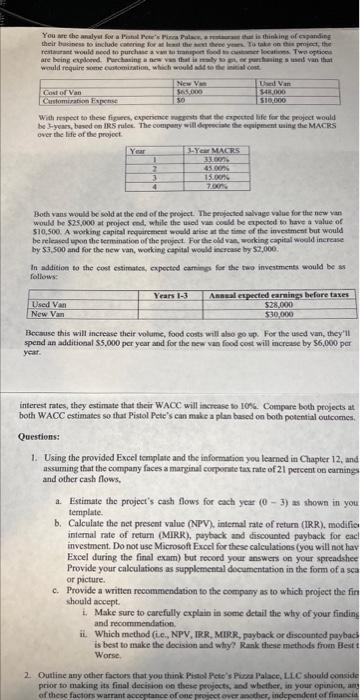

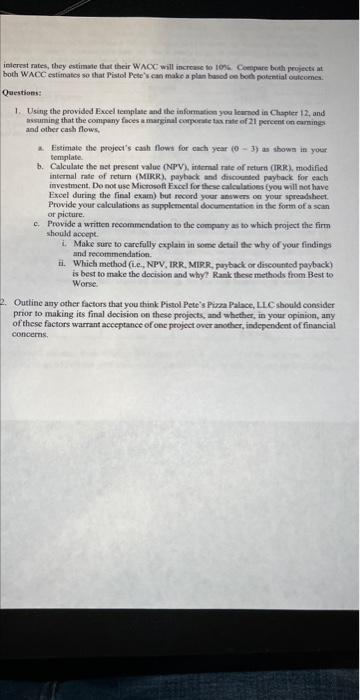

You are the analyst for a Pistal Pete's Pirza Palace, a restauriat that is thinking of expanding their business to include catering for at loast the nexl throt youn. To take on this projoct, the restaurant would eeed to parthase a van to transport food fo caitoener locatioss. Two options are being explored. Furchasing a new van that is ready so go, or purchasing a used van that woold require same customization, which would add to the initial oest. With reypect to these figures, experience suggeats that the expected life for the project would be 3-ycars, based on IRS rules. The conpany will deprociate the equipment esint the MACRS over the life of the project. Both vans would be sold at the end of the project. The projocted salvage value for the new van woald be $25,000 at project end, while the ased vie coeld be cepocted to have a value of 510.500: A working capital requerement would arise at the tine of the invstment bur would. be released upon the termination of the project. For the eld van, wodking capital would increase by $3,500 and for the new van, woeking capital would increase by $2000. In addition to the cost estimates, expected earnings for the two isvenments wuuld be as follows: Because this will increase their volume, food costs will alwe go ap. For the used ian, they'lil spend an addational 35,000 per year and for the new vas focat oost will increaie by 96.000per year. The company's current. WACC is 7.5F : However, if the Federal Reserve contime to naise: interest rates, they estimate that their WACC will increase to IONk. Compare both projects at both WACC cuianates so that Pistel Pete's can make a plas based ea both potential outcoraes. Questions: 1. Using the provided focel template and the information yoo leamed in Chapter 12, and assumsing that the company facess a marginal oorporate tax rate of 21 percent ca earning and other cash flows. a. Estimate the project's cach flews fer each year (03) as showa in your templabe. b. Calculate the nct present value (NPV), internal rate of rehurn (IRR), modified internal rate of return (MIRR), payback and drcounted payback for each investment. Do not use Microsoft Eucri for these calkelations fyou will not have Fxcel during the final exam) buit recoed yoer answers on yoer spreadaheet. Provide your calculations as supplerncatal docamentation in the form of a scan or picture. c. Provide a writien rocoenmeradation to the company as to which project the firm should acoept. 1. Make sure to carefally explain in acrne detail the why of your findings and reconimendatict. it. Which method (ie. NPV, IRR, MIRR, paytaok or discocauted payback) is bot to make the dociuion and why? Rark these meihods from Best to Worre 2. Outliae any other facton that you thick Prsol Pete's Pirra Faluce, L.LC abould coesider prior to making its final decinice on these projects, and wbether, in your opinion, any of these factors warmant asceptanse of one perjoct over anctler, independent of financial eoncerns. Tax at 2196 Earnings After Tax FBIT (I-I) Add back deprecuation EBIT (1.T) - Derreciution Afler Tax Saluage Value Caut Flow Depreciation rate Depreciations Salvage Value Book Valae Cain (or Low) Tax on Gain (or Low) Atter Tax Salvzze Valie Ose the following Sectisa to Determine Camulative Caih Flows for your Payback Peried and Dlscoua Cun Filow Cumulative CF. Cain Fhow py factor 1 1 140.10y inear Discountad CF Cumblane Ditcountas CF Caith Flow would require mince contomization, which would adt to the irinial deet. With rapect so there figuess, cupcricnce mesents that the mpoctred lafe far the project would over the life of the projoct. Both vans would be sold at the end of the pregect. The pewiected salvage walue for the new van would he 525,000 at project mend, while the used vae coeld be cupecticul to have a value of 510,500.A wotking eapical recpirement wceld atise at the time of the inveriment but would be released moo the terminatioe of the progect. For the old van, working capital wcold increase by 53,500 and for the new van, working eafital wock inctcase by 52,000 . In addition to the cosit estirnates, expectid earrings far alse tao investmenta would be ss follows: Because this will increase their volume, food costs will also go ap. For the tised van, they'1l spend an additional 55,000 per year and for the new van food cost will increase by 56,000 per year. interest rates, they extimute that their WACC will iacrease so IOSL. Coenpare both projects at both WACC estimates so that Pistol Pete's can make a plan based on both potential outcomes. Questions: 1. Using the provided Exeel template and the information you leamed in Chapter 12, and assuming that the company faces a marginal corponite tax rafte of 21 perceat os earnings and other cash flows. a. Eitimate the project's cash flows for each year (05) as shown in you ternplate. b. Calculate the net present value (NPV), intemal rate of retum (IRR), modifie; intemal rate of retum (MIRR), paybuck and ciscounted payback for each investment. Do not use Microsoft Excel for these calculations (you will not hav Excel during the final exam) but recoed your answers on your spreadshee Provide your calculations as supplcmental decumentation in the form of a sca or picture. c. Provide a written recommendation to the company as to which projeet the fin should accept. i. Make sure to carefully cxplain in some detail the wby of your findins and recocmmendation. ii. Which method (ic., NPV, IRR, MLPR, poyback or discounted paybac5 is best to make the decision and why? Rank theie methods fruen Best t Worse. 2. Outline any other factors that you think. Piaol Fiete's Pioca Palace, L.LC should conside prior to making its final decieion on these projects, and wbether, in your opinjon, any of these factors warrant acceptance of can poject over ascether, independent of fiaascia inierest mates, they estimale that their WACC will increase so tofs. Ceeppare both projectr at both WACC estimates so that Pisiof Pete's can make a plan busod oo both potertial eutcemes. Qaestions: 1. Using the provided Evcel template and the information you learnod is Chapter 12, and assuming that the company foces a marginal corporate tax rate of 21 percent en cuming? and other cash flows, a. Estimate the project's eash flows for each year (03) as showa in your template. b. Calculate the net present value (NPV), internal rate of return (IRR), modified intermal rase of return (MIIRR). paybsck and discounted payback for each investment, Do noe use Mictosoft Fixcel foe these calcalatioes fyou will nos have Excel during the final exam) hut record your answers on your spreidaheet. Provide your calculations as supplemental documentatice in the form of a scin or picture. c. Provide a written recornmendation to the compuny as to which project the firm should acecpt. i. Make sure to carefully explain in some detail the why of your findings and reconmendation. ii. Which method (i.e., NPV, IRR, MBRR, puyback or diseounted payback) is best to make the decision and whyl? Rank these methods from Best to Worse. 2. Outine any other factors that you think Pistol Pete's Piora Palace, L. C should consider prior to making ies final decision on these projects, and whether, in your opiaion, any of these factors warrant acceptance of one project oncr ancther, independeat of finabcial concerns. You are the analyst for a Pistal Pete's Pirza Palace, a restauriat that is thinking of expanding their business to include catering for at loast the nexl throt youn. To take on this projoct, the restaurant would eeed to parthase a van to transport food fo caitoener locatioss. Two options are being explored. Furchasing a new van that is ready so go, or purchasing a used van that woold require same customization, which would add to the initial oest. With reypect to these figures, experience suggeats that the expected life for the project would be 3-ycars, based on IRS rules. The conpany will deprociate the equipment esint the MACRS over the life of the project. Both vans would be sold at the end of the project. The projocted salvage value for the new van woald be $25,000 at project end, while the ased vie coeld be cepocted to have a value of 510.500: A working capital requerement would arise at the tine of the invstment bur would. be released upon the termination of the project. For the eld van, wodking capital would increase by $3,500 and for the new van, woeking capital would increase by $2000. In addition to the cost estimates, expected earnings for the two isvenments wuuld be as follows: Because this will increase their volume, food costs will alwe go ap. For the used ian, they'lil spend an addational 35,000 per year and for the new vas focat oost will increaie by 96.000per year. The company's current. WACC is 7.5F : However, if the Federal Reserve contime to naise: interest rates, they estimate that their WACC will increase to IONk. Compare both projects at both WACC cuianates so that Pistel Pete's can make a plas based ea both potential outcoraes. Questions: 1. Using the provided focel template and the information yoo leamed in Chapter 12, and assumsing that the company facess a marginal oorporate tax rate of 21 percent ca earning and other cash flows. a. Estimate the project's cach flews fer each year (03) as showa in your templabe. b. Calculate the nct present value (NPV), internal rate of rehurn (IRR), modified internal rate of return (MIRR), payback and drcounted payback for each investment. Do not use Microsoft Eucri for these calkelations fyou will not have Fxcel during the final exam) buit recoed yoer answers on yoer spreadaheet. Provide your calculations as supplerncatal docamentation in the form of a scan or picture. c. Provide a writien rocoenmeradation to the company as to which project the firm should acoept. 1. Make sure to carefally explain in acrne detail the why of your findings and reconimendatict. it. Which method (ie. NPV, IRR, MIRR, paytaok or discocauted payback) is bot to make the dociuion and why? Rark these meihods from Best to Worre 2. Outliae any other facton that you thick Prsol Pete's Pirra Faluce, L.LC abould coesider prior to making its final decinice on these projects, and wbether, in your opinion, any of these factors warmant asceptanse of one perjoct over anctler, independent of financial eoncerns. Tax at 2196 Earnings After Tax FBIT (I-I) Add back deprecuation EBIT (1.T) - Derreciution Afler Tax Saluage Value Caut Flow Depreciation rate Depreciations Salvage Value Book Valae Cain (or Low) Tax on Gain (or Low) Atter Tax Salvzze Valie Ose the following Sectisa to Determine Camulative Caih Flows for your Payback Peried and Dlscoua Cun Filow Cumulative CF. Cain Fhow py factor 1 1 140.10y inear Discountad CF Cumblane Ditcountas CF Caith Flow would require mince contomization, which would adt to the irinial deet. With rapect so there figuess, cupcricnce mesents that the mpoctred lafe far the project would over the life of the projoct. Both vans would be sold at the end of the pregect. The pewiected salvage walue for the new van would he 525,000 at project mend, while the used vae coeld be cupecticul to have a value of 510,500.A wotking eapical recpirement wceld atise at the time of the inveriment but would be released moo the terminatioe of the progect. For the old van, working capital wcold increase by 53,500 and for the new van, working eafital wock inctcase by 52,000 . In addition to the cosit estirnates, expectid earrings far alse tao investmenta would be ss follows: Because this will increase their volume, food costs will also go ap. For the tised van, they'1l spend an additional 55,000 per year and for the new van food cost will increase by 56,000 per year. interest rates, they extimute that their WACC will iacrease so IOSL. Coenpare both projects at both WACC estimates so that Pistol Pete's can make a plan based on both potential outcomes. Questions: 1. Using the provided Exeel template and the information you leamed in Chapter 12, and assuming that the company faces a marginal corponite tax rafte of 21 perceat os earnings and other cash flows. a. Eitimate the project's cash flows for each year (05) as shown in you ternplate. b. Calculate the net present value (NPV), intemal rate of retum (IRR), modifie; intemal rate of retum (MIRR), paybuck and ciscounted payback for each investment. Do not use Microsoft Excel for these calculations (you will not hav Excel during the final exam) but recoed your answers on your spreadshee Provide your calculations as supplcmental decumentation in the form of a sca or picture. c. Provide a written recommendation to the company as to which projeet the fin should accept. i. Make sure to carefully cxplain in some detail the wby of your findins and recocmmendation. ii. Which method (ic., NPV, IRR, MLPR, poyback or discounted paybac5 is best to make the decision and why? Rank theie methods fruen Best t Worse. 2. Outline any other factors that you think. Piaol Fiete's Pioca Palace, L.LC should conside prior to making its final decieion on these projects, and wbether, in your opinjon, any of these factors warrant acceptance of can poject over ascether, independent of fiaascia inierest mates, they estimale that their WACC will increase so tofs. Ceeppare both projectr at both WACC estimates so that Pisiof Pete's can make a plan busod oo both potertial eutcemes. Qaestions: 1. Using the provided Evcel template and the information you learnod is Chapter 12, and assuming that the company foces a marginal corporate tax rate of 21 percent en cuming? and other cash flows, a. Estimate the project's eash flows for each year (03) as showa in your template. b. Calculate the net present value (NPV), internal rate of return (IRR), modified intermal rase of return (MIIRR). paybsck and discounted payback for each investment, Do noe use Mictosoft Fixcel foe these calcalatioes fyou will nos have Excel during the final exam) hut record your answers on your spreidaheet. Provide your calculations as supplemental documentatice in the form of a scin or picture. c. Provide a written recornmendation to the compuny as to which project the firm should acecpt. i. Make sure to carefully explain in some detail the why of your findings and reconmendation. ii. Which method (i.e., NPV, IRR, MBRR, puyback or diseounted payback) is best to make the decision and whyl? Rank these methods from Best to Worse. 2. Outine any other factors that you think Pistol Pete's Piora Palace, L. C should consider prior to making ies final decision on these projects, and whether, in your opiaion, any of these factors warrant acceptance of one project oncr ancther, independeat of finabcial concerns