Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the auditor for Brakes Limited which operates profitably with five employees. Draft profit before tax is $ 9 m and total assets are

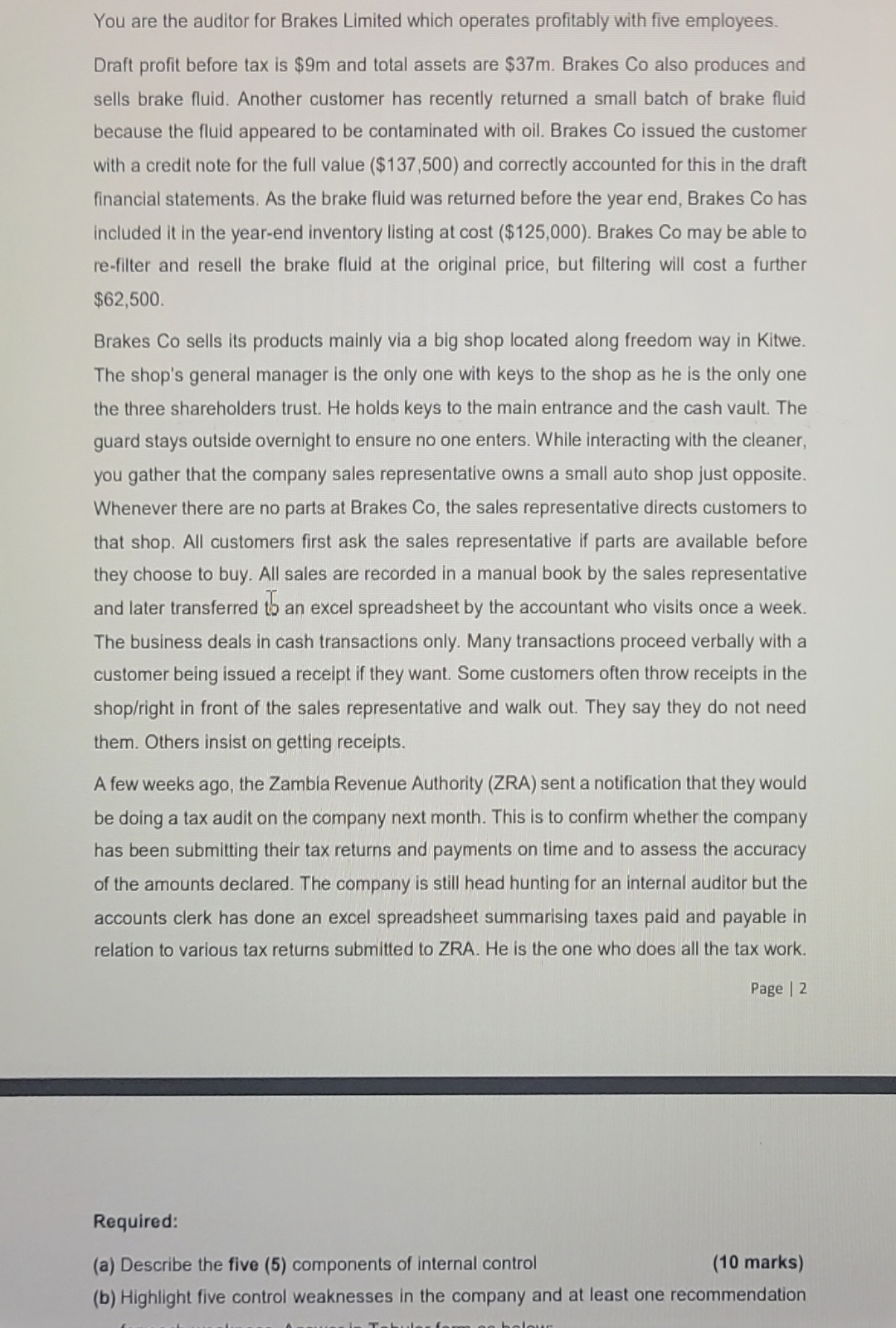

You are the auditor for Brakes Limited which operates profitably with five employees.

Draft profit before tax is $ and total assets are $ Brakes Co also produces and sells brake fluid. Another customer has recently returned a small batch of brake fluid because the fluid appeared to be contaminated with oil. Brakes Co issued the customer with a credit note for the full value $ and correctly accounted for this in the draft financial statements. As the brake fluid was returned before the year end, Brakes Co has included it in the yearend inventory listing at cost $ Brakes Co may be able to refilter and resell the brake fluid at the original price, but filtering will cost a further $

Brakes Co sells its products mainly via a big shop located along freedom way in Kitwe. The shop's general manager is the only one with keys to the shop as he is the only one the three shareholders trust. He holds keys to the main entrance and the cash vault. The guard stays outside overnight to ensure no one enters. While interacting with the cleaner, you gather that the company sales representative owns a small auto shop just opposite. Whenever there are no parts at Brakes Co the sales representative directs customers to that shop. All customers first ask the sales representative if parts are available before they choose to buy. All sales are recorded in a manual book by the sales representative and later transferred th an excel spreadsheet by the accountant who visits once a week. The business deals in cash transactions only. Many transactions proceed verbally with a customer being issued a receipt if they want. Some customers often throw receipts in the shopright in front of the sales representative and walk out. They say they do not need them. Others insist on getting receipts.

A few weeks ago, the Zambia Revenue Authority ZRA sent a notification that they would be doing a tax audit on the company next month. This is to confirm whether the company has been submitting their tax returns and payments on time and to assess the accuracy of the amounts declared. The company is still head hunting for an internal auditor but the accounts clerk has done an excel spreadsheet summarising taxes paid and payable in relation to various tax returns submitted to ZRA. He is the one who does all the tax work.

Required:

a Describe the five components of internal control

b Highlight five control weaknesses in the company and at least one recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started