Answered step by step

Verified Expert Solution

Question

1 Approved Answer

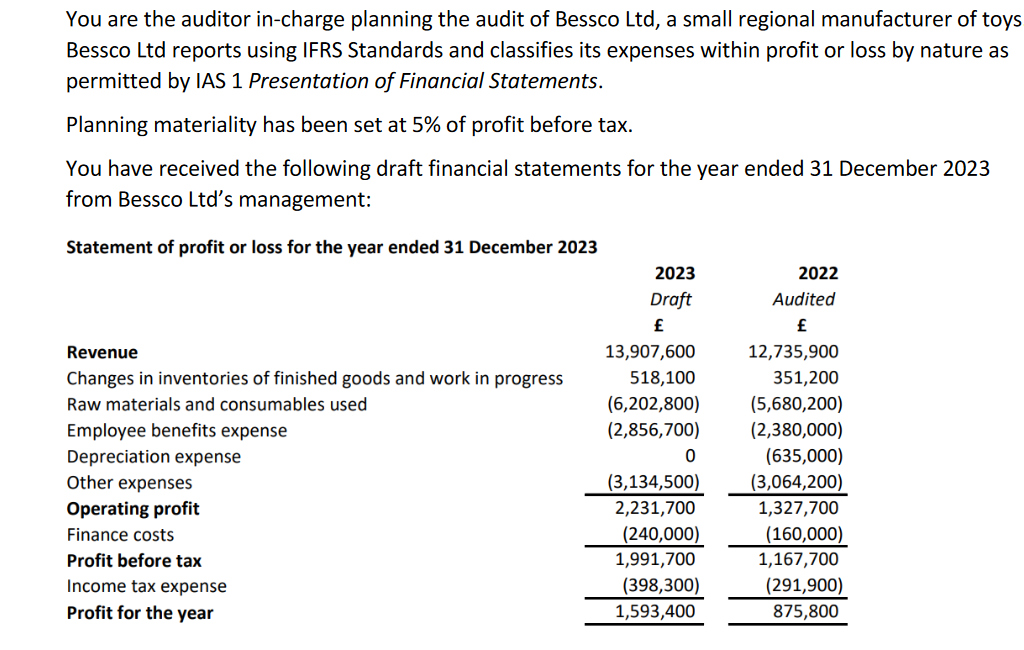

You are the auditor in-charge planning the audit of Bessco Ltd, a small regional manufacturer of toys Bessco Ltd reports using IFRS Standards and

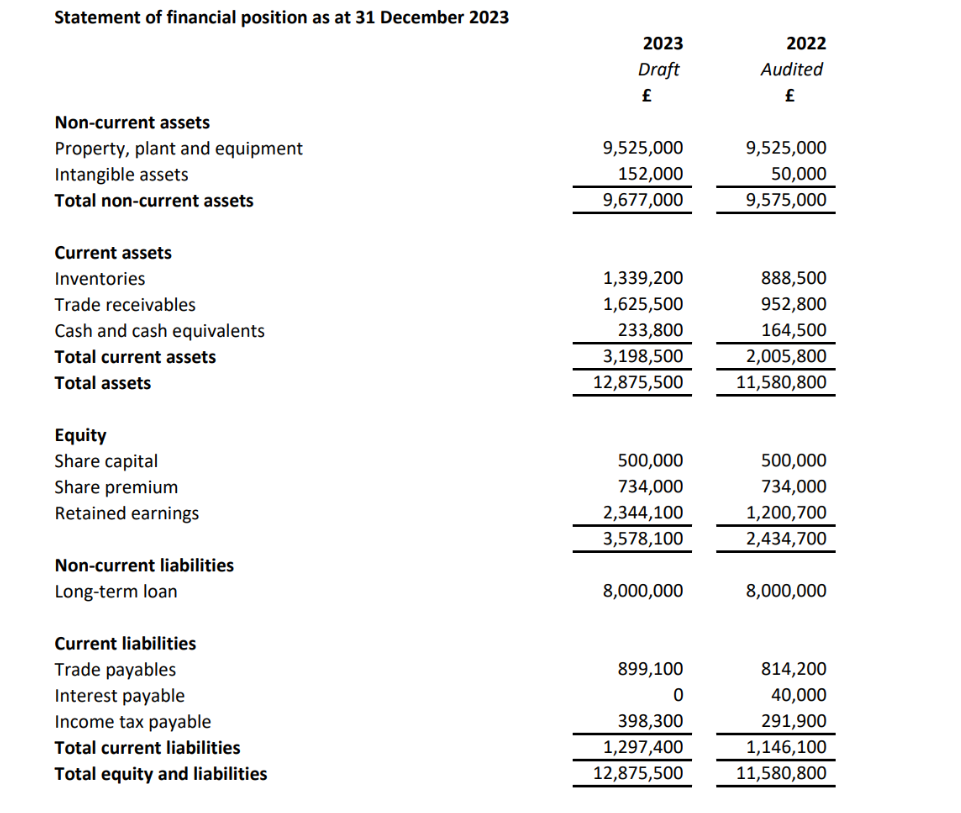

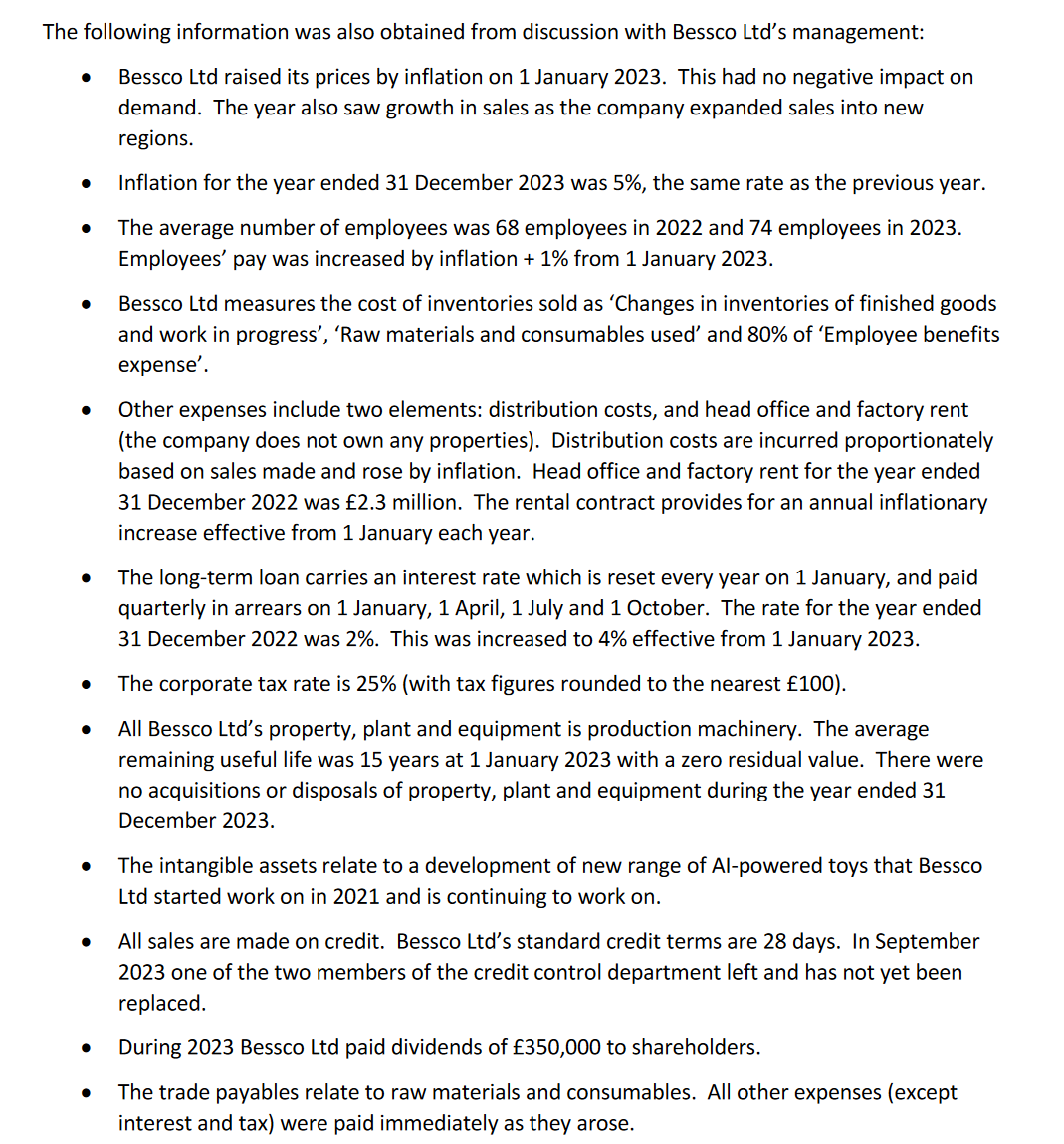

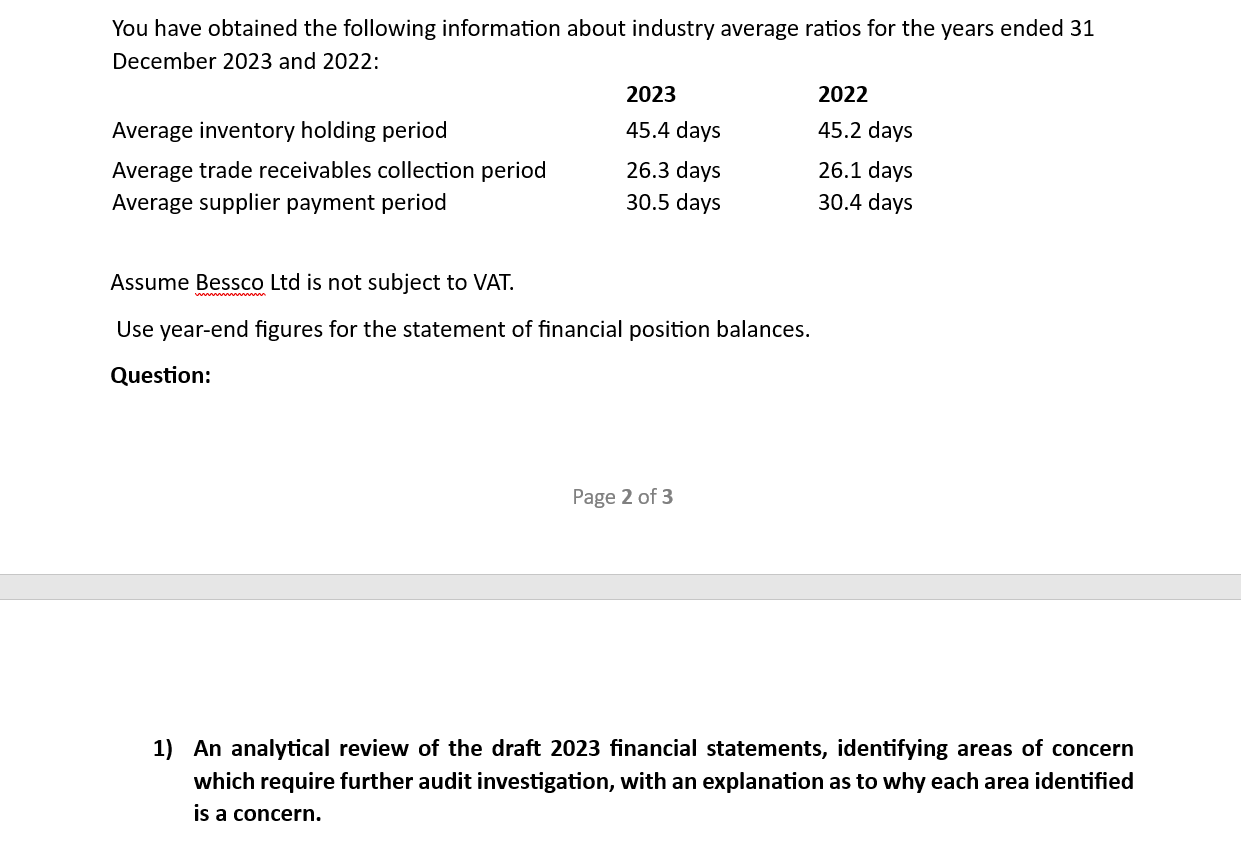

You are the auditor in-charge planning the audit of Bessco Ltd, a small regional manufacturer of toys Bessco Ltd reports using IFRS Standards and classifies its expenses within profit or loss by nature as permitted by IAS 1 Presentation of Financial Statements. Planning materiality has been set at 5% of profit before tax. You have received the following draft financial statements for the year ended 31 December 2023 from Bessco Ltd's management: Statement of profit or loss for the year ended 31 December 2023 Revenue Changes in inventories of finished goods and work in progress Raw materials and consumables used Employee benefits expense Depreciation expense Other expenses Operating profit Finance costs Profit before tax Income tax expense Profit for the year 2023 2022 Draft Audited 13,907,600 12,735,900 518,100 351,200 (6,202,800) (5,680,200) (2,856,700) (2,380,000) 0 (635,000) (3,134,500) (3,064,200) 2,231,700 1,327,700 (240,000) (160,000) 1,991,700 1,167,700 (398,300) (291,900) 1,593,400 875,800 Statement of financial position as at 31 December 2023 2023 Draft 2022 Audited Non-current assets Property, plant and equipment Intangible assets Total non-current assets 9,525,000 9,525,000 152,000 9,677,000 50,000 9,575,000 Current assets Inventories 1,339,200 888,500 Trade receivables 1,625,500 952,800 Cash and cash equivalents 233,800 164,500 Total current assets 3,198,500 2,005,800 Total assets 12,875,500 11,580,800 Equity Share capital 500,000 500,000 Share premium 734,000 734,000 Retained earnings 2,344,100 1,200,700 3,578,100 2,434,700 Non-current liabilities Long-term loan 8,000,000 8,000,000 Current liabilities Trade payables Interest payable 899,100 814,200 0 40,000 Income tax payable 398,300 291,900 Total current liabilities 1,297,400 1,146,100 Total equity and liabilities 12,875,500 11,580,800 The following information was also obtained from discussion with Bessco Ltd's management: Bessco Ltd raised its prices by inflation on 1 January 2023. This had no negative impact on demand. The year also saw growth in sales as the company expanded sales into new regions. Inflation for the year ended 31 December 2023 was 5%, the same rate as the previous year. The average number of employees was 68 employees in 2022 and 74 employees in 2023. Employees' pay was increased by inflation + 1% from 1 January 2023. Bessco Ltd measures the cost of inventories sold as 'Changes in inventories of finished goods and work in progress', 'Raw materials and consumables used' and 80% of 'Employee benefits expense'. Other expenses include two elements: distribution costs, and head office and factory rent (the company does not own any properties). Distribution costs are incurred proportionately based on sales made and rose by inflation. Head office and factory rent for the year ended 31 December 2022 was 2.3 million. The rental contract provides for an annual inflationary increase effective from 1 January each year. The long-term loan carries an interest rate which is reset every year on 1 January, and paid quarterly in arrears on 1 January, 1 April, 1 July and 1 October. The rate for the year ended 31 December 2022 was 2%. This was increased to 4% effective from 1 January 2023. The corporate tax rate is 25% (with tax figures rounded to the nearest 100). All Bessco Ltd's property, plant and equipment is production machinery. The average remaining useful life was 15 years at 1 January 2023 with a zero residual value. There were no acquisitions or disposals of property, plant and equipment during the year ended 31 December 2023. The intangible assets relate to a development of new range of Al-powered toys that Bessco Ltd started work on in 2021 and is continuing to work on. All sales are made on credit. Bessco Ltd's standard credit terms are 28 days. In September 2023 one of the two members of the credit control department left and has not yet been replaced. During 2023 Bessco Ltd paid dividends of 350,000 to shareholders. The trade payables relate to raw materials and consumables. All other expenses (except interest and tax) were paid immediately as they arose. You have obtained the following information about industry average ratios for the years ended 31 December 2023 and 2022: 2023 Average inventory holding period 45.4 days 2022 45.2 days Average trade receivables collection period 26.3 days 26.1 days Average supplier payment period 30.5 days 30.4 days Assume Bessco Ltd is not subject to VAT. Use year-end figures for the statement of financial position balances. Question: Page 2 of 3 1) An analytical review of the draft 2023 financial statements, identifying areas of concern which require further audit investigation, with an explanation as to why each area identified is a concern.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started