Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Background Amity Holdings Pty Limited (Amity) is an Australian resident company that was incorporated during 2022. After purchasing several investments including real estate and

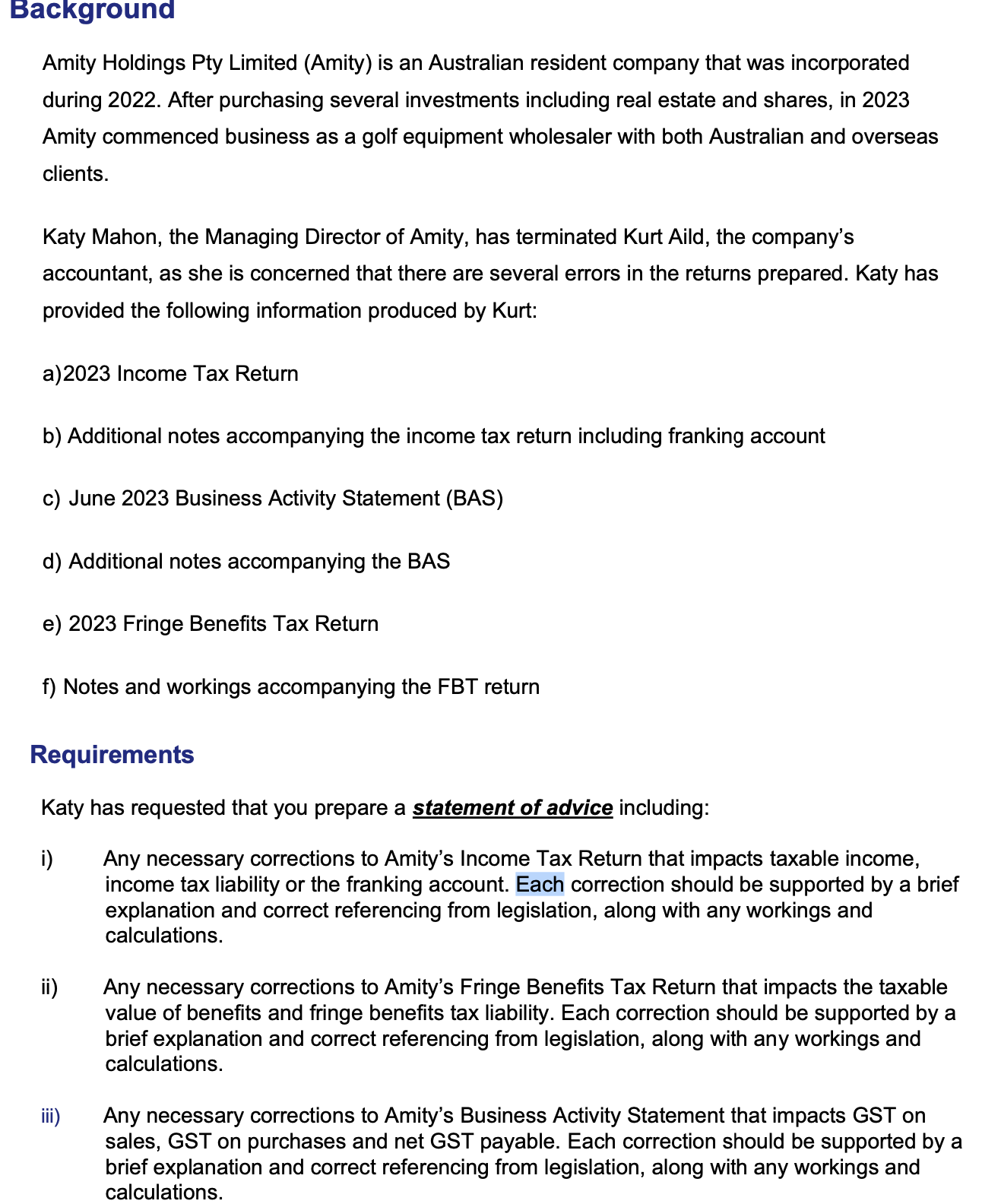

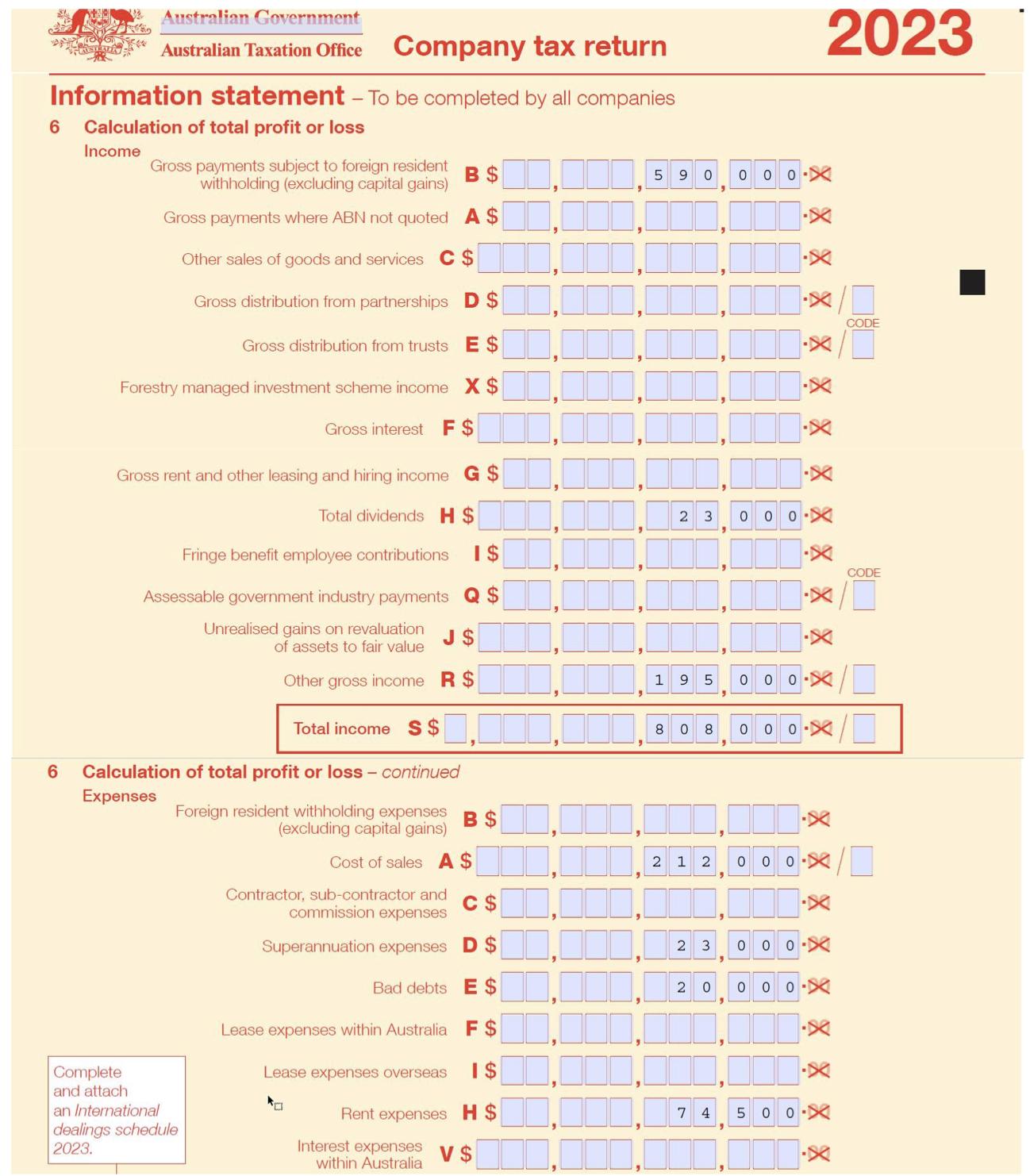

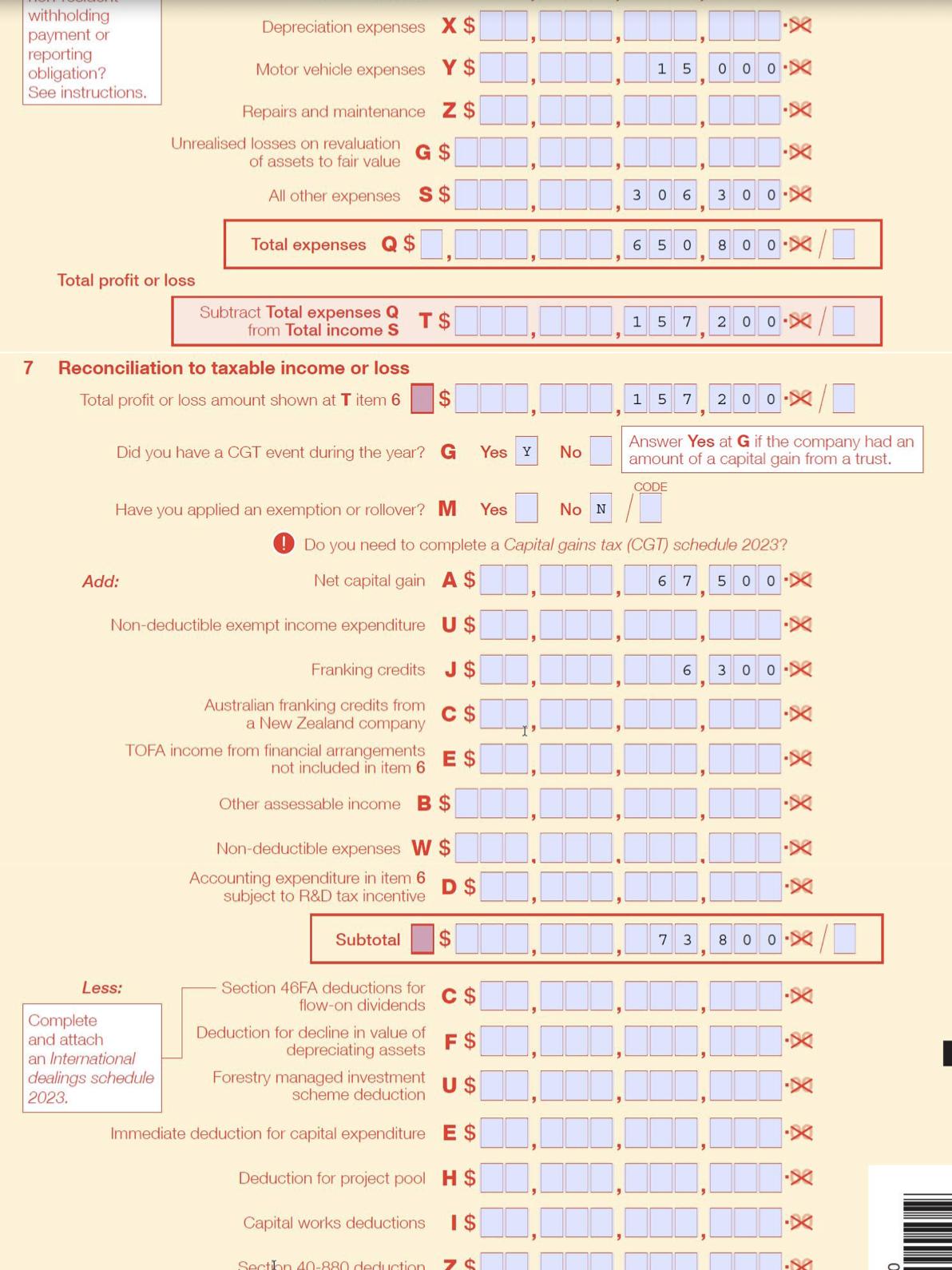

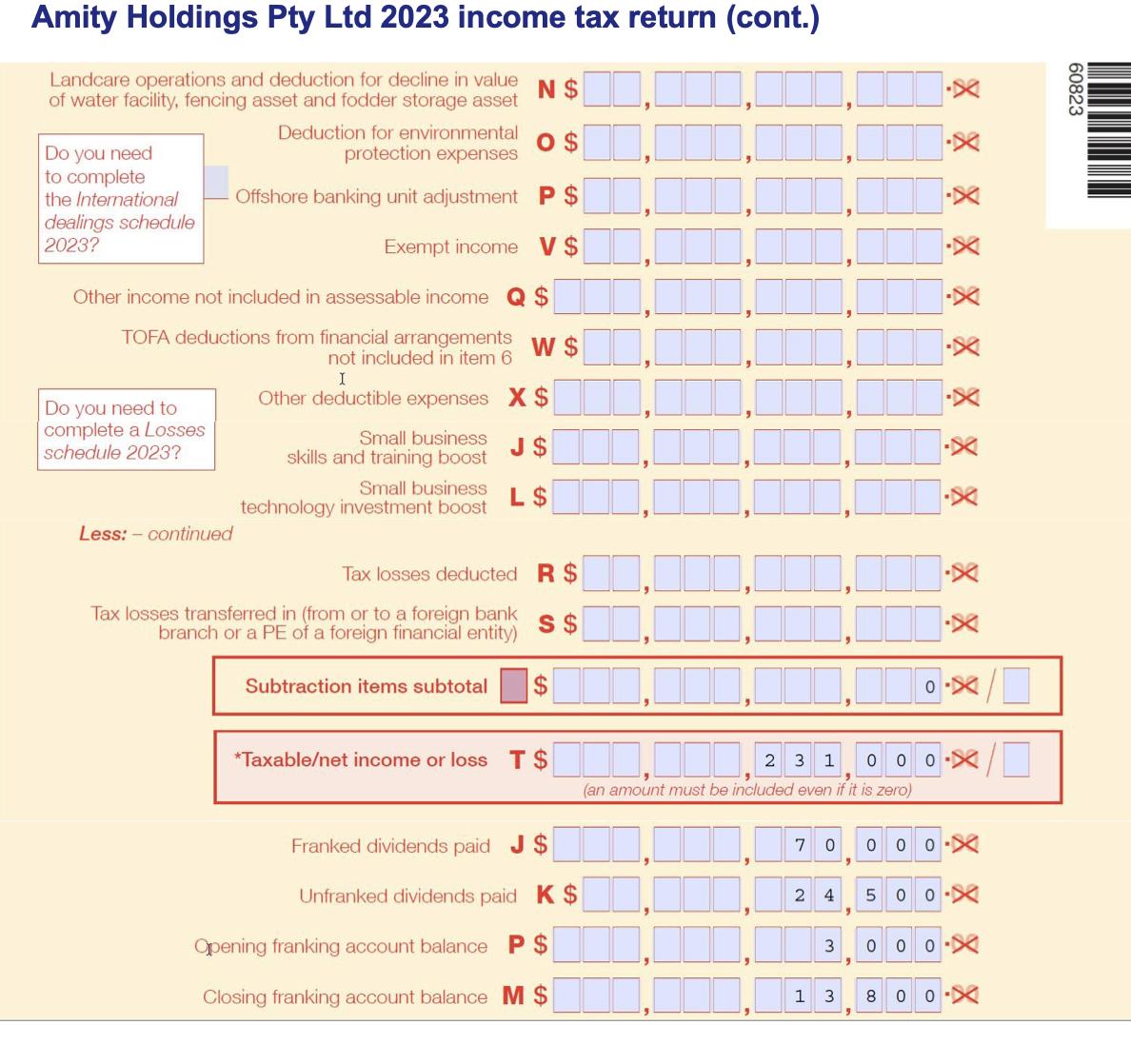

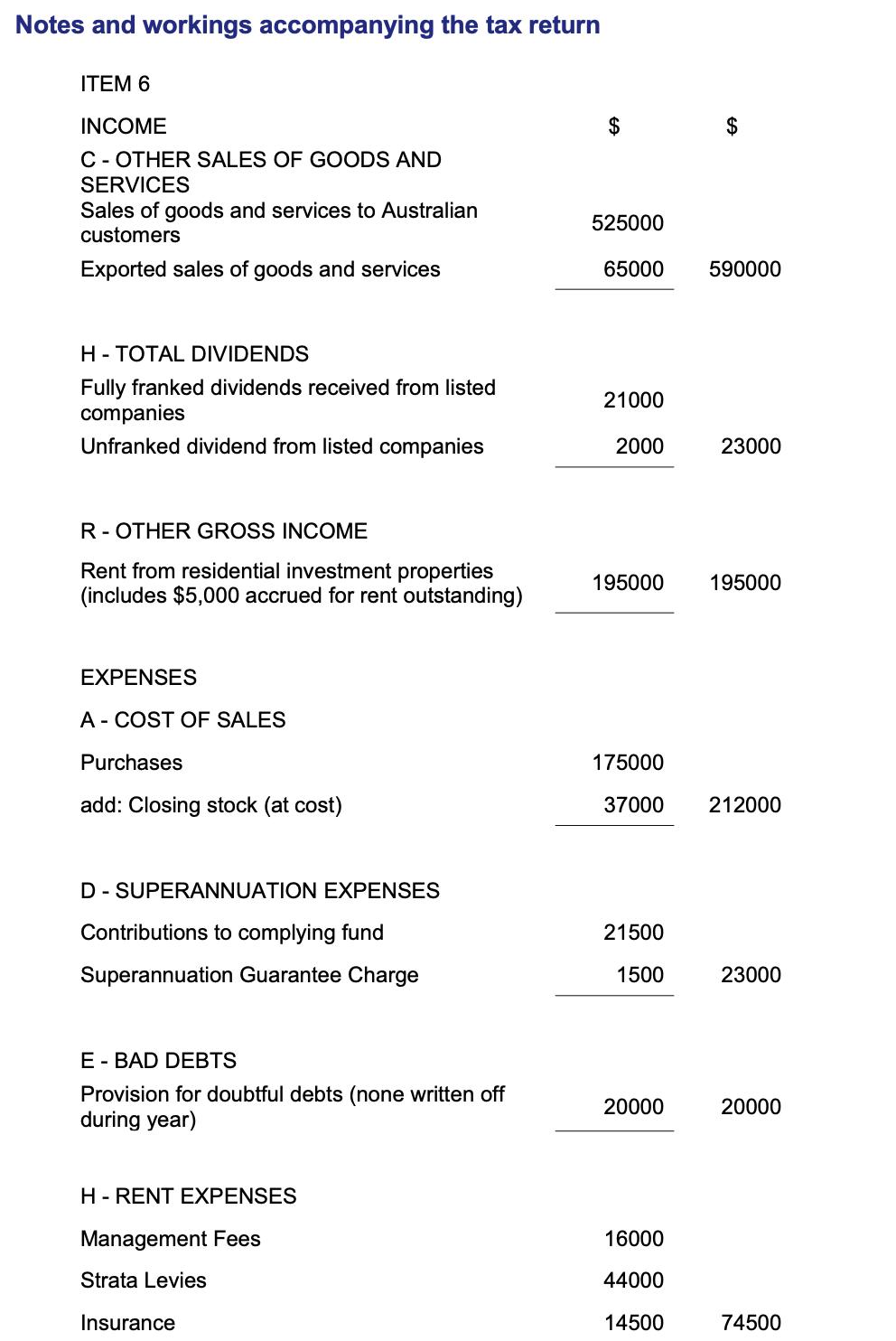

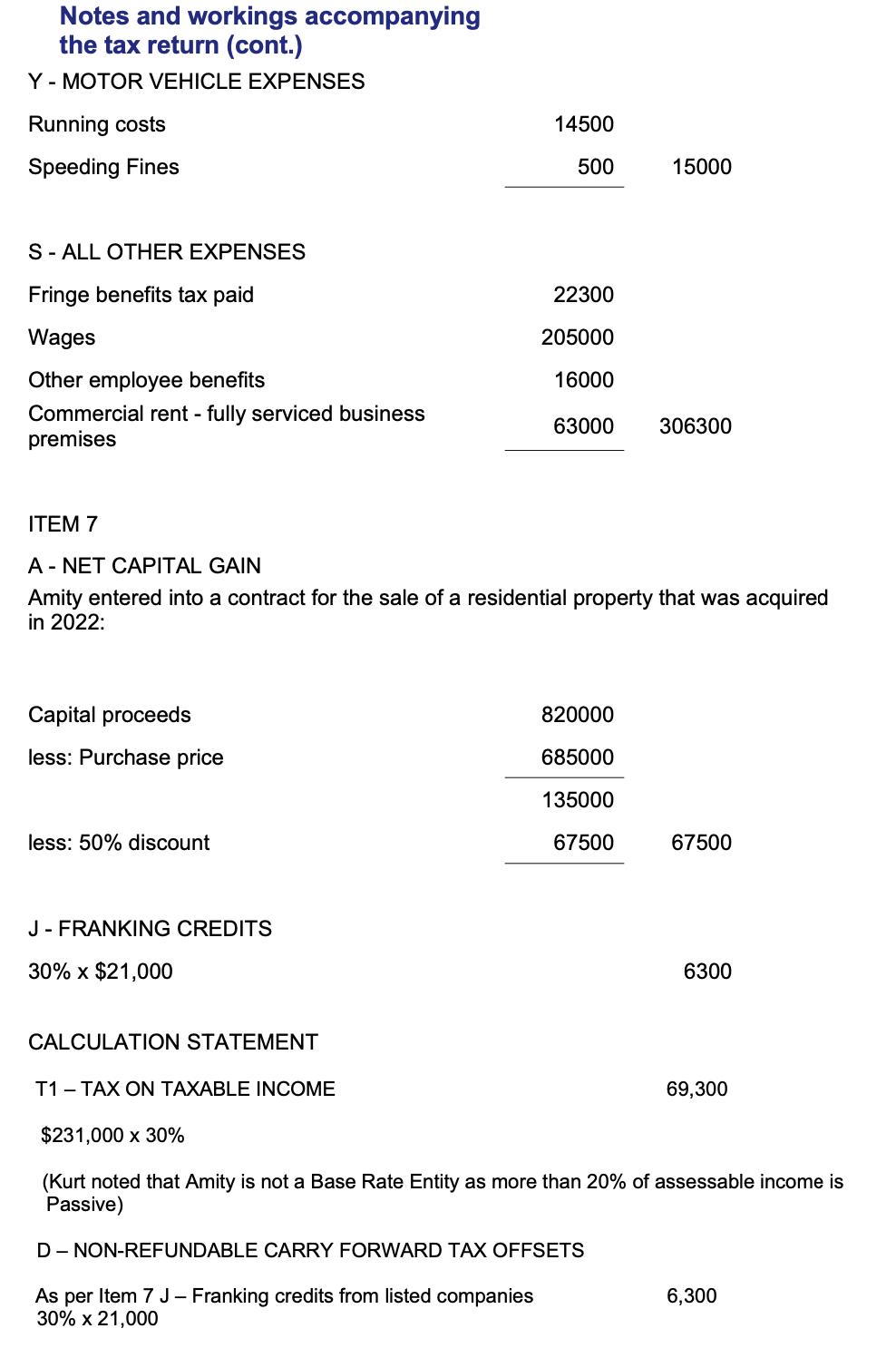

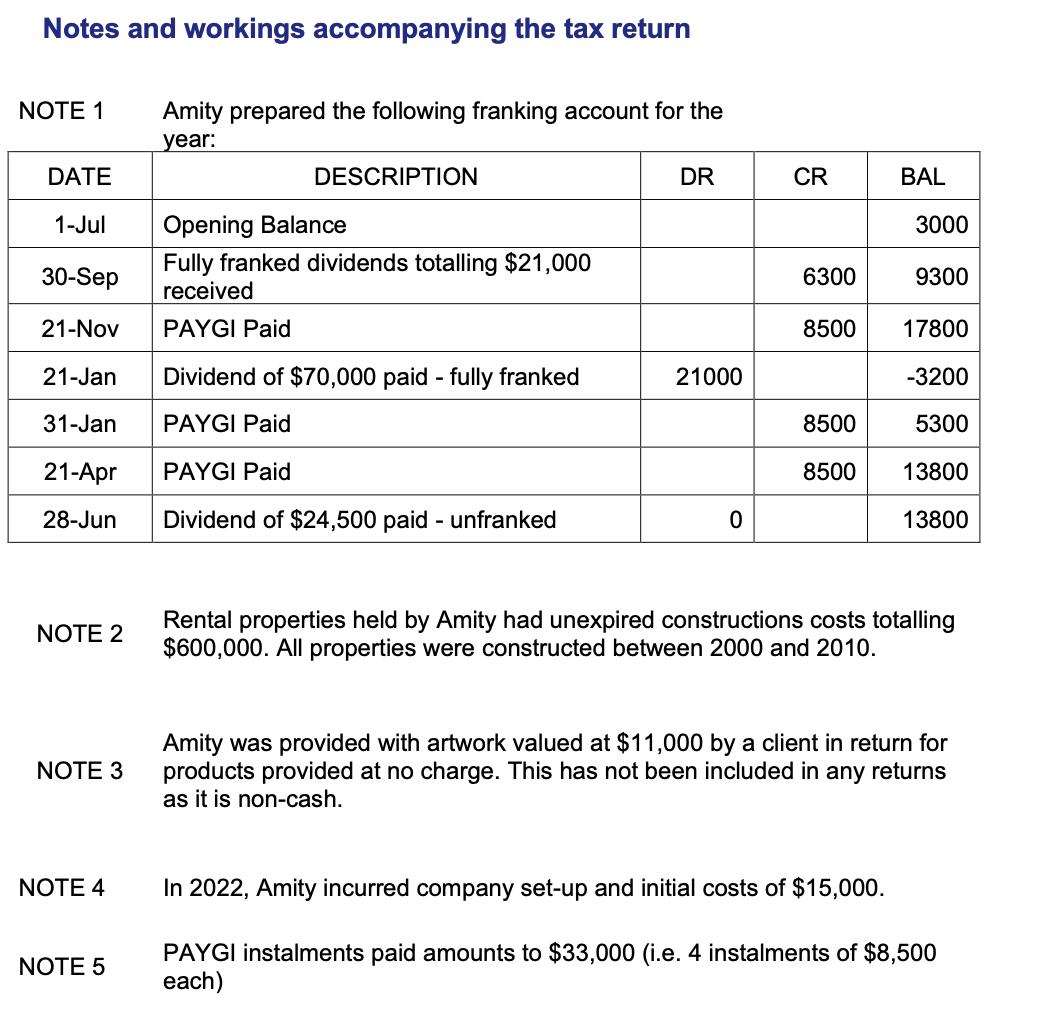

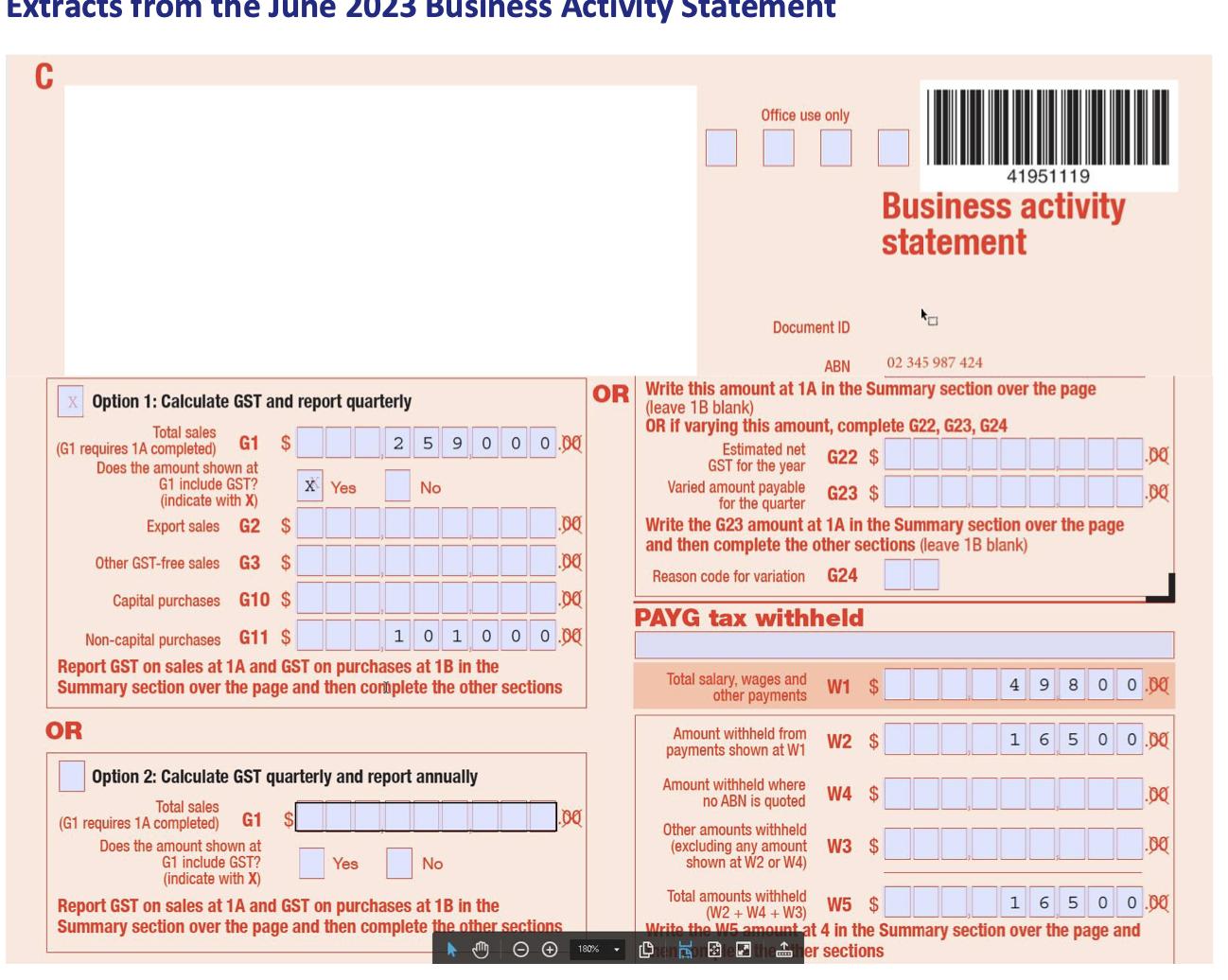

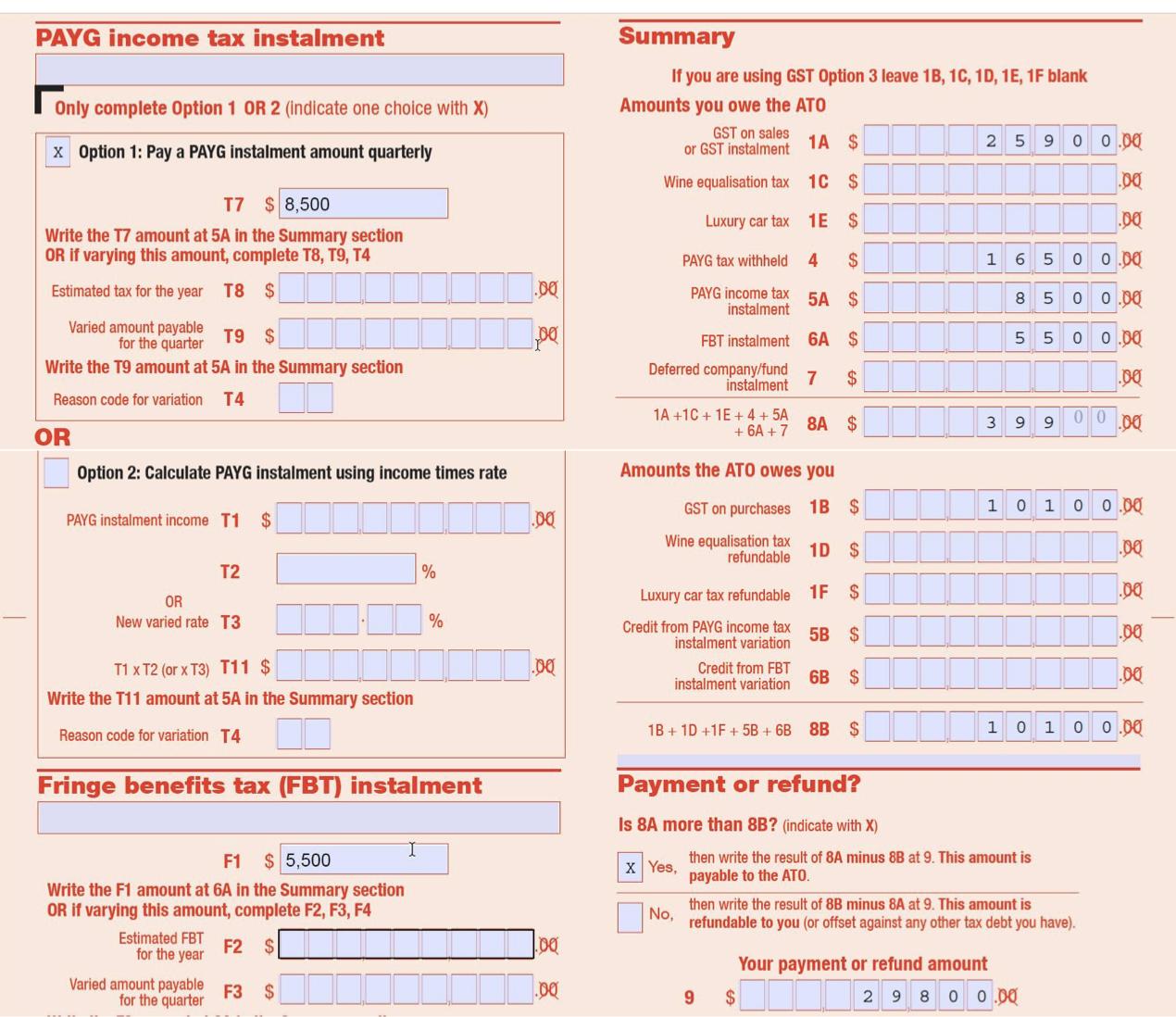

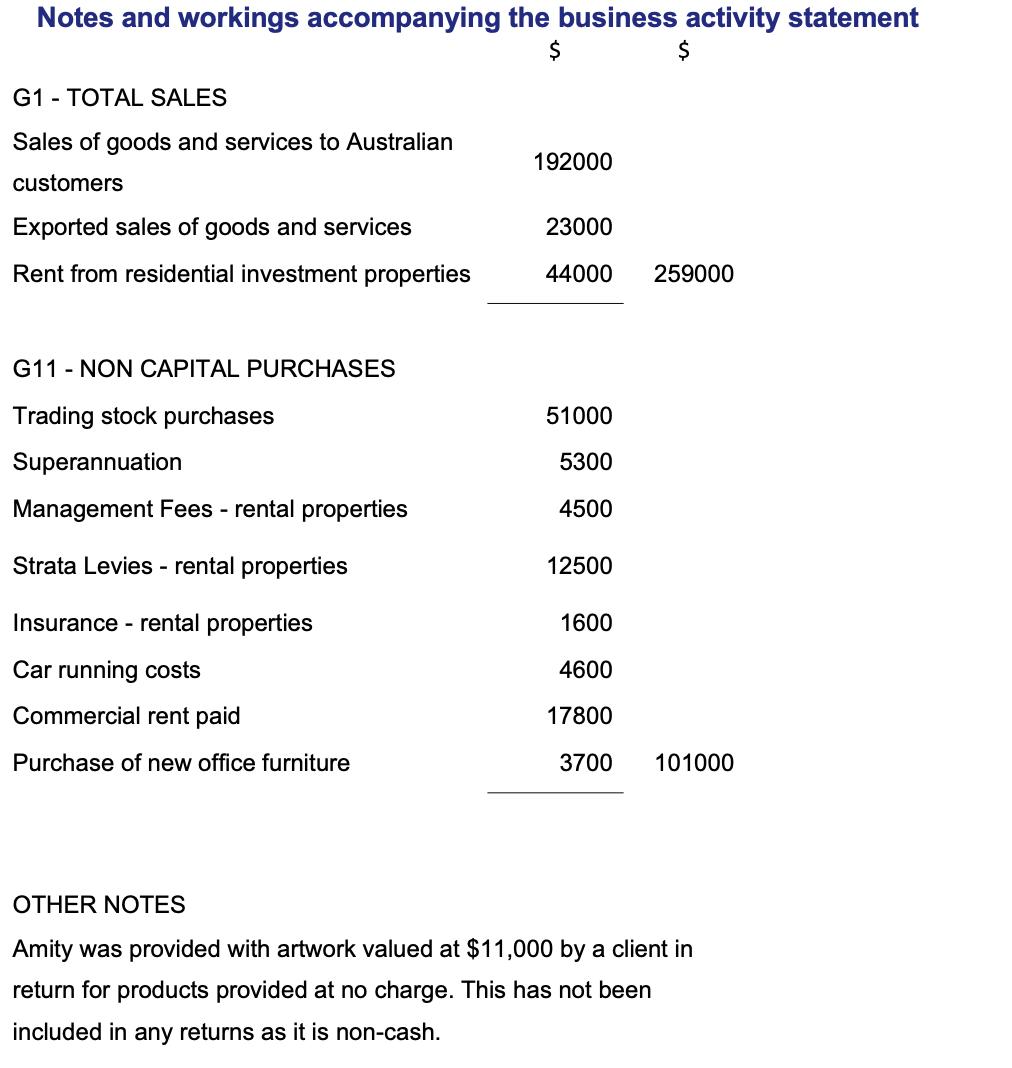

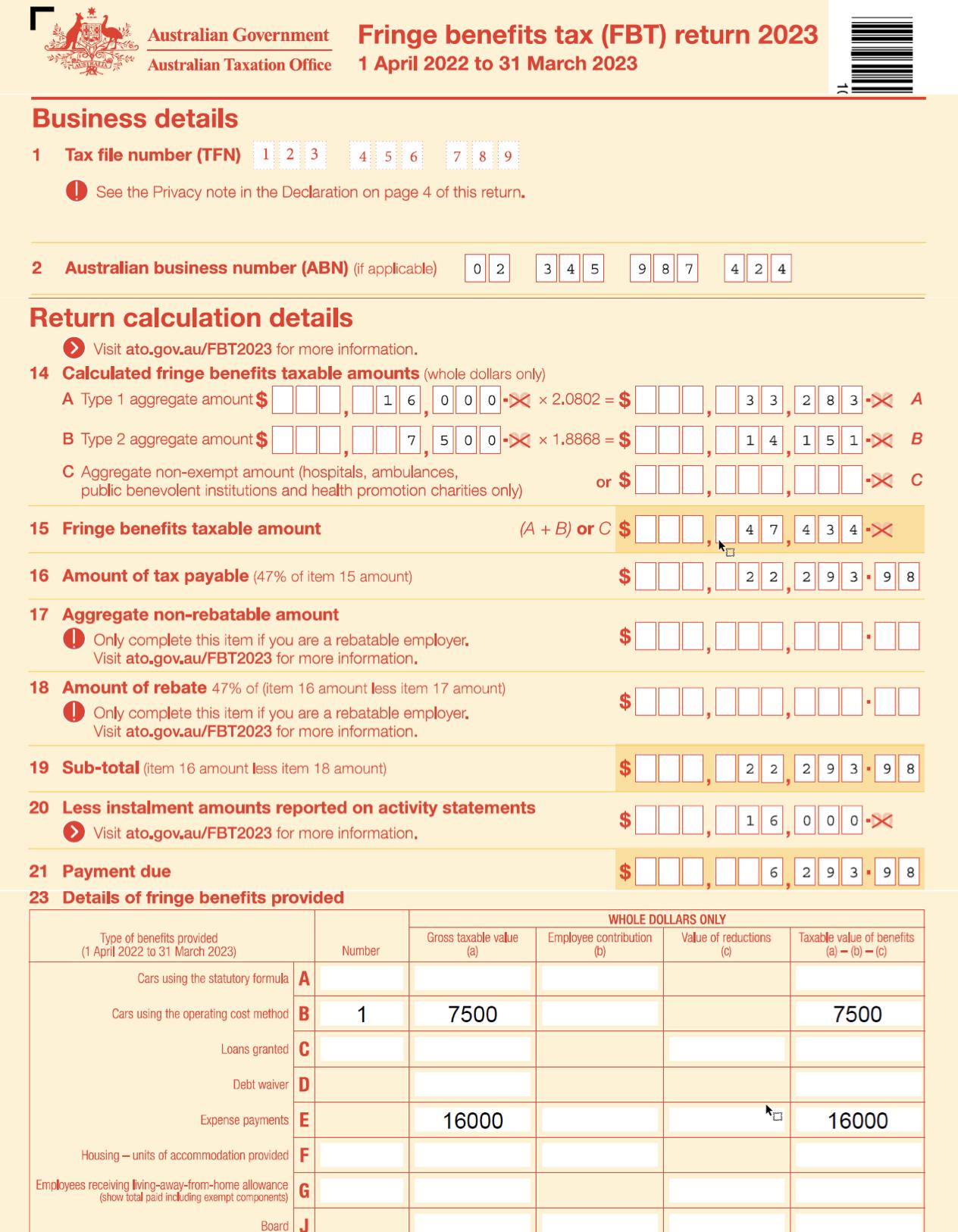

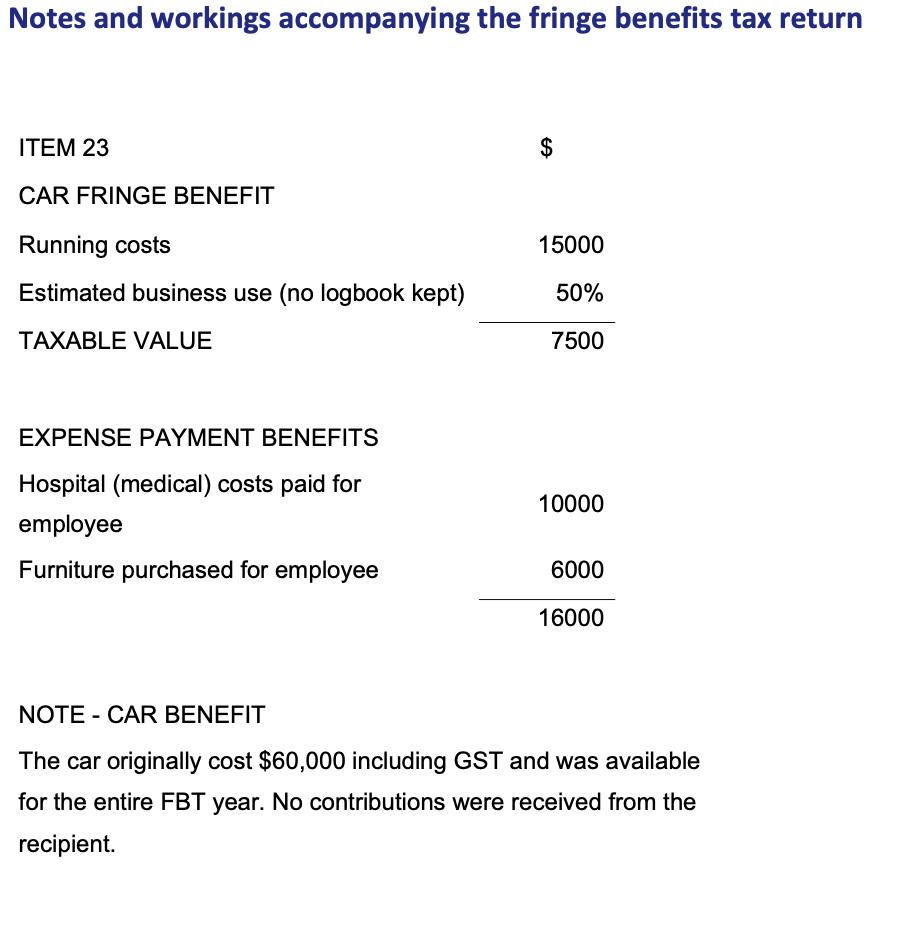

Background Amity Holdings Pty Limited (Amity) is an Australian resident company that was incorporated during 2022. After purchasing several investments including real estate and shares, in 2023 Amity commenced business as a golf equipment wholesaler with both Australian and overseas clients. Katy Mahon, the Managing Director of Amity, has terminated Kurt Aild, the company's accountant, as she is concerned that there are several errors in the returns prepared. Katy has provided the following information produced by Kurt: a)2023 Income Tax Return b) Additional notes accompanying the income tax return including franking account c) June 2023 Business Activity Statement (BAS) d) Additional notes accompanying the BAS e) 2023 Fringe Benefits Tax Return f) Notes and workings accompanying the FBT return Requirements Katy has requested that you prepare a statement of advice including: i) ii) iii) Any necessary corrections to Amity's Income Tax Return that impacts taxable income, income tax liability or the franking account. Each correction should be supported by a brief explanation and correct referencing from legislation, along with any workings and calculations. Any necessary corrections to Amity's Fringe Benefits Tax Return that impacts the taxable value of benefits and fringe benefits tax liability. Each correction should be supported by a brief explanation and correct referencing from legislation, along with any workings and calculations. Any necessary corrections to Amity's Business Activity Statement that impacts GST on sales, GST on purchases and net GST payable. Each correction should be supported by a brief explanation and correct referencing from legislation, along with any workings and calculations. 2023 CODE Australian Government Australian Taxation Office Company tax return Information statement - To be completed by all companies 6 Calculation of total profit or loss Income Gross payments subject to foreign resident withholding (excluding capital gains) B $ Gross payments where ABN not quoted A $ Other sales of goods and services C $ Gross distribution from partnerships D $ Gross distribution from trusts E $ Forestry managed investment scheme income X $ Gross interest F $ Gross rent and other leasing and hiring income G $ Total dividends H $ Fringe benefit employee contributions I $ Assessable government industry payments Q $ Unrealised gains on revaluation of assets to fair value J $ Other gross income R$ Total income S $ 5 9 0 000- 2 3 " 000- 1 9 5 0 0 8 0 8 00 X X X X X X X X X X X X 0-X Calculation of total profit or loss - continued 6 Expenses Complete and attach an International dealings schedule 2023. Foreign resident withholding expenses B $ (excluding capital gains) Cost of sales A $ Contractor, sub-contractor and commission expenses C $ Superannuation expenses D $ Bad debts E$ Lease expenses within Australia F $ Lease expenses overseas I $ Rent expenses H $ Interest expenses V $ within Australia X X 2 1 2 0 0 0- 2 3 0 0 0-X 2 0 0 0 0-X X X X X 7 4 5 00- " CODE withholding payment or reporting obligation? See instructions. Depreciation expenses X $ Motor vehicle expenses Y $ Repairs and maintenance Z $ Unrealised losses on revaluation of assets to fair value G $ All other expenses S $ Total expenses 1 5 00 0.1 X X X 3 0 6 300- 6 5 0 80 0-X Total profit or loss Subtract Total expenses Q from Total income S T$ 1 5 7 200 X 7 Reconciliation to taxable income or loss Total profit or loss amount shown at T item 6 $ 1 5 7 200- Did you have a CGT event during the year? G Yes Y No Answer Yes at G if the company had an amount of a capital gain from a trust. CODE Have you applied an exemption or rollover? M Yes No N Do you need to complete a Capital gains tax (CGT) schedule 2023? Add: Net capital gain A $ 6 7 5 0 0-X Non-deductible exempt income expenditure U $ Franking credits J $ Australian franking credits from C $ a New Zealand company I' TOFA income from financial arrangements E $ not included in item 6. Other assessable income B $ Non-deductible expenses W $ Accounting expenditure in item 6 subject to R&D tax incentive D $ Subtotal $ Less: Section 46FA deductions for flow-on dividends C $ Complete and attach Deduction for decline in value of an International depreciating assets F $ dealings schedule 2023. Forestry managed investment U $ scheme deduction Immediate deduction for capital expenditure E $ Deduction for project pool H $ Capital works deductions I $ Section 40-880 deduction 75 6 3 0 7 3 8 0 0- X X X X 0-1 X X X X X X Amity Holdings Pty Ltd 2023 income tax return (cont.) Landcare operations and deduction for decline in value of water facility, fencing asset and fodder storage asset N $ Do you need Deduction for environmental protection expenses O $ to complete the International Offshore banking unit adjustment P $ dealings schedule 2023? Exempt income V $ Other income not included in assessable income $ TOFA deductions from financial arrangements W $ Do you need to not included in item 6 I Other deductible expenses X $ complete a Losses schedule 2023? Small business J $ skills and training boost Small business technology investment boost L $ Less: continued Tax losses deducted R$ Tax losses transferred in (from or to a foreign bank branch or a PE of a foreign financial entity) S $ Subtraction items subtotal $ X X X X X X X X X 60823 X X *Taxable/net income or loss T $ Franked dividends paid J $ Unfranked dividends paid K $ Opening franking account balance P $ Closing franking account balance M $ 2 3 1 000X (an amount must be included even if it is zero) 7 0 0 00-X 2 4 5 00-X 3 0 00- 1 3 800- Notes and workings accompanying the tax return ITEM 6 INCOME C - OTHER SALES OF GOODS AND SERVICES $ $ Sales of goods and services to Australian customers 525000 Exported sales of goods and services 65000 590000 H-TOTAL DIVIDENDS Fully franked dividends received from listed companies Unfranked dividend from listed companies R-OTHER GROSS INCOME Rent from residential investment properties (includes $5,000 accrued for rent outstanding) EXPENSES A COST OF SALES Purchases add: Closing stock (at cost) 21000 2000 23000 195000 195000 175000 37000 212000 D-SUPERANNUATION EXPENSES Contributions to complying fund 21500 Superannuation Guarantee Charge 1500 23000 E - BAD DEBTS Provision for doubtful debts (none written off during year) 20000 20000 H-RENT EXPENSES Management Fees Strata Levies Insurance 16000 44000 14500 74500 Notes and workings accompanying the tax return (cont.) Y - MOTOR VEHICLE EXPENSES Running costs Speeding Fines 14500 500 15000 S-ALL OTHER EXPENSES Fringe benefits tax paid 22300 Wages 205000 Other employee benefits 16000 Commercial rent - fully serviced business premises 63000 306300 ITEM 7 A - NET CAPITAL GAIN Amity entered into a contract for the sale of a residential property that was acquired in 2022: Capital proceeds less: Purchase price less: 50% discount J-FRANKING CREDITS 30% x $21,000 CALCULATION STATEMENT T1 - TAX ON TAXABLE INCOME 820000 685000 135000 67500 67500 6300 69,300 $231,000 x 30% (Kurt noted that Amity is not a Base Rate Entity as more than 20% of assessable income is Passive) D - NON-REFUNDABLE CARRY FORWARD TAX OFFSETS As per Item 7 J - Franking credits from listed companies 30% x 21,000 6,300 NOTE 1 Notes and workings accompanying the tax return Amity prepared the following franking account for the year: DATE DESCRIPTION DR CR BAL 1-Jul Opening Balance 3000 Fully franked dividends totalling $21,000 30-Sep 6300 9300 received 21-Nov PAYGI Paid 8500 17800 21-Jan Dividend of $70,000 paid - fully franked 21000 -3200 31-Jan PAYGI Paid 8500 5300 21-Apr PAYGI Paid 8500 13800 28-Jun Dividend of $24,500 paid - unfranked 0 13800 NOTE 2 Rental properties held by Amity had unexpired constructions costs totalling $600,000. All properties were constructed between 2000 and 2010. NOTE 3 Amity was provided with artwork valued at $11,000 by a client in return for products provided at no charge. This has not been included in any returns as it is non-cash. NOTE 4 NOTE 5 In 2022, Amity incurred company set-up and initial costs of $15,000. PAYGI instalments paid amounts to $33,000 (i.e. 4 instalments of $8,500 each) Extracts from the June 2023 Business Activity Statement C Option 1: Calculate GST and report quarterly Total sales (G1 requires 1A completed) G1 $ Does the amount shown at 2590 0 0.00 G1 include GST? X Yes No (indicate with X) Export sales G2 $ Other GST-free sales G3 $ Capital purchases G10 S Non-capital purchases G11 $ .00 .00 .00 1 0 1 0 0 0.00 8 Report GST on sales at 1A and GST on purchases at 1B in the Summary section over the page and then complete the other sections OR Option 2: Calculate GST quarterly and report annually Total sales (G1 requires 1A completed) G1 $ Does the amount shown at G1 include GST? Yes No (indicate with X) Report GST on sales at 1A and GST on purchases at 1B in the Office use only 41951119 Business activity statement Document ID ABN 02 345 987 424 OR Write this amount at 1A in the Summary section over the page (leave 1B blank) OR if varying this amount, complete G22, G23, G24 Estimated net G22 $ GST for the year Varied amount payable G23 $ for the quarter Write the G23 amount at 1A in the Summary section over the page and then complete the other sections (leave 1B blank) Reason code for variation G24 PAYG tax withheld .00 .00 Total salary, wages and other payments W1 $ 49800.00 Amount withheld from payments shown at W1 W2 $ 1 6 5 0 0.00 Amount withheld where no ABN is quoted W4 $ .00 .00 Other amounts withheld .00 Summary section over the page and then complete the other sections 180% (excluding any amount W3 $ shown at W2 or W4) Total amounts withheld (W2+W4+ W3) W5 $ 1 6 5 0 0.00 Write the W5 amount at 4 in the Summary section over the page and Centheher sections PAYG income tax instalment Summary Only complete Option 1 OR 2 (indicate one choice with X) x Option 1: Pay a PAYG instalment amount quarterly T7 $8,500 Write the T7 amount at 5A in the Summary section OR if varying this amount, complete T8, T9, T4 Estimated tax for the year T8 $ Varied amount payable T9 $ for the quarter Write the T9 amount at 5A in the Summary section Reason code for variation T4 OR If you are using GST Option 3 leave 1B, 1C, 1D, 1E, 1F blank Amounts you owe the ATO GST on sales or GST instalment 1A $ Wine equalisation tax 1C $ Luxury car tax 1E $ PAYG tax withheld 4 $ .00 ,00 2 5900.00 .00 .00 PAYG income tax 5A $ instalment FBT instalment 6A $ Deferred company/fund 7 $ instalment 1A+1C+1E+4+5A +6A+7 8A $ 1 6 5 0 0.00 850 8 5 0 0.00 5 5 0 0.00 .00 00.00 39900 Option 2: Calculate PAYG instalment using income times rate Amounts the ATO owes you PAYG instalment income T1 $ OR T2 New varied rate T3 T1 x T2 (or x T3) T11 $ Write the T11 amount at 5A in the Summary section Reason code for variation T4 .00 GST on purchases 1B $ 1 0 1 0 0.00 Wine equalisation tax refundable 1D $ .00 % Luxury car tax refundable 1F $ .00 % Credit from PAYG income tax 5B $ .00 instalment variation .00 Credit from FBT instalment variation 6B $ .00 1 0 1 0 0.00 Fringe benefits tax (FBT) instalment F1 $ 5,500 Write the F1 amount at 6A in the Summary section OR if varying this amount, complete F2,F3, F4 Estimated FBT F2 $ for the year Varied amount payable F3 $ for the quarter I 00 00 .00 1B+1D+1F+5B+ 6B 8B $ Payment or refund? Is 8A more than 8B? (indicate with X) X Yes, No, then write the result of 8A minus 8B at 9. This amount is payable to the ATO. then write the result of 8B minus 8A at 9. This amount is refundable to you (or offset against any other tax debt you have). 9 $ Your payment or refund amount 29800.00 Notes and workings accompanying the business activity statement $ $ G1 TOTAL SALES Sales of goods and services to Australian 192000 customers Exported sales of goods and services 23000 Rent from residential investment properties 44000 259000 G11 NON CAPITAL PURCHASES Trading stock purchases 51000 Superannuation 5300 Management Fees - rental properties 4500 Strata Levies rental properties 12500 Insurance rental properties 1600 Car running costs 4600 Commercial rent paid 17800 Purchase of new office furniture 3700 101000 OTHER NOTES Amity was provided with artwork valued at $11,000 by a client in return for products provided at no charge. This has not been included in any returns as it is non-cash. Australian Government Australian Taxation Office Business details Fringe benefits tax (FBT) return 2023 1 April 2022 to 31 March 2023 1 Tax file number (TFN) 1 2 3 4 5 6 7 8 9 See the Privacy note in the Declaration on page 4 of this return. 2 Australian business number (ABN) (if applicable) 0 2 Return calculation details Visit ato.gov.au/FBT2023 for more information. 14 Calculated fringe benefits taxable amounts (whole dollars only) A Type 1 aggregate amount $ B Type 2 aggregate amount $ 3 4 5 9 8 7 4 2 4 1 6 000-X x 2.0802 $ 3 3 283-A 7 500-x 1.8868 = 1 4 151-X B or SA - C C Aggregate non-exempt amount (hospitals, ambulances, public benevolent institutions and health promotion charities only) 15 Fringe benefits taxable amount 16 Amount of tax payable (47% of item 15 amount) 17 Aggregate non-rebatable amount Only complete this item if you are a rebatable employer. Visit ato.gov.au/FBT2023 for more information. 18 Amount of rebate 47% of (item 16 amount less item 17 amount) Only complete this item if you are a rebatable employer. Visit ato.gov.au/FBT2023 for more information. 19 Sub-total (item 16 amount less item 18 amount) (A + B) or C $ 4 20 Less instalment amounts reported on activity statements Visit ato.gov.au/FBT2023 for more information. 21 Payment due 23 Details of fringe benefits provided SA SA 7 434-X 22,293-98 $, 22,293-98 1 6 0 0 0-X $6,293-98 WHOLE DOLLARS ONLY Type of benefits provided (1 April 2022 to 31 March 2023) Number Gross taxable value (a) Employee contribution (b) Value of reductions (c) Taxable value of benefits (a)-(b)-(c) Cars using the statutory formula A Cars using the operating cost method B 1 7500 7500 Loans granted C Debt waiver D Expense payments E 16000 16000 Employees receiving living-away-from-home allowance Housing units of accommodation provided F (show total paid including exempt components) G Board Notes and workings accompanying the fringe benefits tax return ITEM 23 CAR FRINGE BENEFIT EA $ Running costs 15000 Estimated business use (no logbook kept) 50% TAXABLE VALUE 7500 EXPENSE PAYMENT BENEFITS Hospital (medical) costs paid for 10000 employee Furniture purchased for employee 6000 16000 NOTE - CAR BENEFIT The car originally cost $60,000 including GST and was available for the entire FBT year. No contributions were received from the recipient.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started