Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you are the auditor of the entity GoodMood. An inventory count was done on December 31. Required: Decide if the following goods should be

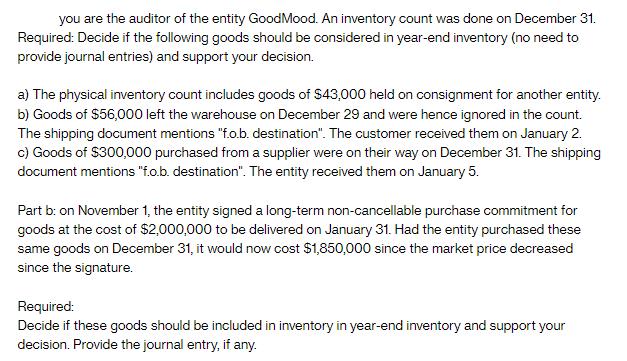

you are the auditor of the entity GoodMood. An inventory count was done on December 31. Required: Decide if the following goods should be considered in year-end inventory (no need to provide journal entries) and support your decision. a) The physical inventory count includes goods of $43,000 held on consignment for another entity. b) Goods of $56,000 left the warehouse on December 29 and were hence ignored in the count. The shipping document mentions "f.o.b. destination". The customer received them on January 2. c) Goods of $300,000 purchased from a supplier were on their way on December 31. The shipping document mentions "f.o.b. destination". The entity received them on January 5. Part b: on November 1, the entity signed a long-term non-cancellable purchase commitment for goods at the cost of $2,000,000 to be delivered on January 31. Had the entity purchased these same goods on December 31, it would now cost $1,850,000 since the market price decreased since the signature. Required: Decide if these goods should be included in inventory in year-end inventory and support your decision. Provide the journal entry, if any.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a The goods held on consignment for another entity worth 43000 should not be considered in yearend inventory Consignment goods are not owned by the en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started