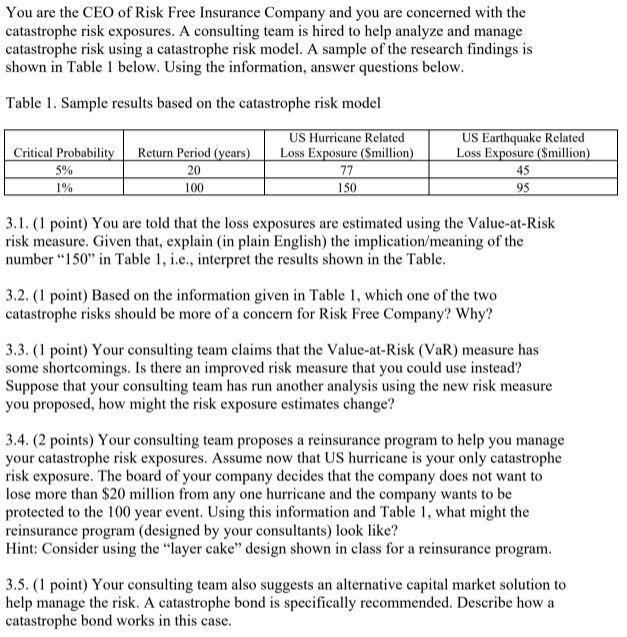

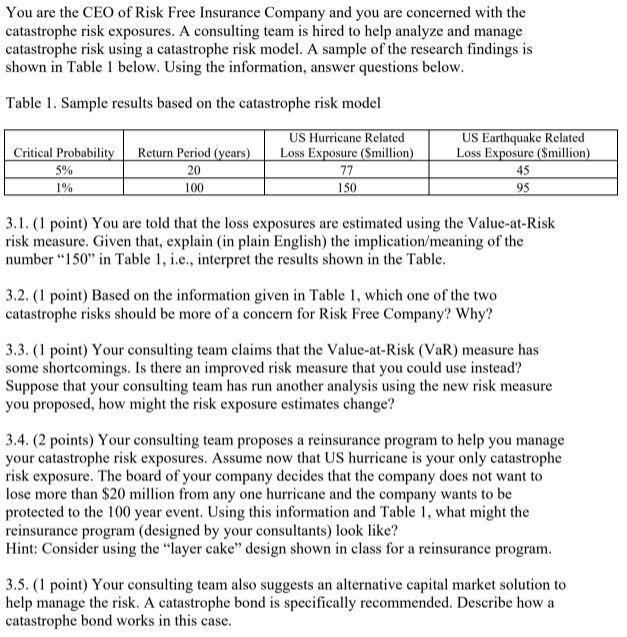

You are the CEO of Risk Free Insurance Company and you are concerned with the catastrophe risk exposures. A consulting team is hired to help analyze and manage catastrophe risk using a catastrophe risk model. A sample of the research findings is shown in Table 1 below. Using the information, answer questions below. Table 1. Sample results based on the catastrophe risk model Critical Probability 5% 1% Return Period (years) 20 100 US Hurricane Related Loss Exposure (Smillion) 77 150 US Earthquake Related Loss Exposure (Smillion) 45 95 3.1. (1 point) You are told that the loss exposures are estimated using the Value-at-Risk risk measure. Given that, explain (in plain English) the implication/meaning of the number "150" in Table 1, i.e., interpret the results shown in the Table. 3.2. (1 point) Based on the information given in Table 1, which one of the two catastrophe risks should be more of a concern for Risk Free Company? Why? 3.3. (1 point) Your consulting team claims that the Value-at-Risk (VaR) measure has some shortcomings. Is there an improved risk measure that you could use instead? Suppose that your consulting team has run another analysis using the new risk measure you proposed, how might the risk exposure estimates change? 3.4. (2 points) Your consulting team proposes a reinsurance program to help you manage your catastrophe risk exposures. Assume now that US hurricane is your only catastrophe risk exposure. The board of your company decides that the company does not want to lose more than $20 million from any one hurricane and the company wants to be protected to the 100 year event. Using this information and Table 1, what might the reinsurance program (designed by your consultants) look like? Hint: Consider using the "layer cake" design shown in class for a reinsurance program. 3.5. (1 point) Your consulting team also suggests an alternative capital market solution to help manage the risk. A catastrophe bond is specifically recommended. Describe how a catastrophe bond works in this case. You are the CEO of Risk Free Insurance Company and you are concerned with the catastrophe risk exposures. A consulting team is hired to help analyze and manage catastrophe risk using a catastrophe risk model. A sample of the research findings is shown in Table 1 below. Using the information, answer questions below. Table 1. Sample results based on the catastrophe risk model Critical Probability 5% 1% Return Period (years) 20 100 US Hurricane Related Loss Exposure (Smillion) 77 150 US Earthquake Related Loss Exposure (Smillion) 45 95 3.1. (1 point) You are told that the loss exposures are estimated using the Value-at-Risk risk measure. Given that, explain (in plain English) the implication/meaning of the number "150" in Table 1, i.e., interpret the results shown in the Table. 3.2. (1 point) Based on the information given in Table 1, which one of the two catastrophe risks should be more of a concern for Risk Free Company? Why? 3.3. (1 point) Your consulting team claims that the Value-at-Risk (VaR) measure has some shortcomings. Is there an improved risk measure that you could use instead? Suppose that your consulting team has run another analysis using the new risk measure you proposed, how might the risk exposure estimates change? 3.4. (2 points) Your consulting team proposes a reinsurance program to help you manage your catastrophe risk exposures. Assume now that US hurricane is your only catastrophe risk exposure. The board of your company decides that the company does not want to lose more than $20 million from any one hurricane and the company wants to be protected to the 100 year event. Using this information and Table 1, what might the reinsurance program (designed by your consultants) look like? Hint: Consider using the "layer cake" design shown in class for a reinsurance program. 3.5. (1 point) Your consulting team also suggests an alternative capital market solution to help manage the risk. A catastrophe bond is specifically recommended. Describe how a catastrophe bond works in this case