Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the CFO of a company and are analyzing one of your company's semiannual bonds with a 10-year maturity that were issued in

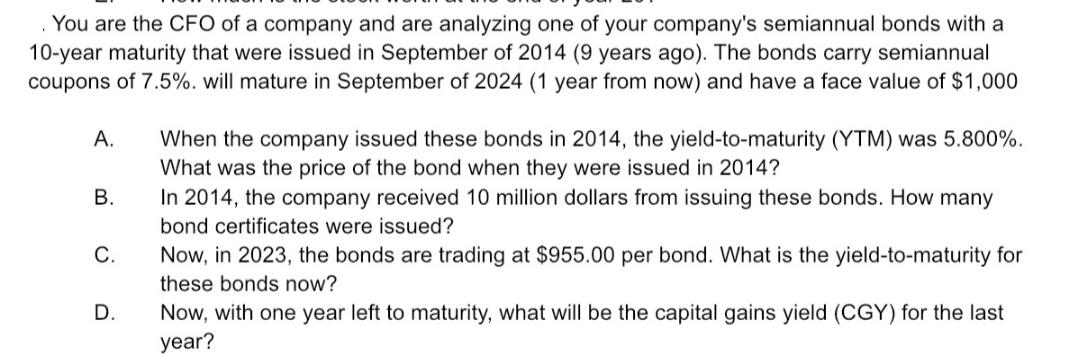

You are the CFO of a company and are analyzing one of your company's semiannual bonds with a 10-year maturity that were issued in September of 2014 (9 years ago). The bonds carry semiannual coupons of 7.5%. will mature in September of 2024 (1 year from now) and have a face value of $1,000 A. B. C. D. When the company issued these bonds in 2014, the yield-to-maturity (YTM) was 5.800%. What was the price of the bond when they were issued in 2014? In 2014, the company received 10 million dollars from issuing these bonds. How many bond certificates were issued? Now, in 2023, the bonds are trading at $955.00 per bond. What is the yield-to-maturity for these bonds now? Now, with one year left to maturity, what will be the capital gains yield (CGY) for the last year?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution A The price of the bond when it was issued in 2014 can be calculated using the present valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started