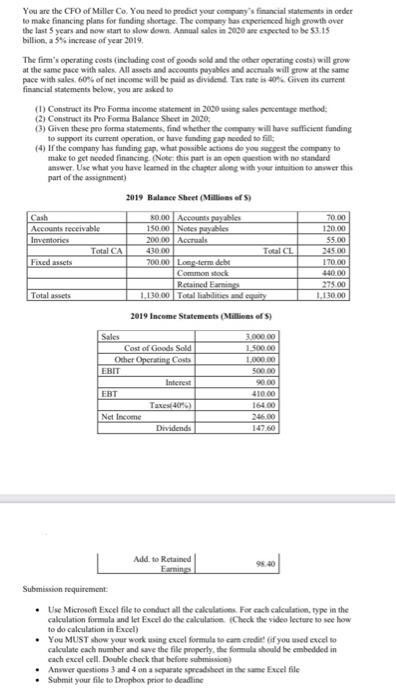

You are the CFO of Miller Co. You need to predict your company's financial statements in order to make financing plans for funding shortage. The company has experienced high growth over the last years and now start to slow down. Annual sales in 2020 are expected to be 53.15 billion, a 5% increase of year 2019, The firm's operating costs (including cost of goods sold and the other operating costs) will grow at the same pace with sales All assets and accounts payables and accruals will grow at the same pace with sales. 60% of net income will be paid as dividend Tax rate is 10%. Given its current financial statements below, you are asked to (1) Construct its Pro Forma income statement in 2000 using sales percentage method (2) Construct its Pro Forma Balance Sheet in 2020, 3) Given these pro forma statements, find whether the company will have sufficient funding to support its current operation, or have funding speeded so fill (4) If the company has funding sap, what possible acties do you suggest the company to make to get needed financing. (Note: this part is an open question with no standard answer. Use what you have leared in the chapter along with your intuition to wwer this part of the assignment) 2019 Balance Sheet (Mallies of Cash Accounts receivable Inventories Total CA 70.00 120.00 55.00 245.00 170.00 440.00 275.00 1.130.00 80.00 Accounts payables 150.00 Notes payables 200.00 Accruals 430.00 TotalCL 700.00 Long-term debt Common stock Retained Emin 1.130.00 Total litics and city Fixed assets Total assets 2019 Income Statements (Millions of S) 3.000.00 1_500.00 1.000.00 5000 Sales Cost of Goods Sold Other Operating Costs EBIT Interest EBT Taxes[407 Net Income Dividends 90.00 410.00 164.00 246.00 147.60 Add to Retained Earning 98.40 Submission requirement: Use Microsoft Excel file to conduct all the calculations. For each calculation, type in the calculation formala and let Excel do the calculation (Check the video lecture to see how to do calculation in Excel) You MUST show your work using excel formula o cam credit if you used excel to calculate each number and save the file properly, the formule should be embedded in cach excel cell. Double check that before submission) Answer questions 3 and 4 on a separate spreadsheet in the same Excel file Submit your file to Dropbox prior to deadline