Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the CFO of the Milk Company and are considering a possible acquisition of the Almond Company. As the name suggests, the Almond

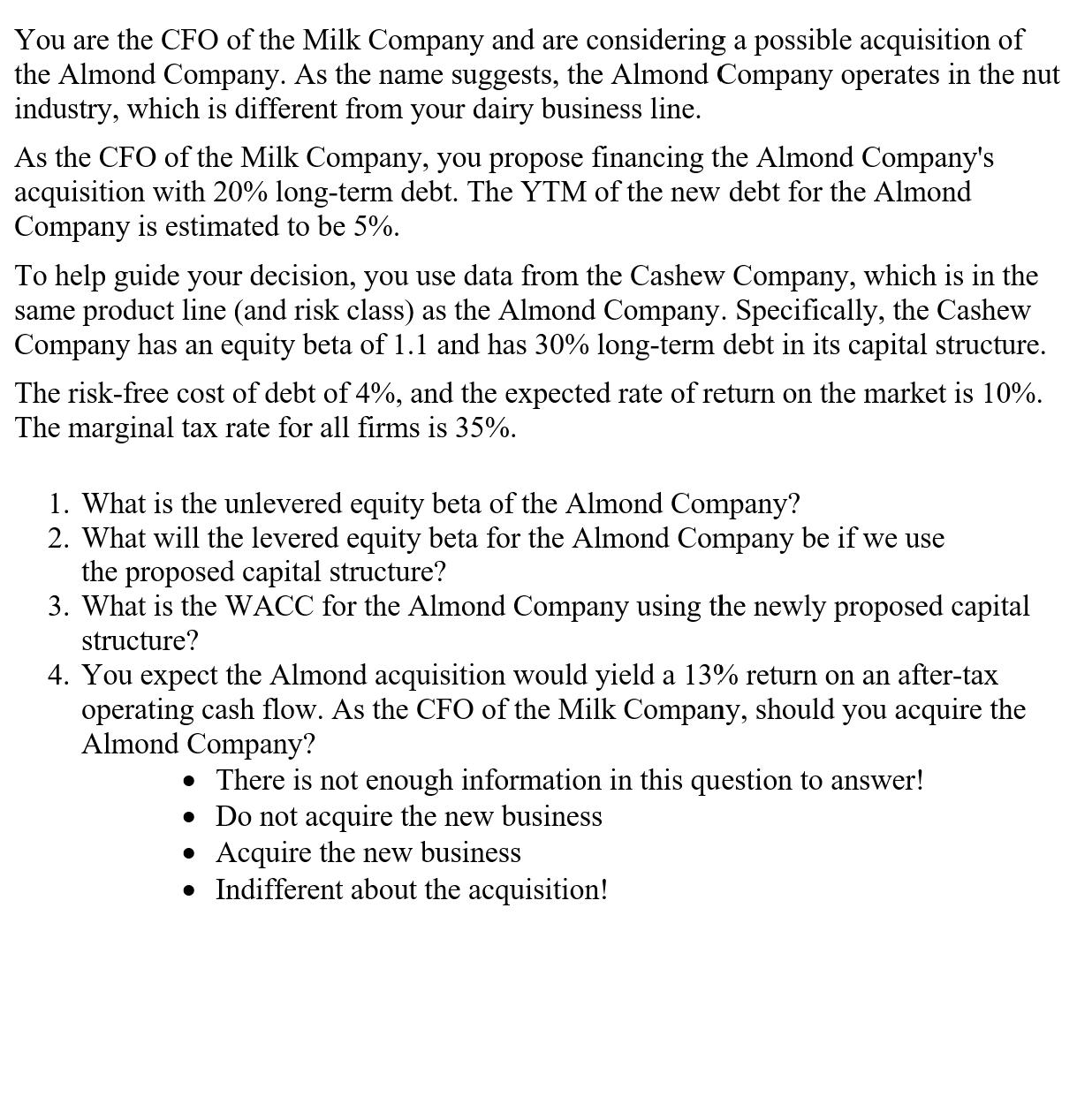

You are the CFO of the Milk Company and are considering a possible acquisition of the Almond Company. As the name suggests, the Almond Company operates in the nut industry, which is different from your dairy business line. As the CFO of the Milk Company, you propose financing the Almond Company's acquisition with 20% long-term debt. The YTM of the new debt for the Almond Company is estimated to be 5%. To help guide your decision, you use data from the Cashew Company, which is in the same product line (and risk class) as the Almond Company. Specifically, the Cashew Company has an equity beta of 1.1 and has 30% long-term debt in its capital structure. The risk-free cost of debt of 4%, and the expected rate of return on the market is 10%. The marginal tax rate for all firms is 35%. 1. What is the unlevered equity beta of the Almond Company? 2. What will the levered equity beta for the Almond Company be if we use the proposed capital structure? 3. What is the WACC for the Almond Company using the newly proposed capital structure? 4. You expect the Almond acquisition would yield a 13% return on an after-tax operating cash flow. As the CFO of the Milk Company, should you acquire the Almond Company? There is not enough information in this question to answer! Do not acquire the new business Acquire the new business Indifferent about the acquisition!

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 What is the unlevered equity beta of the Almond Company We can use the following formula to calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started