Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the CFO of TRADETECH, a firm that produces handheld wireless trading modules, which allow any reckless) day-trader to trade from anywhere without the

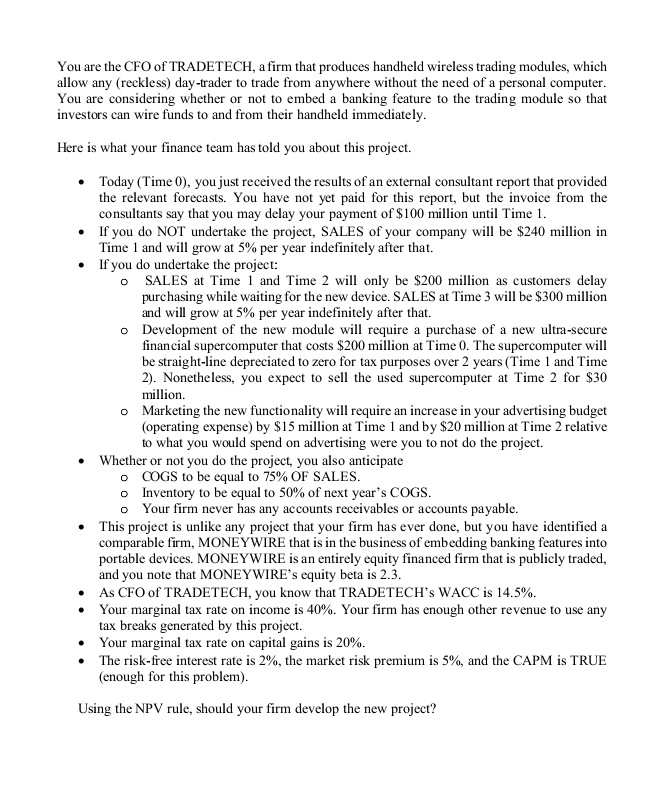

You are the CFO of TRADETECH, a firm that produces handheld wireless trading modules, which allow any reckless) day-trader to trade from anywhere without the need of a personal computer. You are considering whether or not to embed a banking feature to the trading module so that investors can wire funds to and from their handheld immediately. Here is what your finance team has told you about this project. Today (Time 0), you just received the results of an external consultant report that provided the relevant forecasts. You have not yet paid for this report, but the invoice from the consultants say that you may delay your payment of $100 million until Time 1. If you do NOT undertake the project, SALES of your company will be $240 million in Time 1 and will grow at 5% per year indefinitely after that. If you do undertake the project: SALES at Time 1 and Time 2 will only be $200 million as customers delay purchasing while waiting for the new device. SALES at Time 3 will be $300 million and will grow at 5% per year indefinitely after that. o Development of the new module will require a purchase of a new ultra-secure financial supercomputer that costs $200 million at Time 0. The supercomputer will be straight-line depreciated to zero for tax purposes over 2 years (Time 1 and Time 2). Nonetheless, you expect to sell the used supercomputer at Time 2 for $30 million. Marketing the new functionality will require an increase in your advertising budget (operating expense) by $15 million at Time 1 and by $20 million at Time 2 relative to what you would spend on advertising were you to not do the project. Whether or not you do the project, you also anticipate o COGS to be equal to 75% OF SALES. Inventory to be equal to 50% of next year's COGS. O Your firm never has any accounts receivables or accounts payable. This project is unlike any project that your firm has ever done, but you have identified a comparable firm, MONEYWIRE that is in the business of embedding banking features into portable devices. MONEYWIRE is an entirely equity financed firm that is publicly traded, and you note that MONEYWIRE's equity beta is 2.3. As CFO of TRADETECH, you know that TRADETECH's WACC is 14.5%. Your marginal tax rate on income is 40%. Your firm has enough other revenue to use any tax breaks generated by this project. Your marginal tax rate on capital gains is 20%. The risk-free interest rate is 2%, the market risk premium is 5%, and the CAPM is TRUE (enough for this problem). Using the NPV rule, should your firm develop the new project? You are the CFO of TRADETECH, a firm that produces handheld wireless trading modules, which allow any reckless) day-trader to trade from anywhere without the need of a personal computer. You are considering whether or not to embed a banking feature to the trading module so that investors can wire funds to and from their handheld immediately. Here is what your finance team has told you about this project. Today (Time 0), you just received the results of an external consultant report that provided the relevant forecasts. You have not yet paid for this report, but the invoice from the consultants say that you may delay your payment of $100 million until Time 1. If you do NOT undertake the project, SALES of your company will be $240 million in Time 1 and will grow at 5% per year indefinitely after that. If you do undertake the project: SALES at Time 1 and Time 2 will only be $200 million as customers delay purchasing while waiting for the new device. SALES at Time 3 will be $300 million and will grow at 5% per year indefinitely after that. o Development of the new module will require a purchase of a new ultra-secure financial supercomputer that costs $200 million at Time 0. The supercomputer will be straight-line depreciated to zero for tax purposes over 2 years (Time 1 and Time 2). Nonetheless, you expect to sell the used supercomputer at Time 2 for $30 million. Marketing the new functionality will require an increase in your advertising budget (operating expense) by $15 million at Time 1 and by $20 million at Time 2 relative to what you would spend on advertising were you to not do the project. Whether or not you do the project, you also anticipate o COGS to be equal to 75% OF SALES. Inventory to be equal to 50% of next year's COGS. O Your firm never has any accounts receivables or accounts payable. This project is unlike any project that your firm has ever done, but you have identified a comparable firm, MONEYWIRE that is in the business of embedding banking features into portable devices. MONEYWIRE is an entirely equity financed firm that is publicly traded, and you note that MONEYWIRE's equity beta is 2.3. As CFO of TRADETECH, you know that TRADETECH's WACC is 14.5%. Your marginal tax rate on income is 40%. Your firm has enough other revenue to use any tax breaks generated by this project. Your marginal tax rate on capital gains is 20%. The risk-free interest rate is 2%, the market risk premium is 5%, and the CAPM is TRUE (enough for this problem). Using the NPV rule, should your firm develop the new project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started