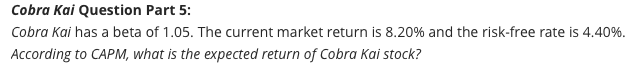

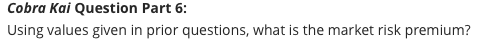

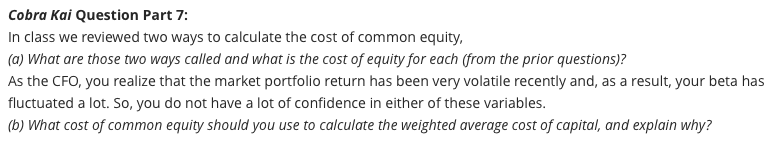

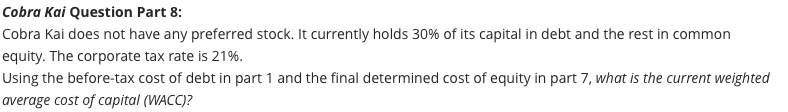

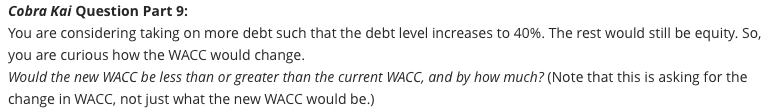

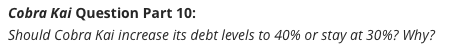

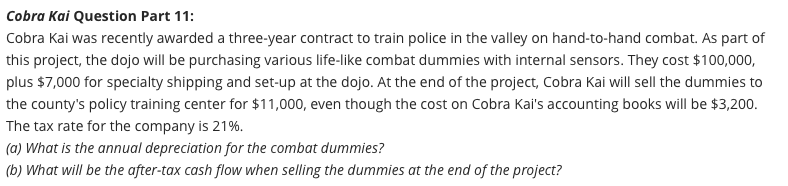

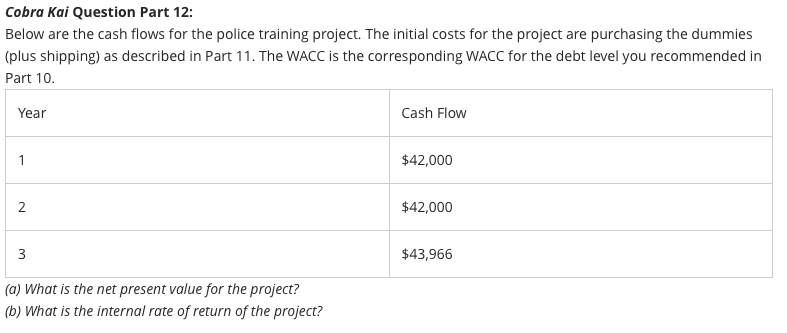

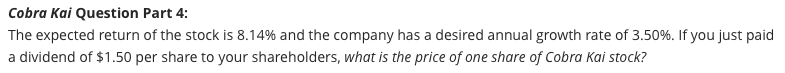

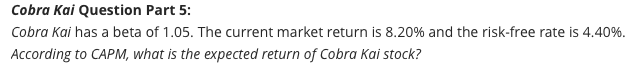

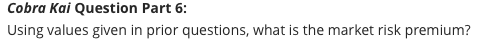

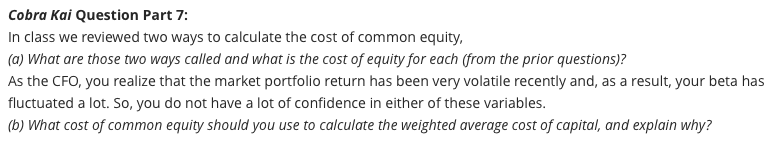

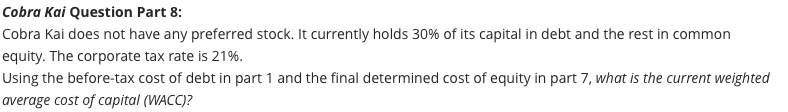

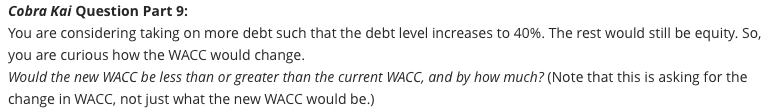

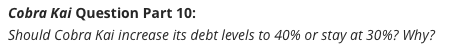

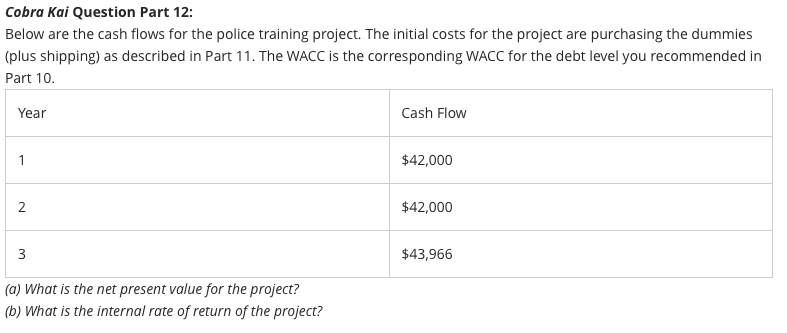

You are the Chief Financial Manager of Cobra Kai, a small but growing company specializing in combat sports training and gear. You are considering taking on more debt by issuing bonds. This series of 10 questions will help you identify if you should issue more debt or stay at current debt levels. You should go through the questions in order. (Round all answers to 2 digits after the decimal. For example, dollar values should be $XX.xx and percentages should be Y.yy%. Show your work for opportunuties for partial credit.) Cobra Kai Question Part 1: The company's current bonds have a coupon rate of 7.00% and coupon payments are made semiannually. The yield to maturity of 5.00% and will mature in 5 years. The par value is $1,000.00. What is the semiannual coupon payment for the bond? Cobra Kai Question Part 2: What is the current price of the bond? Cobra Kai Question Part 3: Is this a discount bond or a premium bond? How do you know? Cobra Kai Question Part 4: The expected return of the stock is 8.14% and the company has a desired annual growth rate of 3.50%. If you just paid a dividend of $1.50 per share to your shareholders, what is the price of one share of Cobra Kai stock? Cobra Kai Question Part 5: Cobra Kai has a beta of 1.05. The current market return is 8.20% and the risk-free rate is 4.40%. According to CAPM, what is the expected return of Cobra Kai stock? Cobra kai Question Part 6: Using values given in prior questions, what is the market risk premium? Cobra Kai Question Part 7: In class we reviewed two ways to calculate the cost of common equity, (a) What are those two ways called and what is the cost of equity for each (from the prior questions)? As the CFO, you realize that the market portfolio return has been very volatile recently and, as a result, your beta has fluctuated a lot. So, you do not have a lot of confidence in either of these variables. (b) What cost of common equity should you use to calculate the weighted average cost of capital, and explain why? Cobra Kai Question Part 8: Cobra Kai does not have any preferred stock. It currently holds 30% of its capital in debt and the rest in common equity. The corporate tax rate is 21%. Using the before-tax cost of debt in part 1 and the final determined cost of equity in part 7, what is the current weighted average cost of capital (WACC)? Cobra Kai Question Part 9: You are considering taking on more debt such that the debt level increases to 40%. The rest would still be equity. So, you are curious how the WACC would change. Would the new WACC be less than or greater than the current WACC, and by how much? (Note that this is asking for the change in WACC, not just what the new WACC would be.) Cobra Kai Question Part 10: Should Cobra Kai increase its debt levels to 40% or stay at 30%? Why? Cobra Kai Question Part 11: Cobra Kai was recently awarded a three-year contract to train police in the valley on hand-to-hand combat. As part of this project, the dojo will be purchasing various life-like combat dummies with internal sensors. They cost $100,000, plus $7,000 for specialty shipping and set-up at the dojo. At the end of the project, Cobra Kai will sell the dummies to the county's policy training center for $11,000, even though the cost on Cobra Kai's accounting books will be $3,200. The tax rate for the company is 21%. (a) What is the annual depreciation for the combat dummies? (b) What will be the after-tax cash flow when selling the dummies at the end of the project? Cobra Kai Question Part 12: Below are the cash flows for the police training project. The initial costs for the project are purchasing the dummies (plus shipping) as described in Part 11. The WACC is the corresponding WACC for the debt level you recommended in Part 10 Year Cash Flow 1 $42,000 N 2 $42,000 3 $43,966 (a) What is the net present value for the project? (b) What is the internal rate of return of the project? You are the Chief Financial Manager of Cobra Kai, a small but growing company specializing in combat sports training and gear. You are considering taking on more debt by issuing bonds. This series of 10 questions will help you identify if you should issue more debt or stay at current debt levels. You should go through the questions in order. (Round all answers to 2 digits after the decimal. For example, dollar values should be $XX.xx and percentages should be Y.yy%. Show your work for opportunuties for partial credit.) Cobra Kai Question Part 1: The company's current bonds have a coupon rate of 7.00% and coupon payments are made semiannually. The yield to maturity of 5.00% and will mature in 5 years. The par value is $1,000.00. What is the semiannual coupon payment for the bond? Cobra Kai Question Part 2: What is the current price of the bond? Cobra Kai Question Part 3: Is this a discount bond or a premium bond? How do you know? Cobra Kai Question Part 4: The expected return of the stock is 8.14% and the company has a desired annual growth rate of 3.50%. If you just paid a dividend of $1.50 per share to your shareholders, what is the price of one share of Cobra Kai stock? Cobra Kai Question Part 5: Cobra Kai has a beta of 1.05. The current market return is 8.20% and the risk-free rate is 4.40%. According to CAPM, what is the expected return of Cobra Kai stock? Cobra kai Question Part 6: Using values given in prior questions, what is the market risk premium? Cobra Kai Question Part 7: In class we reviewed two ways to calculate the cost of common equity, (a) What are those two ways called and what is the cost of equity for each (from the prior questions)? As the CFO, you realize that the market portfolio return has been very volatile recently and, as a result, your beta has fluctuated a lot. So, you do not have a lot of confidence in either of these variables. (b) What cost of common equity should you use to calculate the weighted average cost of capital, and explain why? Cobra Kai Question Part 8: Cobra Kai does not have any preferred stock. It currently holds 30% of its capital in debt and the rest in common equity. The corporate tax rate is 21%. Using the before-tax cost of debt in part 1 and the final determined cost of equity in part 7, what is the current weighted average cost of capital (WACC)? Cobra Kai Question Part 9: You are considering taking on more debt such that the debt level increases to 40%. The rest would still be equity. So, you are curious how the WACC would change. Would the new WACC be less than or greater than the current WACC, and by how much? (Note that this is asking for the change in WACC, not just what the new WACC would be.) Cobra Kai Question Part 10: Should Cobra Kai increase its debt levels to 40% or stay at 30%? Why? Cobra Kai Question Part 11: Cobra Kai was recently awarded a three-year contract to train police in the valley on hand-to-hand combat. As part of this project, the dojo will be purchasing various life-like combat dummies with internal sensors. They cost $100,000, plus $7,000 for specialty shipping and set-up at the dojo. At the end of the project, Cobra Kai will sell the dummies to the county's policy training center for $11,000, even though the cost on Cobra Kai's accounting books will be $3,200. The tax rate for the company is 21%. (a) What is the annual depreciation for the combat dummies? (b) What will be the after-tax cash flow when selling the dummies at the end of the project? Cobra Kai Question Part 12: Below are the cash flows for the police training project. The initial costs for the project are purchasing the dummies (plus shipping) as described in Part 11. The WACC is the corresponding WACC for the debt level you recommended in Part 10 Year Cash Flow 1 $42,000 N 2 $42,000 3 $43,966 (a) What is the net present value for the project? (b) What is the internal rate of return of the project