Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you are the chief investment officer at an endowment fund. the fund manages half the investment portfolio in house with their own investment team and

you are the chief investment officer at an endowment fund. the fund manages half the investment portfolio in house with their own investment team and outsources half to 2 independant investment managers for the benefit or diversification. The fund has recently recieved a very generus donation of $5 million from a successful coworker. as CIO you must decide which independsnt manager will get the new money to manage.

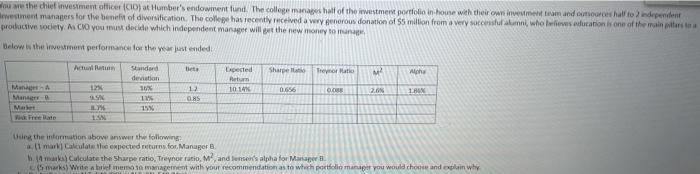

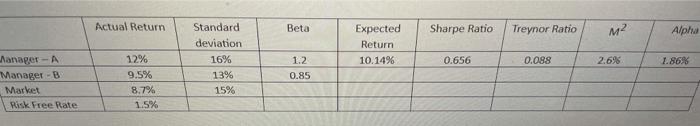

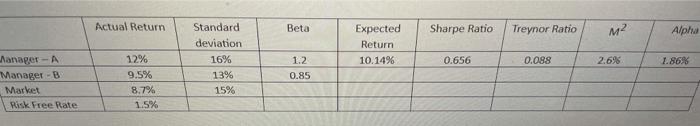

You are the chiefestment officer (CIO) Humber's endowme font. The college mange half of the investment portfolio in house with their own investeem and outsources halto 2 independent wwesoment managers for the best of diversification. The college has recently received a wrotice of 5 million for a urycome, who believes education of the main piano nductive society. As you man decide which independent manager will get the new moto na Benw is the intestment performance for the your stended Actor Standard Espeed Share be 32 1. 10016 OS 2 Manager - Mart M 19 Um the intermitenbove was the found (Collate the section Manager bi moralatan the Sharper treure und Jensen's ha for Manager We were to me with you to as to which potoman you would choose and party ou me the chief investment office (10) Humbur's endowment fund. The college half of the westment portfolio in house with their own neam and outdoors hall to 2 independent Investment managers for the benefit of diversification. The college has recently received a very generous donation of million from a very succesul lumni, who lives aduation is one of the main plantas productive society. As CIO you must decide which independent manager will the new money to Below is the investment performance for the year just ended Actu Dieta Standard deviation Sharge Treynor Hati M wie Lapested Reum 10141 12 OS 0.656 MA Manga Market 2.0% Ung the information above answer the following (1 mark Calculate the expected returns for Manager 4 malay Calculate the shape ratio, Treynor ratio, M, and lemon's alpha for Massager 5) Write a brief memoto wagement with your recommendation as to which portfolio manage you would choose and explain why Actual Return Beta Sharpe Ratio Treynor Ratio M2 Alpha Expected Return 10.14% Standard deviation 16% 13% 15% 1.2 0.656 0.088 2.6% 1.86% Manager - A Manager - Market Risk Free Rate 0.85 12% 9.5% 8.7% 1.5% using the info in the table calculate:

a. the expected return for manager B.

b. the sharpe ratio, treynor ratio, m squared, and jensens alpha for manager B.

c. write a brief memo to management with your recommendation at to which portfolio manager to choose and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started