Answered step by step

Verified Expert Solution

Question

1 Approved Answer

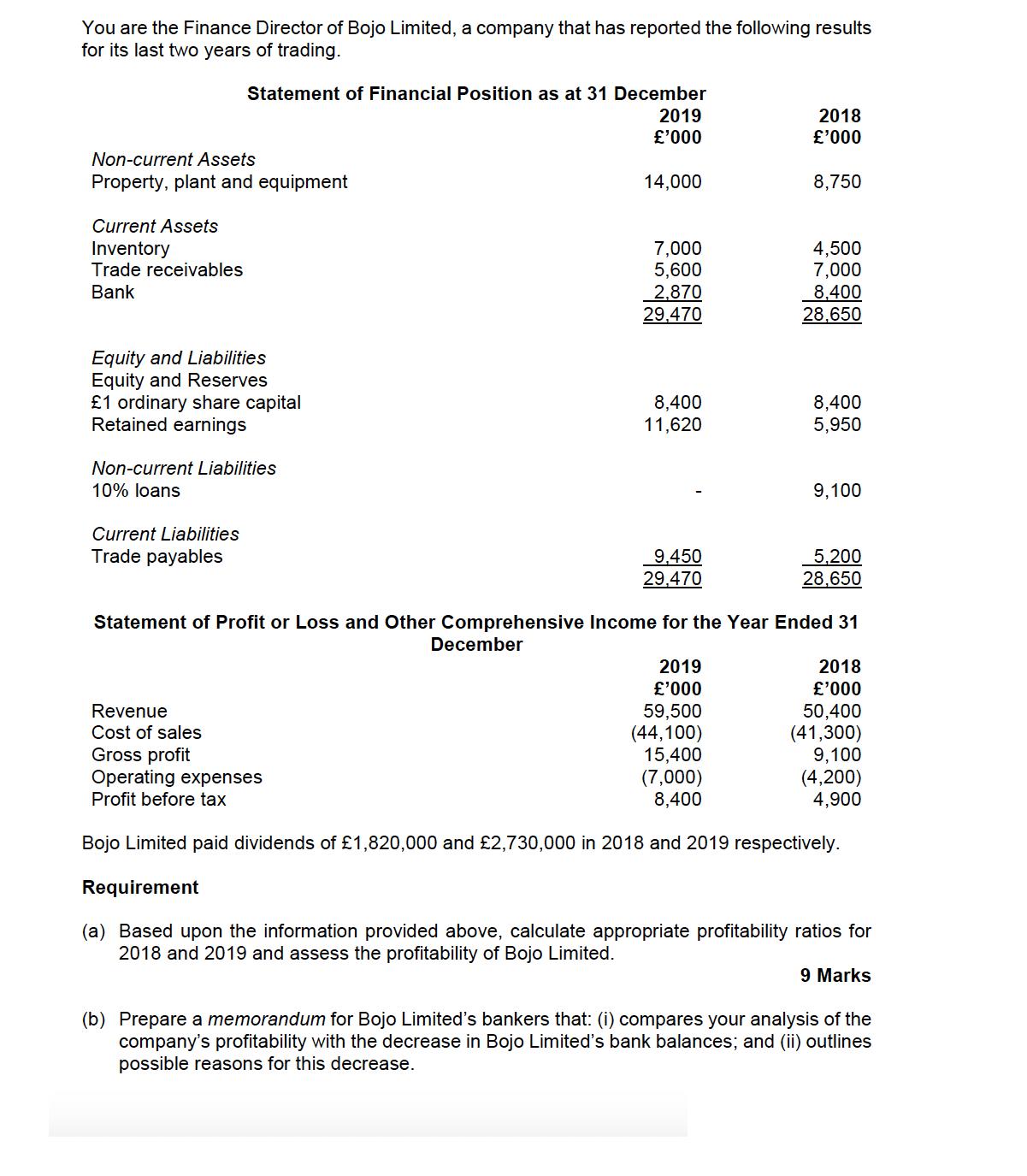

You are the Finance Director of Bojo Limited, a company that has reported the following results for its last two years of trading. Non-current

You are the Finance Director of Bojo Limited, a company that has reported the following results for its last two years of trading. Non-current Assets Property, plant and equipment Current Assets Inventory Trade receivables Bank Statement of Financial Position as at 31 December 2019 '000 Equity and Liabilities Equity and Reserves 1 ordinary share capital Retained earnings Non-current Liabilities 10% loans Current Liabilities Trade payables Revenue Cost of sales Gross profit 14,000 7,000 5,600 2,870 29,470 8,400 11,620 9,450 29,470 2019 '000 59,500 (44,100) 15,400 2018 '000 8,750 (7,000) 8,400 4,500 7,000 8,400 28,650 Statement of Profit or Loss and Other Comprehensive Income for the Year Ended 31 December 8,400 5,950 9,100 5,200 28,650 2018 '000 50,400 (41,300) 9,100 (4,200) 4,900 Operating expenses Profit before tax Bojo Limited paid dividends of 1,820,000 and 2,730,000 in 2018 and 2019 respectively. Requirement (a) Based upon the information provided above, calculate appropriate profitability ratios for 2018 and 2019 and assess the profitability of Bojo Limited. 9 Marks (b) Prepare a memorandum for Bojo Limited's bankers that: (i) compares your analysis of the company's profitability with the decrease in Bojo Limited's bank balances; and (ii) outlines possible reasons for this decrease.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Profitability Ratios Gross Profit Margin 2018 44100 29470 44100 332 2019 59500 28650 59500 518 Net Profit Margin 2018 8400 4200 44100 186 2019 15400 7000 59500 259 Return on Equity 2018 8400 4200 84...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started