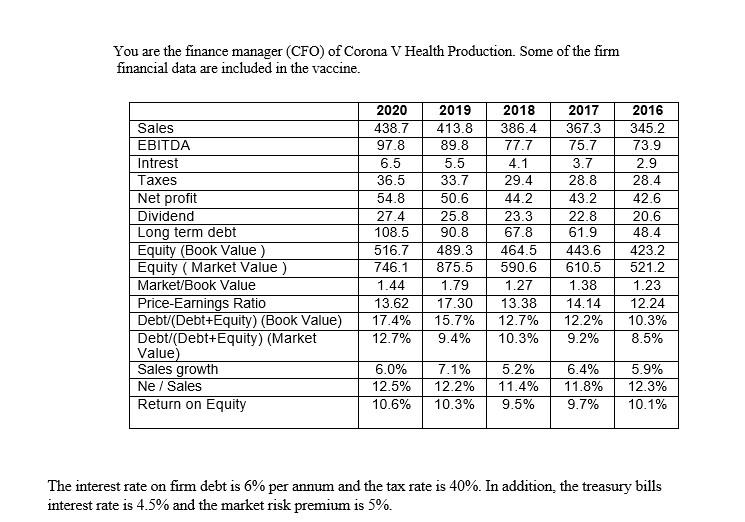

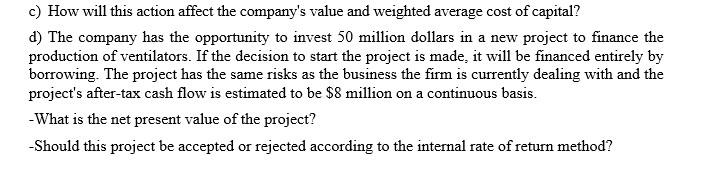

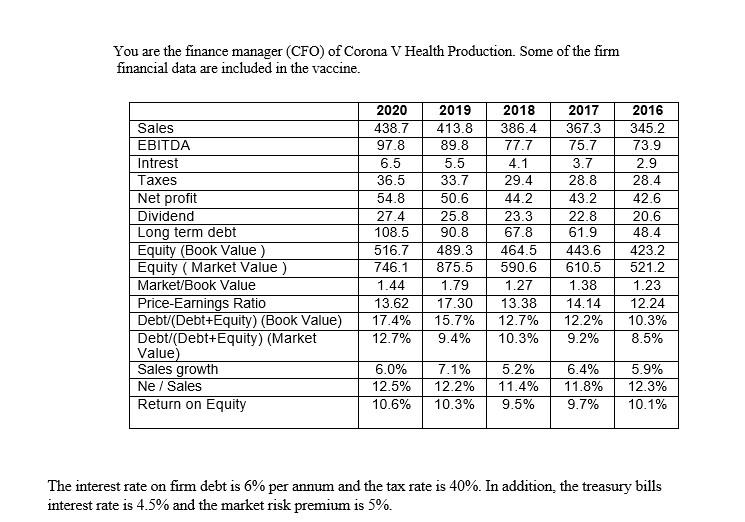

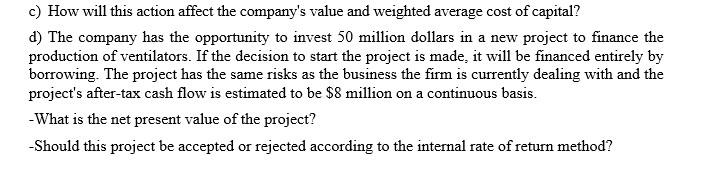

You are the finance manager (CFO) of Corona V Health Production. Some of the firm financial data are included in the vaccine. 2018 2017 2020 438.7 2019 413.8 89.8 386.4 77.7 97.8 2016 345.2 73.9 367.3 75.7 6.5 36.5 5.5 33.7 4.1 29.4 3.7 28.8 43.2 2.9 28.4 42.6 44.2 54.8 27.4 108.5 50.6 25.8 90.8 20.6 48.4 Sales EBITDA Intrest Taxes Net profit Dividend Long term debt Equity (Book Value) Equity (Market Value ) Market/Book Value Price-Earnings Ratio Debt/(Debt+Equity) (Book Value) Debt/(Debt+Equity) (Market Value) Sales growth Ne / Sales Return on Equity 23.3 67.8 464.5 590.6 22.8 61.9 443.6 610.5 516.7 746.1 423.2 521.2 489.3 875.5 1.79 17.30 1.38 1.23 1.44 13.62 17.4% 12.7% 1.27 13.38 12.7% 14.14 12.2% 9.2% 12.24 10.3% 15.7% 9.4% 10.3% 8.5% 6.0% 12.5% 10.6% 7.1% 12.2% 5.2% 11.4% 6.4% 11.8% 5.9% 12.3% 10.3% 9.5% 9.7% 10.1% The interest rate on firm debt is 6% per annum and the tax rate is 40%. In additionthe treasury bills interest rate is 4.5% and the market risk premium is 5%. c) How will this action affect the company's value and weighted average cost of capital? d) The company has the opportunity to invest 50 million dollars in a new project to finance the production of ventilators. If the decision to start the project is made, it will be financed entirely by borrowing. The project has the same risks as the business the firm is currently dealing with and the project's after-tax cash flow is estimated to be $8 million on a continuous basis. - What is the net present value of the project? -Should this project be accepted or rejected according to the internal rate of return method? You are the finance manager (CFO) of Corona V Health Production. Some of the firm financial data are included in the vaccine. 2018 2017 2020 438.7 2019 413.8 89.8 386.4 77.7 97.8 2016 345.2 73.9 367.3 75.7 6.5 36.5 5.5 33.7 4.1 29.4 3.7 28.8 43.2 2.9 28.4 42.6 44.2 54.8 27.4 108.5 50.6 25.8 90.8 20.6 48.4 Sales EBITDA Intrest Taxes Net profit Dividend Long term debt Equity (Book Value) Equity (Market Value ) Market/Book Value Price-Earnings Ratio Debt/(Debt+Equity) (Book Value) Debt/(Debt+Equity) (Market Value) Sales growth Ne / Sales Return on Equity 23.3 67.8 464.5 590.6 22.8 61.9 443.6 610.5 516.7 746.1 423.2 521.2 489.3 875.5 1.79 17.30 1.38 1.23 1.44 13.62 17.4% 12.7% 1.27 13.38 12.7% 14.14 12.2% 9.2% 12.24 10.3% 15.7% 9.4% 10.3% 8.5% 6.0% 12.5% 10.6% 7.1% 12.2% 5.2% 11.4% 6.4% 11.8% 5.9% 12.3% 10.3% 9.5% 9.7% 10.1% The interest rate on firm debt is 6% per annum and the tax rate is 40%. In additionthe treasury bills interest rate is 4.5% and the market risk premium is 5%. c) How will this action affect the company's value and weighted average cost of capital? d) The company has the opportunity to invest 50 million dollars in a new project to finance the production of ventilators. If the decision to start the project is made, it will be financed entirely by borrowing. The project has the same risks as the business the firm is currently dealing with and the project's after-tax cash flow is estimated to be $8 million on a continuous basis. - What is the net present value of the project? -Should this project be accepted or rejected according to the internal rate of return method