Answered step by step

Verified Expert Solution

Question

1 Approved Answer

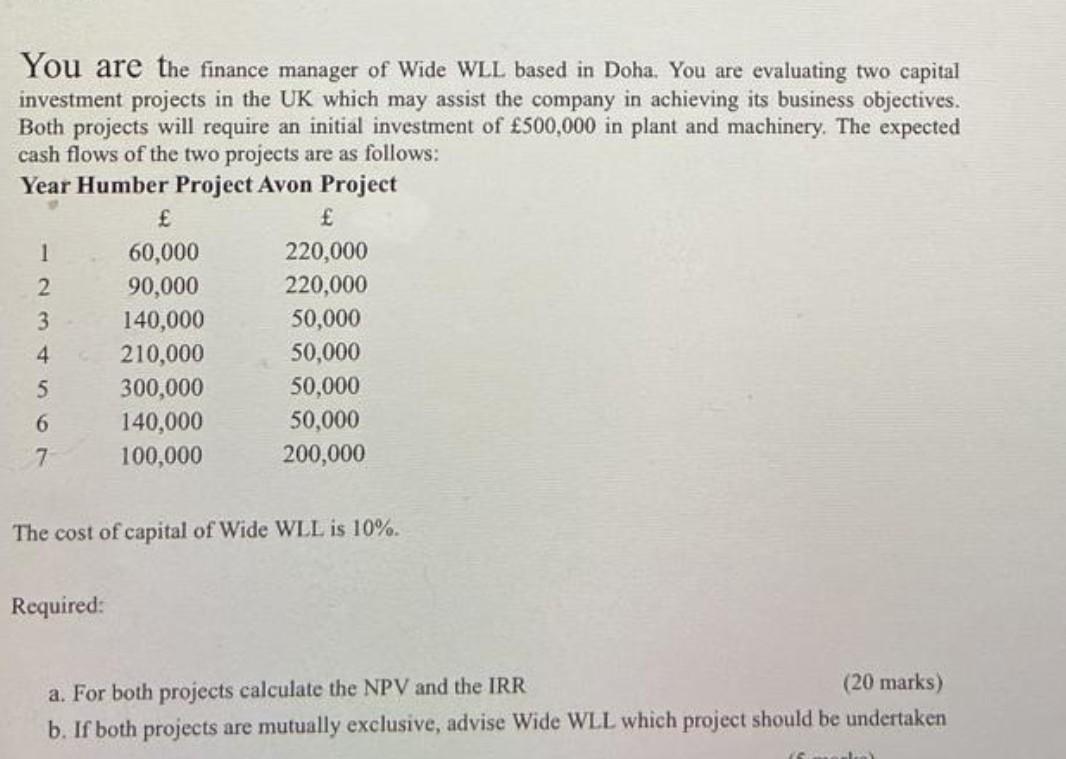

You are the finance manager of Wide WLL based in Doha. You are evaluating two capital investment projects in the UK which may assist the

You are the finance manager of Wide WLL based in Doha. You are evaluating two capital investment projects in the UK which may assist the company in achieving its business objectives. Both projects will require an initial investment of 500,000 in plant and machinery. The expected cash flows of the two projects are as follows: Year Humber Project Avon Project 1 60,000 220,000 2 90,000 220,000 3 140,000 50,000 4 210,000 50,000 5 300,000 50,000 6 140,000 50,000 7 100,000 200,000 The cost of capital of Wide WLL is 10%. Required: a. For both projects calculate the NPV and the IRR (20 marks) b. If both projects are mutually exclusive, advise Wide WLL which project should be undertaken

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started