Answered step by step

Verified Expert Solution

Question

1 Approved Answer

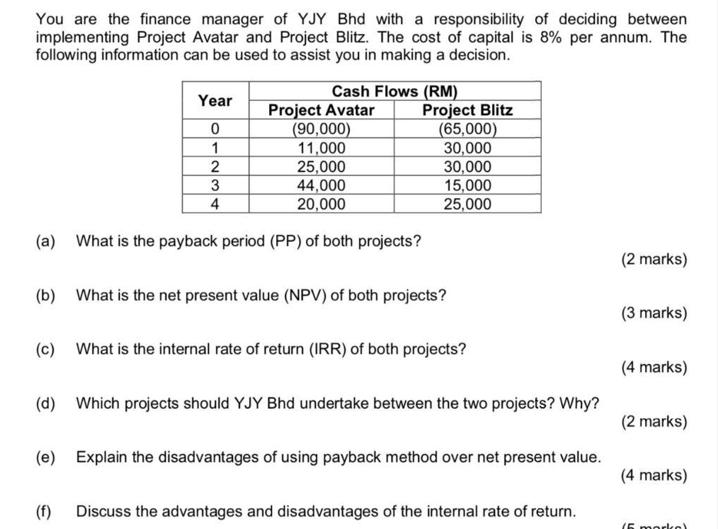

You are the finance manager of YJY Bhd with a responsibility of deciding between implementing Project Avatar and Project Blitz. The cost of capital

You are the finance manager of YJY Bhd with a responsibility of deciding between implementing Project Avatar and Project Blitz. The cost of capital is 8% per annum. The following information can be used to assist you in making a decision. Year 0 1 2 3 4 Cash Flows (RM) Project Avatar (90,000) 11,000 25,000 44,000 20,000 (a) What is the payback period (PP) of both projects? Project Blitz (f) (65,000) 30,000 30,000 15,000 25,000 (b) What is the net present value (NPV) of both projects? (c) What is the internal rate of return (IRR) of both projects? (d) Which projects should YJY Bhd undertake between the two projects? Why? (e) Explain the disadvantages of using payback method over net present value. Discuss the advantages and disadvantages of the internal rate of return. (2 marks) (3 marks) (4 marks) (2 marks) (4 marks) 15 morkel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Id be glad to help you with the financial analysis of Project Avatar and Project Blitz for YJY Bhd Payback Period PP Project Avatar Cumulative cash fl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started