Question

You are the Financial Analyst at Wellington Laboratories Ltd., a New Orleans, USA based bulk drugs manufacturer, which is evaluating the following project for manufacturing

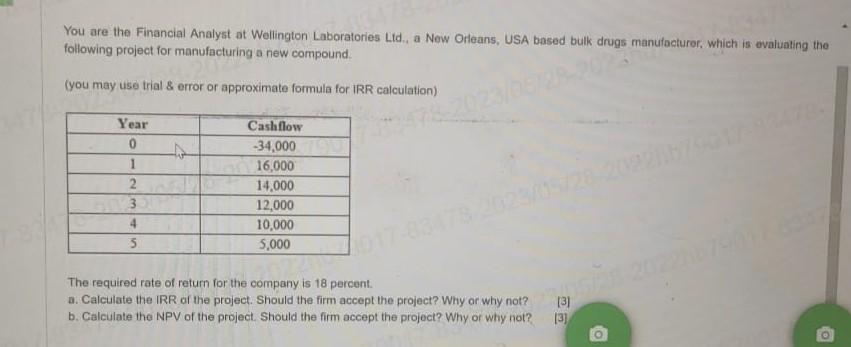

You are the Financial Analyst at Wellington Laboratories Ltd., a New Orleans, USA based bulk drugs manufacturer, which is evaluating the following project for manufacturing a new compound. (you may use trial & error or approximate formula for IRR calculation) Year 0 1 2 5 Cashflow -34,000 16,000 14,000 12,000 10,000 5,000 The required rate of return for the company is 18 percent. a. Calculate the IRR of the project. Should the firm accept the project? Why or why not? b. Calculate the NPV of the project. Should the firm accept the project? Why or why not? [3] (3) O to

You are the Financial Analyst at Wellington Laboratories Lid, a New Orleans, USA based bulk drugs manufacturer, which is evaluating the following project for manufacturing a new compound. (you may use trial & error or approximate formula for IRR calculation) The required rate of retum for the company is 18 percent. a. Calculate the IRR of the project. Should the firm accept the project? Why or why not? b. Calculate the NPV of the project. Should the firm accept the project? Why or why not? [3] [3]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started