Question

You are the financial analyst for the University of South Carolina's athletic department. As part of its master facilities plan, the department's chief financial

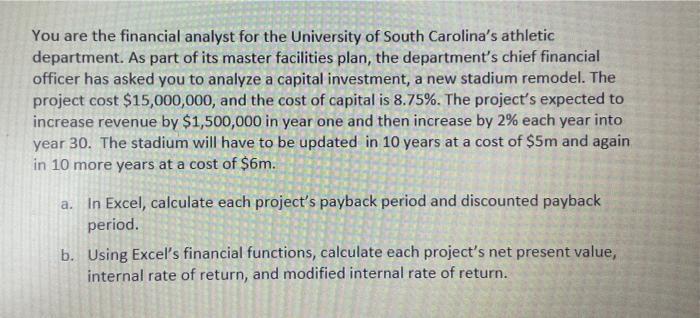

You are the financial analyst for the University of South Carolina's athletic department. As part of its master facilities plan, the department's chief financial officer has asked you to analyze a capital investment, a new stadium remodel. The project cost $15,000,000, and the cost of capital is 8.75%. The project's expected to increase revenue by $1,500,000 in year one and then increase by 2% each year into year 30. The stadium will have to be updated in 10 years at a cost of $5m and again in 10 more years at a cost of $6m. a. In Excel, calculate each project's payback period and discounted payback period. b. Using Excel's financial functions, calculate each project's net present value, internal rate of return, and modified internal rate of return.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Systems Analysis And Design

Authors: Joseph Valacich, Joey George

8th Edition

0134204921, 978-0134204925

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App