Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the financial analyst team for Zippy GPT Inc., a newly publicly traded company that specializes in Al technology. One of your teammates,

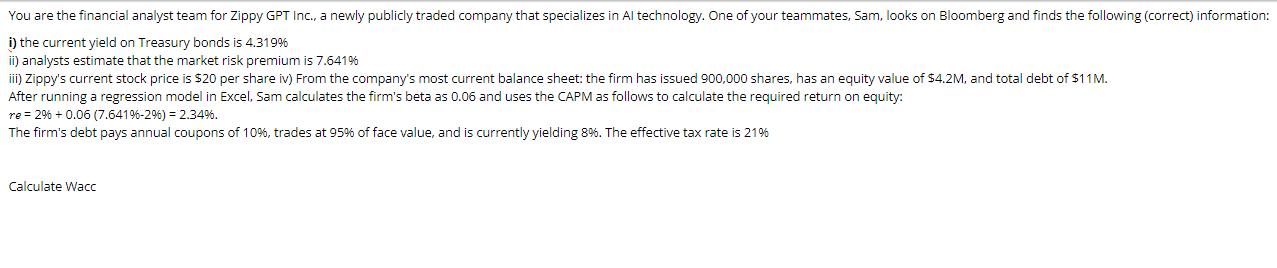

You are the financial analyst team for Zippy GPT Inc., a newly publicly traded company that specializes in Al technology. One of your teammates, Sam, looks on Bloomberg and finds the following (correct) information: i) the current yield on Treasury bonds is 4.319% ii) analysts estimate that the market risk premium is 7.641% iii) Zippy's current stock price is $20 per share iv) From the company's most current balance sheet: the firm has issued 900,000 shares, has an equity value of $4.2M, and total debt of $11M. After running a regression model in Excel, Sam calculates the firm's beta as 0.06 and uses the CAPM as follows to calculate the required return on equity: re = 2% +0.06 (7.641% -29%6) = 2.34%. The firm's debt pays annual coupons of 10%, trades at 95% of face value, and is currently yielding 8%. The effective tax rate is 21% Calculate Wacc

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the WACC WACC EVRe DVRd1 T Where E is the market value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started