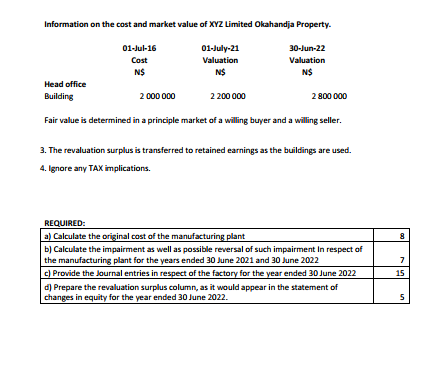

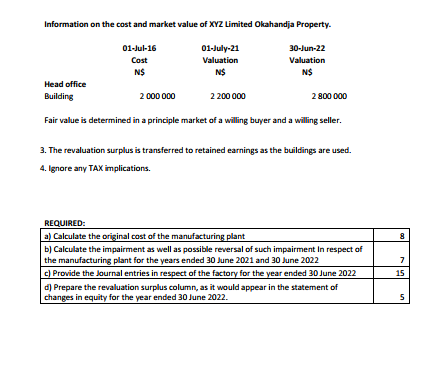

You are the financial Director of a sanitizer and chemicals production company XYZ Limited. XYZ Limited has a year-end of 30 June. The company is based in Windhoek and has access to the follawing data for the fiscal year that concluded on 30 June 2021, regarding its numerous properties, plants, and equipment: 1. XYZ Company self-constructed its manufacturing plant, which became available for use on 1 danuary 20.18. The detail of the construction costs incurred on specific dates is as follows: Manufacturing did not start until 1 February 20.18, following extensive testing of the facility in November 20.17 and December 20.17. Testing cast N$200000, which was dispersed aver the course of two months. The plant was predicted to have an eight-year useful life and a residual value of N $150,000. These estimates have never needed to be changed. Because of a decline in the demand for sanitizers during the preceding fiscal year, the recoverable amount of the plant was N$1800000 as of June 30, 2020. The demand for sanitieers surged significantly because of the global COVID 19 pandemic, and as of June 30,2022 , the recoverable amount was reevaluated to be N $2,000,000. XYZ Company accounts for manufacturing plant in accordance with the Cost Model and depreciates it over its useful life. 2. On July 1, 2016, XYZ Limited purchased a property in Okahandja. XYZ Limited using a revaluation approach based on the fair market value of property takes owner-occupied land and buildings into consideration. Since the fair values of the property was close to their carrying amounts in previous years, the first revaluation was carried out on 30 June 2022 anly. Depreciation that had acerued as of the revaluation date is subtracted from the asset's gross carrying value. Owner-occupied structures are depreciated throughout the course of their 8 -year useful life in a straight line. Depreciation for the year is based on the most recent valuation and XYZ Limited uses the gross replacement method to account. for revaluation. The following information is available in respect of the cost and open market valuations of the property in Okahandja. Information on the cost and market value of XYZ Limited Okahandja Property. Fair value is determined in a principle market of a willing buper and a willing seller. 3. The revaluation surplus is transferred to retained earnings as the buildings are used. 4. Ignore any TAX implications