Question

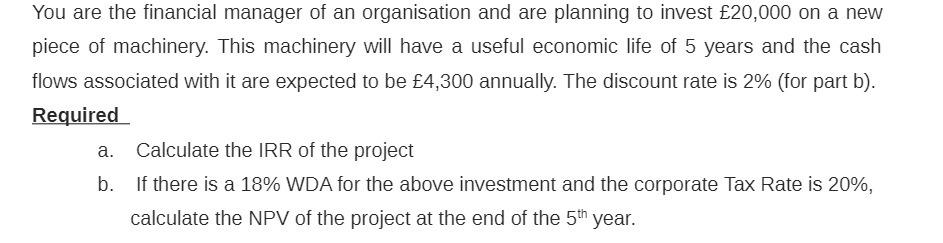

You are the financial manager of an organisation and are planning to invest 20,000 on a new piece of machinery. This machinery will have

You are the financial manager of an organisation and are planning to invest 20,000 on a new piece of machinery. This machinery will have a useful economic life of 5 years and the cash flows associated with it are expected to be 4,300 annually. The discount rate is 2% (for part b). Required Calculate the IRR of the project b. If there is a 18% WDA for the above investment and the corporate Tax Rate is 20%, calculate the NPV of the project at the end of the 5th year.

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Investment Analysis New Machinery a Calculating the Internal Rate of Return IRR Due to the complexity of IRR calculations we cant find the exact IRR u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ

6th Canadian edition

978-0132893534, 9780133389401, 132893533, 133389405, 978-0133392883

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App