Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the financial manager of Concord (Pty) Ltd. Concord's executive committee requested you to present the committee with the company's current market-valued weighted

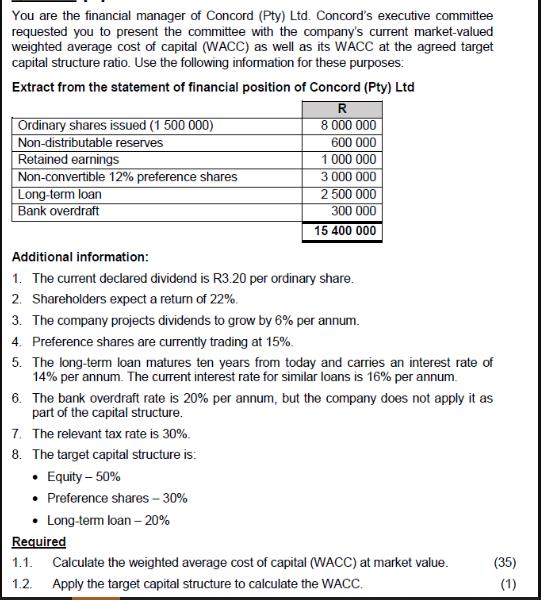

You are the financial manager of Concord (Pty) Ltd. Concord's executive committee requested you to present the committee with the company's current market-valued weighted average cost of capital (WACC) as well as its WACC at the agreed target capital structure ratio. Use the following information for these purposes: Extract from the statement of financial position of Concord (Pty) Ltd R 8 000 000 600 000 1 000 000 3 000 000 Ordinary shares issued (1 500 000) Non-distributable reserves Retained earnings Non-convertible 12% preference shares Long-term loan Bank overdraft 2 500 000 300 000 15 400 000 Additional information: 1. The current declared dividend is R3.20 per ordinary share. 2. Shareholders expect a return of 22%. 3. The company projects dividends to grow by 6% per annum. 4. Preference shares are currently trading at 15%. 5. The long-term loan matures ten years from today and carries an interest rate of 14% per annum. The current interest rate for similar loans is 16% per annum. 6. The bank overdraft rate is 20% per annum, but the company does not apply it as part of the capital structure. 7. The relevant tax rate is 30%. 8. The target capital structure is: Equity - 50% Preference shares - 30% Long-term loan -20% Required 1.1. Calculate the weighted average cost of capital (WACC) at market value. 1.2. Apply the target capital structure to calculate the WACC. (35) (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided lets calculate the Weighted Average Cost of Capital WACC for Concord Pty Ltd The WACC is the average rate of return a company is expected to pay to its security holde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started