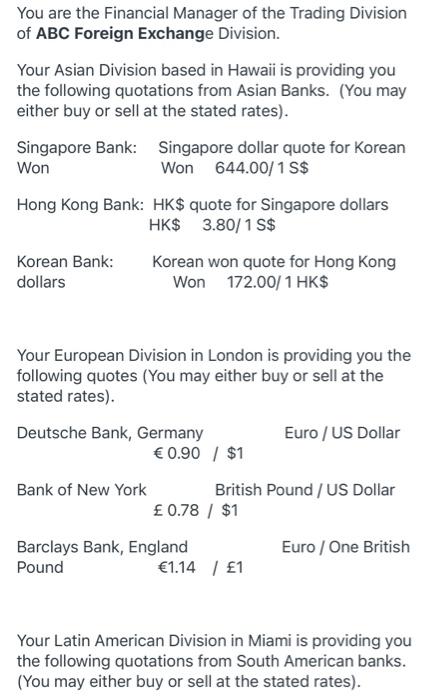

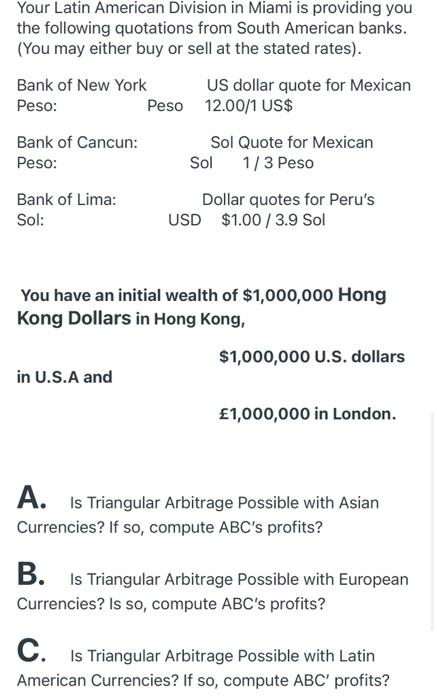

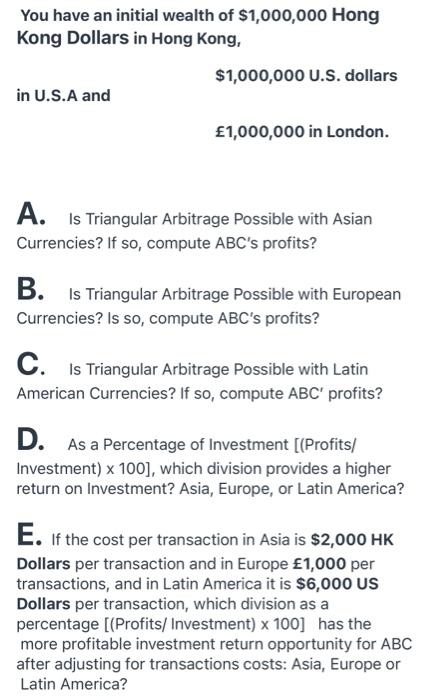

You are the Financial Manager of the Trading Division of ABC Foreign Exchange Division. Your Asian Division based in Hawaii is providing you the following quotations from Asian Banks. (You may either buy or sell at the stated rates). Singapore Bank: Singapore dollar quote for Korean Won Won 644.00/1 S$ Hong Kong Bank: HK$ quote for Singapore dollars HK$ 3.80/1 S$ Korean Bank: Korean won quote for Hong Kong dollars Won 172.00/ 1 HK$ Your European Division in London is providing you the following quotes (You may either buy or sell at the stated rates). Deutsche Bank, Germany Euro / US Dollar 0.90 / $1 Bank of New York British Pound / US Dollar 0.78 / $1 Barclays Bank, England Pound 1.14 | 1 Euro / One British Your Latin American Division in Miami is providing you the following quotations from South American banks. (You may either buy or sell at the stated rates). Your Latin American Division in Miami is providing you the following quotations from South American banks. (You may either buy or sell at the stated rates). Bank of New York US dollar quote for Mexican Peso: Peso 12.00/1 US$ Bank of Cancun: Peso: Sol Quote for Mexican Sol 1/3 Peso Dollar quotes for Peru's USD $1.00 / 3.9 Sol Bank of Lima: Sol: You have an initial wealth of $1,000,000 Hong Kong Dollars in Hong Kong, $1,000,000 U.S. dollars in U.S.A and 1,000,000 in London. A. Is Triangular Arbitrage Possible with Asian Currencies? If so, compute ABC's profits? B. Is Triangular Arbitrage Possible with European Currencies? Is so, compute ABC's profits? C. Is Triangular Arbitrage Possible with Latin American Currencies? If so, compute ABC' profits? You have an initial wealth of $1,000,000 Hong Kong Dollars in Hong Kong, $1,000,000 U.S. dollars in U.S.A and 1,000,000 in London. A. Is Triangular Arbitrage Possible with Asian Currencies? If so, compute ABC's profits? B. Is Triangular Arbitrage Possible with European Currencies? Is so, compute ABC's profits? C. Is Triangular Arbitrage Possible with Latin American Currencies? If so, compute ABC' profits? D. As a Percentage of Investment ((Profits/ Investment) x 100], which division provides a higher return on Investment? Asia, Europe, or Latin America? E. If the cost per transaction in Asia is $2,000 HK Dollars per transaction and in Europe 1,000 per transactions, and in Latin America it is $6,000 US Dollars per transaction, which division as a percentage [(Profits/ Investment) x 100] has the more profitable investment return opportunity for ABC after adjusting for transactions costs: Asia, Europe or Latin America? You are the Financial Manager of the Trading Division of ABC Foreign Exchange Division. Your Asian Division based in Hawaii is providing you the following quotations from Asian Banks. (You may either buy or sell at the stated rates). Singapore Bank: Singapore dollar quote for Korean Won Won 644.00/1 S$ Hong Kong Bank: HK$ quote for Singapore dollars HK$ 3.80/1 S$ Korean Bank: Korean won quote for Hong Kong dollars Won 172.00/ 1 HK$ Your European Division in London is providing you the following quotes (You may either buy or sell at the stated rates). Deutsche Bank, Germany Euro / US Dollar 0.90 / $1 Bank of New York British Pound / US Dollar 0.78 / $1 Barclays Bank, England Pound 1.14 | 1 Euro / One British Your Latin American Division in Miami is providing you the following quotations from South American banks. (You may either buy or sell at the stated rates). Your Latin American Division in Miami is providing you the following quotations from South American banks. (You may either buy or sell at the stated rates). Bank of New York US dollar quote for Mexican Peso: Peso 12.00/1 US$ Bank of Cancun: Peso: Sol Quote for Mexican Sol 1/3 Peso Dollar quotes for Peru's USD $1.00 / 3.9 Sol Bank of Lima: Sol: You have an initial wealth of $1,000,000 Hong Kong Dollars in Hong Kong, $1,000,000 U.S. dollars in U.S.A and 1,000,000 in London. A. Is Triangular Arbitrage Possible with Asian Currencies? If so, compute ABC's profits? B. Is Triangular Arbitrage Possible with European Currencies? Is so, compute ABC's profits? C. Is Triangular Arbitrage Possible with Latin American Currencies? If so, compute ABC' profits? You have an initial wealth of $1,000,000 Hong Kong Dollars in Hong Kong, $1,000,000 U.S. dollars in U.S.A and 1,000,000 in London. A. Is Triangular Arbitrage Possible with Asian Currencies? If so, compute ABC's profits? B. Is Triangular Arbitrage Possible with European Currencies? Is so, compute ABC's profits? C. Is Triangular Arbitrage Possible with Latin American Currencies? If so, compute ABC' profits? D. As a Percentage of Investment ((Profits/ Investment) x 100], which division provides a higher return on Investment? Asia, Europe, or Latin America? E. If the cost per transaction in Asia is $2,000 HK Dollars per transaction and in Europe 1,000 per transactions, and in Latin America it is $6,000 US Dollars per transaction, which division as a percentage [(Profits/ Investment) x 100] has the more profitable investment return opportunity for ABC after adjusting for transactions costs: Asia, Europe or Latin America