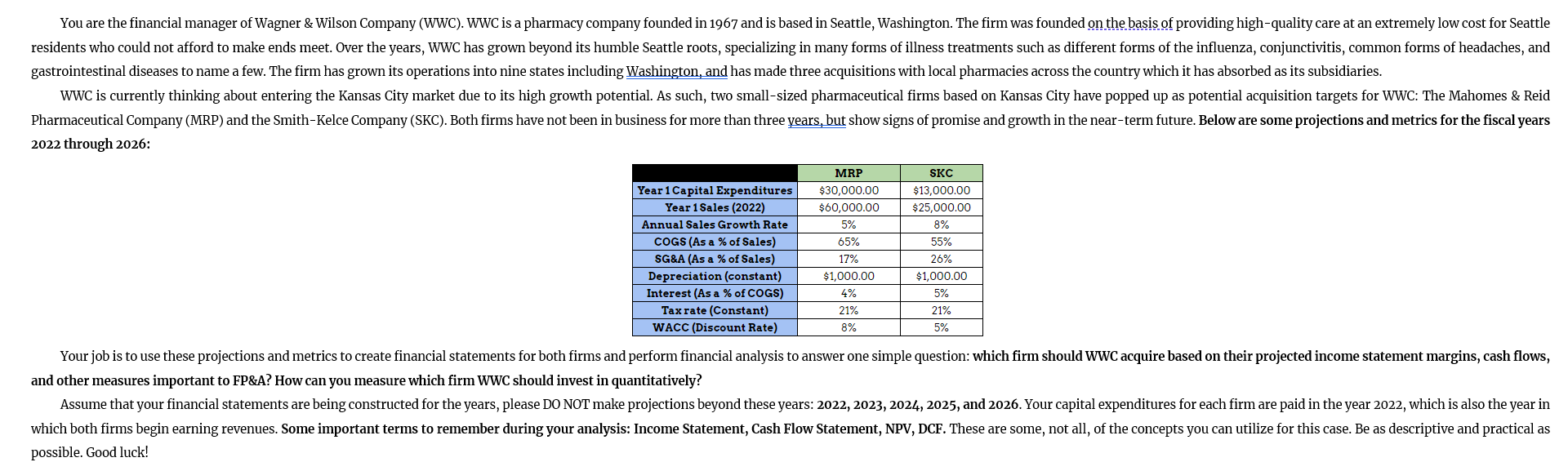

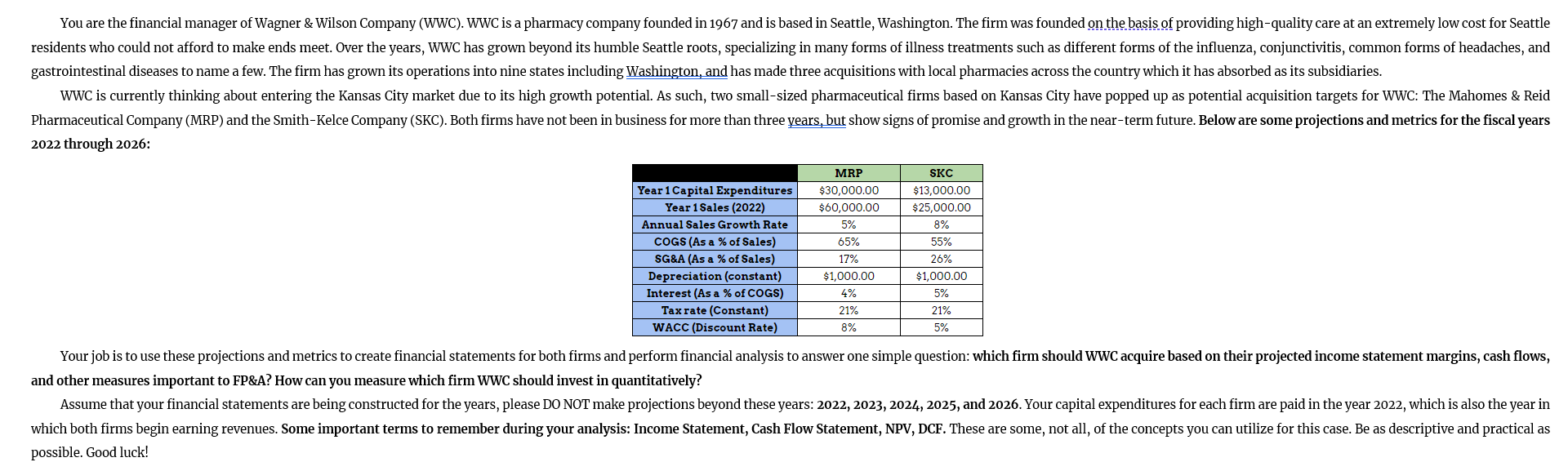

You are the financial manager of Wagner & Wilson Company (WWC). WWC is a pharmacy company founded in 1967 and is based in Seattle, Washington. The firm was founded on the basis of providing high-quality care at an extremely low cost for Seattle residents who could not afford to make ends meet. Over the years, WWC has grown beyond its humble Seattle roots, specializing in many forms of illness treatments such as different forms of the influenza, conjunctivitis, common forms of headaches, and gastrointestinal diseases to name a few. The firm has grown its operations into nine states including Washington, and has made three acquisitions with local pharmacies across the country which it has absorbed as its subsidiaries. WWC is currently thinking about entering the Kansas City market due to its high growth potential. As such, two small-sized pharmaceutical firms based on Kansas City have popped up as potential acquisition targets for WWC: The Mahomes & Reid Pharmaceutical Company (MRP) and the Smith-Kelce Company (SKC). Both firms have not been in business for more than three years, but show signs of promise and growth in the near-term future. Below are some projections and metrics for the fiscal years 2022 through 2026: SKC $13,000.00 MRP $30,000.00 $60,000.00 5% $25,000.00 8% Year 1 Capital Expenditures Year 1 Sales (2022) Annual Sales Growth Rate COGS (As a % of Sales) SG&A (As a % of Sales) Depreciation (constant) Interest (As a % of COGS) 65% 55% 17% $1,000.00 4% 26% $1,000.00 5% 21% 21% Tax rate (Constant) WACC (Discount Rate) 8% 5% Your job is to use these projections and metrics to create financial statements for both firms and perform financial analysis to answer one simple question: which firm should WWC acquire based on their projected income statement margins, cash flows, and other measures important to FP&A? How can you measure which firm WWC should invest in quantitatively? Assume that your financial statements are being constructed for the years, please DO NOT make projections beyond these years: 2022, 2023, 2024, 2025, and 2026. Your capital expenditures for each firm are paid in the year 2022, which is also the year in which both firms begin earning revenues. Some important terms to remember during your analysis: Income Statement, Cash Flow Statement, NPV, DCF. These are some, not all, of the concepts you can utilize for this case. Be as descriptive and practical as possible. Good luck! You are the financial manager of Wagner & Wilson Company (WWC). WWC is a pharmacy company founded in 1967 and is based in Seattle, Washington. The firm was founded on the basis of providing high-quality care at an extremely low cost for Seattle residents who could not afford to make ends meet. Over the years, WWC has grown beyond its humble Seattle roots, specializing in many forms of illness treatments such as different forms of the influenza, conjunctivitis, common forms of headaches, and gastrointestinal diseases to name a few. The firm has grown its operations into nine states including Washington, and has made three acquisitions with local pharmacies across the country which it has absorbed as its subsidiaries. WWC is currently thinking about entering the Kansas City market due to its high growth potential. As such, two small-sized pharmaceutical firms based on Kansas City have popped up as potential acquisition targets for WWC: The Mahomes & Reid Pharmaceutical Company (MRP) and the Smith-Kelce Company (SKC). Both firms have not been in business for more than three years, but show signs of promise and growth in the near-term future. Below are some projections and metrics for the fiscal years 2022 through 2026: SKC $13,000.00 MRP $30,000.00 $60,000.00 5% $25,000.00 8% Year 1 Capital Expenditures Year 1 Sales (2022) Annual Sales Growth Rate COGS (As a % of Sales) SG&A (As a % of Sales) Depreciation (constant) Interest (As a % of COGS) 65% 55% 17% $1,000.00 4% 26% $1,000.00 5% 21% 21% Tax rate (Constant) WACC (Discount Rate) 8% 5% Your job is to use these projections and metrics to create financial statements for both firms and perform financial analysis to answer one simple question: which firm should WWC acquire based on their projected income statement margins, cash flows, and other measures important to FP&A? How can you measure which firm WWC should invest in quantitatively? Assume that your financial statements are being constructed for the years, please DO NOT make projections beyond these years: 2022, 2023, 2024, 2025, and 2026. Your capital expenditures for each firm are paid in the year 2022, which is also the year in which both firms begin earning revenues. Some important terms to remember during your analysis: Income Statement, Cash Flow Statement, NPV, DCF. These are some, not all, of the concepts you can utilize for this case. Be as descriptive and practical as possible. Good luck