Question

You are the financial planner for Johnson Controls. Assume last years profits were $730,000. The board of directors decided to forgo dividends to stockholders and

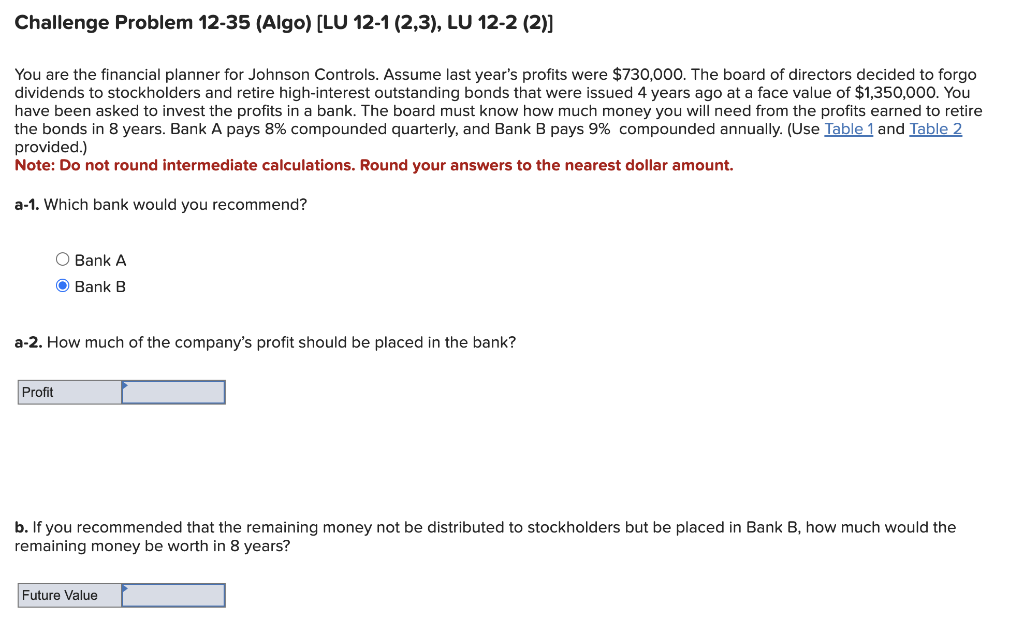

You are the financial planner for Johnson Controls. Assume last years profits were $730,000. The board of directors decided to forgo dividends to stockholders and retire high-interest outstanding bonds that were issued 4 years ago at a face value of $1,350,000. You have been asked to invest the profits in a bank. The board must know how much money you will need from the profits earned to retire the bonds in 8 years. Bank A pays 8% compounded quarterly, and Bank B pays 9% compounded annually. (Use Table 1 and Table 2 provided.)

Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount.

a-1. Which bank would you recommend?

multiple choice

Bank A

Bank B

a-2. How much of the companys profit should be placed in the bank?

b. If you recommended that the remaining money not be distributed to stockholders but be placed in Bank B, how much would the remaining money be worth in 8 years?

You are the financial planner for Johnson Controls. Assume last year's profits were $730,000. The board of directors decided to forgo dividends to stockholders and retire high-interest outstanding bonds that were issued 4 years ago at a face value of $1,350,000. You have been asked to invest the profits in a bank. The board must know how much money you will need from the profits earned to retire the bonds in 8 years. Bank A pays 8% compounded quarterly, and Bank B pays 9% compounded annually. (Use Table 1 and Table 2 provided.) Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount. a-1. Which bank would you recommend? Bank A Bank B a-2. How much of the company's profit should be placed in the bank? b. If you recommended that the remaining money not be distributed to stockholders but be placed in Bank B, how much would the remaining money be worth in 8 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started