Answered step by step

Verified Expert Solution

Question

1 Approved Answer

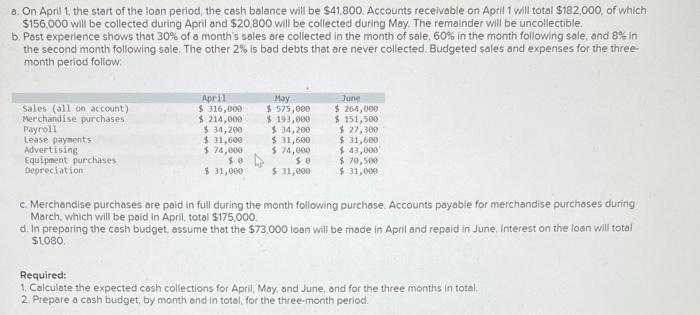

a. On April 1, the start of the loan period, the cash balance will be $41,800. Accounts receivable on April 1 will total $182,000,

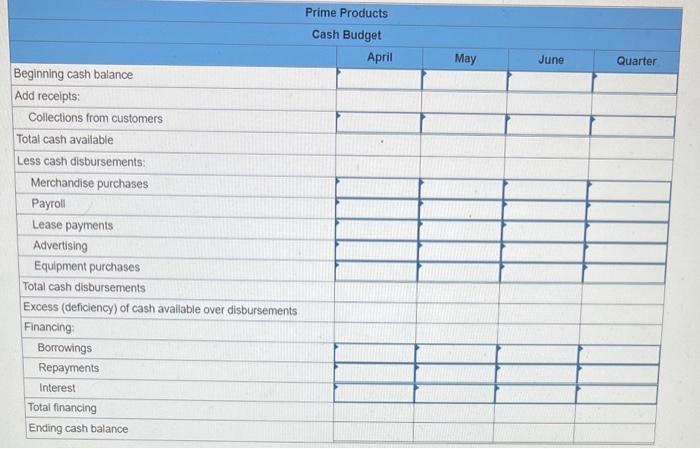

a. On April 1, the start of the loan period, the cash balance will be $41,800. Accounts receivable on April 1 will total $182,000, of which $156,000 will be collected during April and $20,800 will be collected during May. The remainder will be uncollectible. b. Past experience shows that 30% of a month's sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the three- month period follow: sales (all on account) Merchandise purchases Payroll Lease payments Advertising Equipment purchases Depreciation April $ 316,000 $ 214,000 $ 34,200 $ 31,600 $ 74,000 50 $ 31,000 May $575,000 $ 193,000 $ 34,200 $ 31,600 $ 74,000 $0 $ 31,000 June $ 264,000 $ 151,500 $ 27,300 $31,600 $ 43,000 $ 70,500 $ 31,000 c. Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases during March, which will be paid in April, total $175,000. d. In preparing the cash budget, assume that the $73,000 loan will be made in April and repaid in June. Interest on the loan will total $1,080. Required: 1. Calculate the expected cash collections for April, May, and June, and for the three months in total. 2. Prepare a cash budget, by month and in total, for the three-month period. Beginning cash balance. Add receipts: Collections from customers Total cash available Less cash disbursements: Merchandise purchases Payroll Lease payments Advertising Equipment purchases Total cash disbursements Excess (deficiency) of cash available over disbursements Financing: Borrowings Repayments Interest Total financing Ending cash balance Prime Products Cash Budget April May June Quarter

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started