Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the investment manager at a company. You observe that in the market share prices can increase or decrease by 50% at the

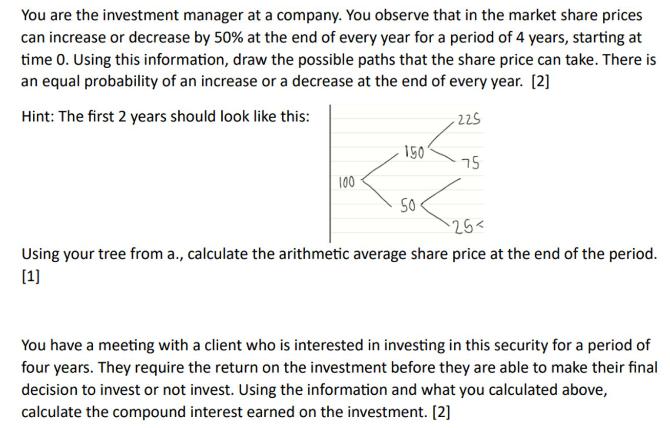

You are the investment manager at a company. You observe that in the market share prices can increase or decrease by 50% at the end of every year for a period of 4 years, starting at time 0. Using this information, draw the possible paths that the share price can take. There is an equal probability of an increase or a decrease at the end of every year. [2] Hint: The first 2 years should look like this: 225 150 75 100 50 25 < Using your tree from a., calculate the arithmetic average share price at the end of the period. [1] You have a meeting with a client who is interested in investing in this security for a period of four years. They require the return on the investment before they are able to make their final decision to invest or not invest. Using the information and what you calculated above, calculate the compound interest earned on the investment. [2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started