Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the manager of a credit department. The sales team has presented a large order from a new purchaser, Wizard Industries. For approximately

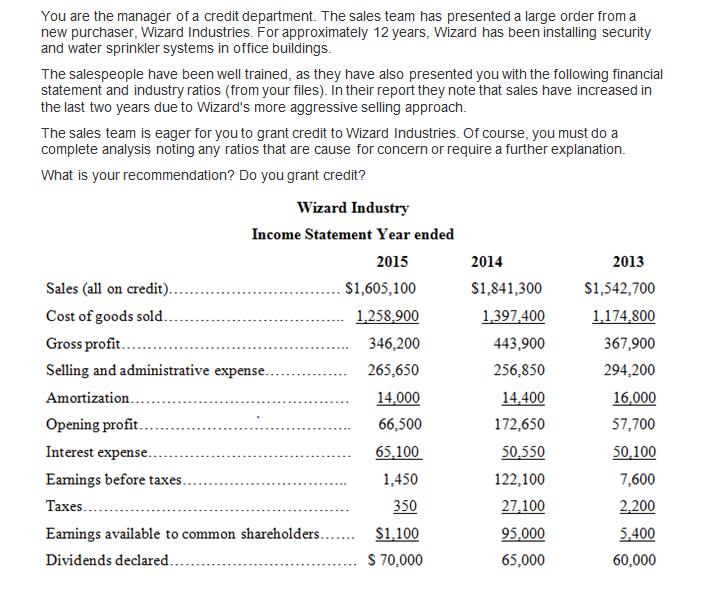

You are the manager of a credit department. The sales team has presented a large order from a new purchaser, Wizard Industries. For approximately 12 years, Wizard has been installing security and water sprinkler systems in office buildings. The salespeople have been well trained, as they have also presented you with the following financial statement and industry ratios (from your files). In their report they note that sales have increased in the last two years due to Wizard's more aggressive selling approach. The sales team is eager for you to grant credit to Wizard Industries. Of course, you must do a complete analysis noting any ratios that are cause for concern or require a further explanation. What is your recommendation? Do you grant credit? Wizard Industry Income Statement Year ended 2015 2014 2013 Sales (all on credit)... $1,605,100 $1,841,300 $1,542,700 Cost of goods sold.. 1,258,900 1,397,400 1,174,800 Gross profit... 346,200 443,900 367,900 Selling and administrative expense.. 265,650 256,850 294,200 Amortization..... 14,000 14,400 16,000 Opening profit.. 66,500 172,650 57,700 Interest expense.. 65,100 50,550 50,100 Eamings before taxes.. 1,450 122,100 7,600 Taxes.......... 350 27,100 2,200 Eamings available to common shareholders....... $1,100 95,000 5,400 Dividends declared... $ 70,000 65,000 60,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started