Question

You are the manager of a hotel. Your hotel needs a new company car. The cost information for one of the vehicles is listed below.

You are the manager of a hotel. Your hotel needs a new company car. The cost information for one of the vehicles is listed below. You plan on keeping the vehicle for 5 years.

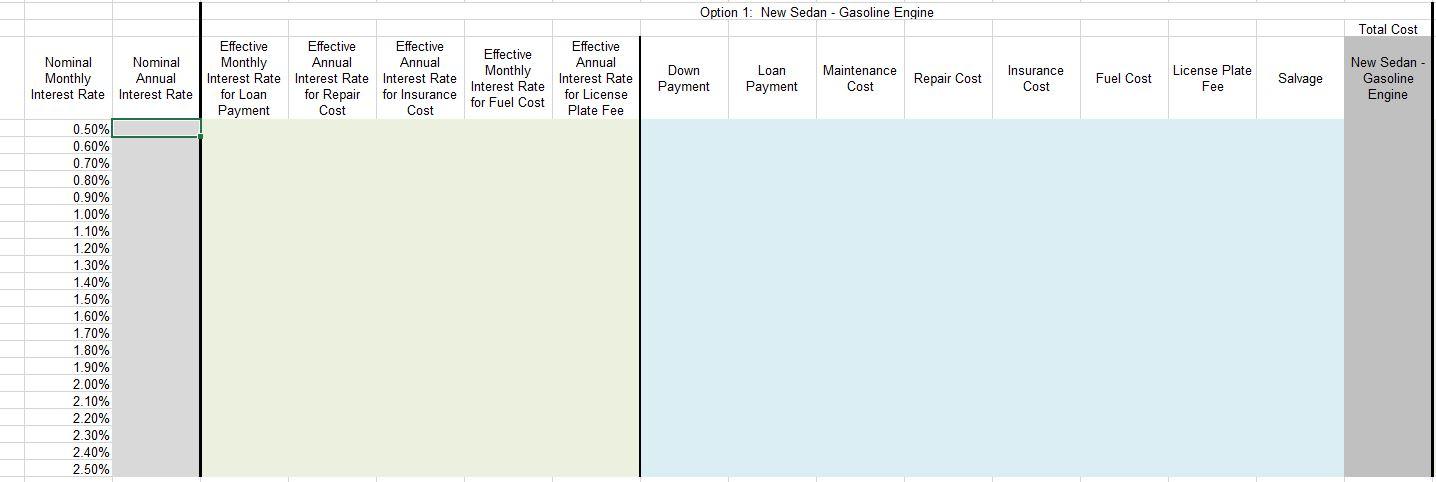

Option 1, Purchase a new sedan with a gasoline engine

Purchase Price: $44,750. You pay $20,000 down (including the trading-in value of the old vehicle) and finance the remaining $24,750 at a nominal annual rate of 5.27% for five years, resulting in a monthly payment of $470. This amount is paid at the end of the month.Total payment is $48,200.

Maintenance Cost: The maintenance schedule for the vehicle is as shown below. Assume all payments are made at the end of the year.

Year 1: $40

Year 2: $425

Year 3: $350

Year 4: $1,600

Year 5: $2,400

Repair Cost: the vehicle comes with a two-year warranty (0 costs for the first two years). For the remaining three years it will cost $100 per year (starting at the end of the third year) with an annual increase of 50.00%. This payment is made at the end of each year.

Insurance Cost: $820 per year with an annual increase of 3.65% per year. This payment is made at the beginning of the year.

Fuel Cost: $125 per month with a monthly increase of 0.25%. This payment is made at the end of the month.

License plate fee: $400 per year with an annual inflation rate of -15.00%. This payment is made at the beginning of the year.

At the end of 5 years, the salvage value is expected to be $24,400.

The equation to convert monthly interest to annual interest is:

iannual = (1 + imonthly)12 - 1

The equation for the effective monthly interest rate for multiple payments is:

ieffective = ((1 + inominal) / (1 + Inflation)) 1

The present value equation for a one-time payment/receipt is:

PV = FV * (1 + i)-n

The present value equation for multiple payments/receipts is:

PV = A * (((1 + ieffective)n - 1) / (ieffective * (1 + ieffective)n))

Use the above information to answer the following questions using the Excel template.

1. Complete the shaded cells in the table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started