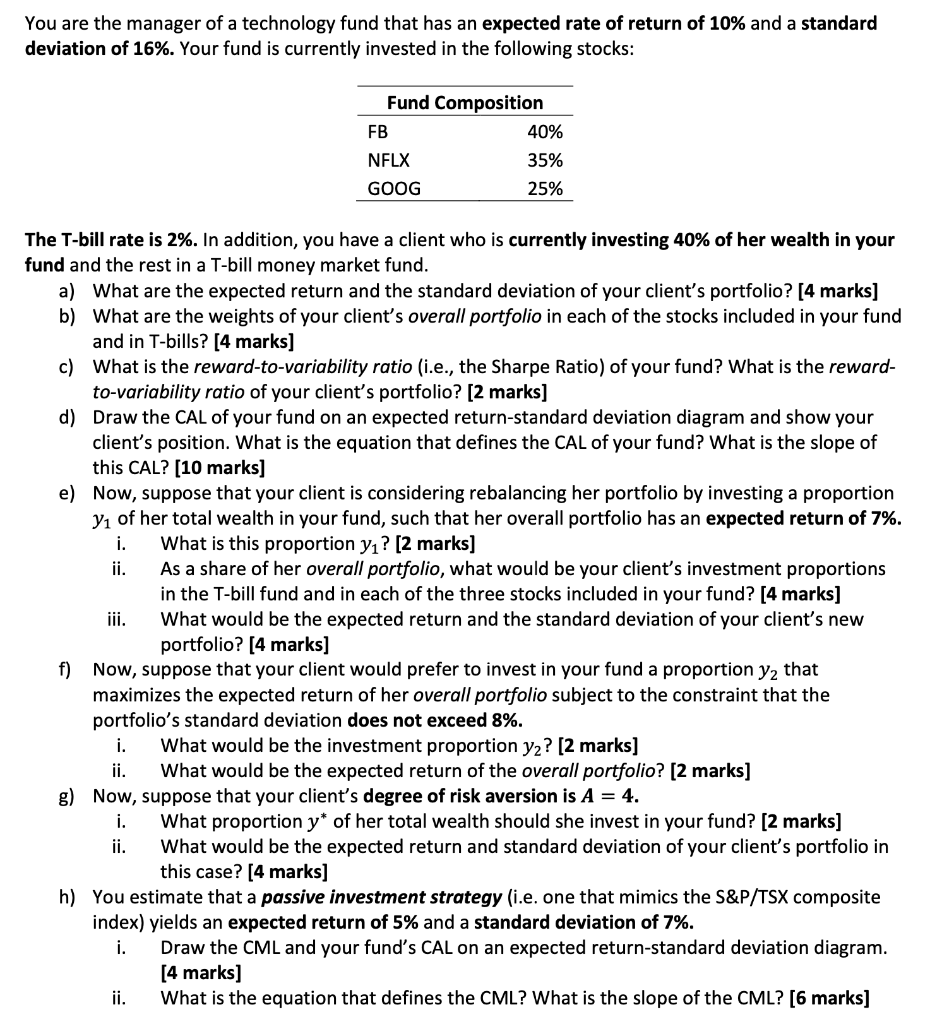

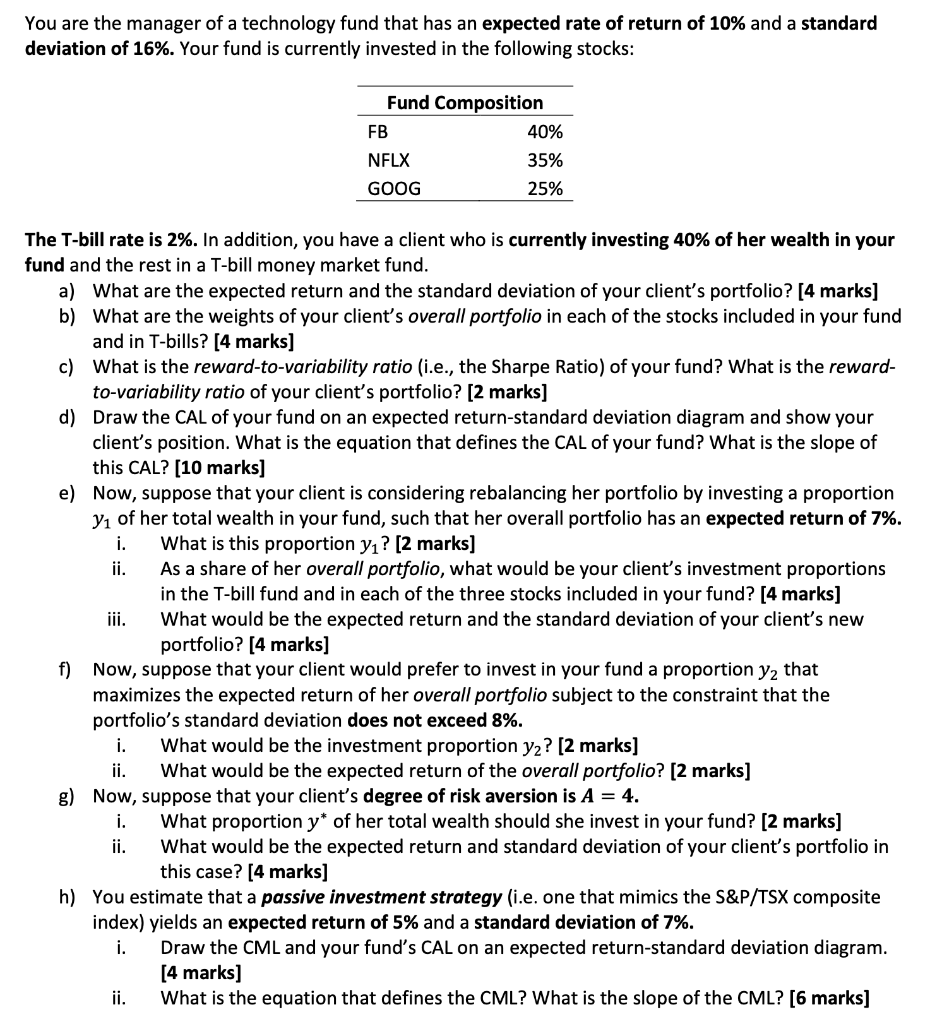

You are the manager of a technology fund that has an expected rate of return of 10% and a standard deviation of 16%. Your fund is currently invested in the following stocks: Fund Composition FB 40% NFLX 35% GOOG 25% The T-bill rate is 2%. In addition, you have a client who is currently investing 40% of her wealth in your fund and the rest in a T-bill money market fund. a) What are the expected return and the standard deviation of your client's portfolio? [4 marks] b) What are the weights of your client's overall portfolio in each of the stocks included in your fund and in T-bills? (4 marks] c) What is the reward-to-variability ratio (i.e., the Sharpe Ratio) of your fund? What is the reward- to-variability ratio of your client's portfolio? [2 marks] d) Draw the CAL of your fund on an expected return-standard deviation diagram and show your client's position. What is the equation that defines the CAL of your fund? What is the slope of this CAL? (10 marks] e) Now, suppose that your client is considering rebalancing her portfolio by investing a proportion Y1 of her total wealth in your fund, such that her overall portfolio has an expected return of 7%. i. What is this proportion y? [2 marks] ii. As a share of her overall portfolio, what would be your client's investment proportions in the T-bill fund and in each of the three stocks included in your fund? [4 marks] What would be the expected return and the standard deviation of your client's new portfolio? [4 marks] f) Now, suppose that your client would prefer to invest in your fund a proportion yz that maximizes the expected return of her overall portfolio subject to the constraint that the portfolio's standard deviation does not exceed 8%. i. What would be the investment proportion yz? [2 marks] ii. What would be the expected return of the overall portfolio? [2 marks] g) Now, suppose that your client's degree of risk aversion is A = 4. i. What proportion y* of her total wealth should she invest in your fund? [2 marks] ii. What would be the expected return and standard deviation of your client's portfolio in this case? (4 marks] h) You estimate that a passive investment strategy (i.e. one that mimics the S&P/TSX composite index) yields an expected return of 5% and a standard deviation of 7%. i. Draw the CML and your fund's CAL on an expected return-standard deviation diagram. [4 marks] ii. What is the equation that defines the CML? What is the slope of the CML? [6 marks] 70 You are the manager of a technology fund that has an expected rate of return of 10% and a standard deviation of 16%. Your fund is currently invested in the following stocks: Fund Composition FB 40% NFLX 35% GOOG 25% The T-bill rate is 2%. In addition, you have a client who is currently investing 40% of her wealth in your fund and the rest in a T-bill money market fund. a) What are the expected return and the standard deviation of your client's portfolio? [4 marks] b) What are the weights of your client's overall portfolio in each of the stocks included in your fund and in T-bills? (4 marks] c) What is the reward-to-variability ratio (i.e., the Sharpe Ratio) of your fund? What is the reward- to-variability ratio of your client's portfolio? [2 marks] d) Draw the CAL of your fund on an expected return-standard deviation diagram and show your client's position. What is the equation that defines the CAL of your fund? What is the slope of this CAL? (10 marks] e) Now, suppose that your client is considering rebalancing her portfolio by investing a proportion Y1 of her total wealth in your fund, such that her overall portfolio has an expected return of 7%. i. What is this proportion y? [2 marks] ii. As a share of her overall portfolio, what would be your client's investment proportions in the T-bill fund and in each of the three stocks included in your fund? [4 marks] What would be the expected return and the standard deviation of your client's new portfolio? [4 marks] f) Now, suppose that your client would prefer to invest in your fund a proportion yz that maximizes the expected return of her overall portfolio subject to the constraint that the portfolio's standard deviation does not exceed 8%. i. What would be the investment proportion yz? [2 marks] ii. What would be the expected return of the overall portfolio? [2 marks] g) Now, suppose that your client's degree of risk aversion is A = 4. i. What proportion y* of her total wealth should she invest in your fund? [2 marks] ii. What would be the expected return and standard deviation of your client's portfolio in this case? (4 marks] h) You estimate that a passive investment strategy (i.e. one that mimics the S&P/TSX composite index) yields an expected return of 5% and a standard deviation of 7%. i. Draw the CML and your fund's CAL on an expected return-standard deviation diagram. [4 marks] ii. What is the equation that defines the CML? What is the slope of the CML? [6 marks] 70