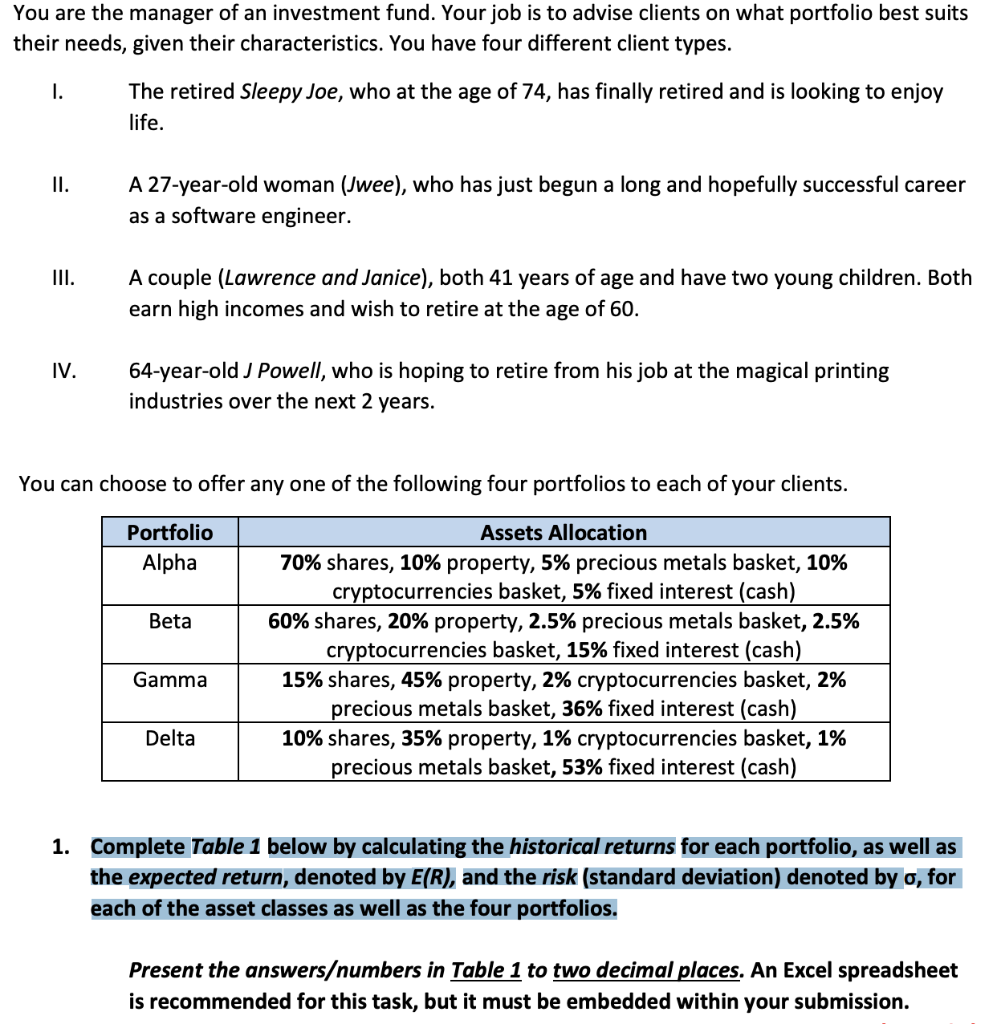

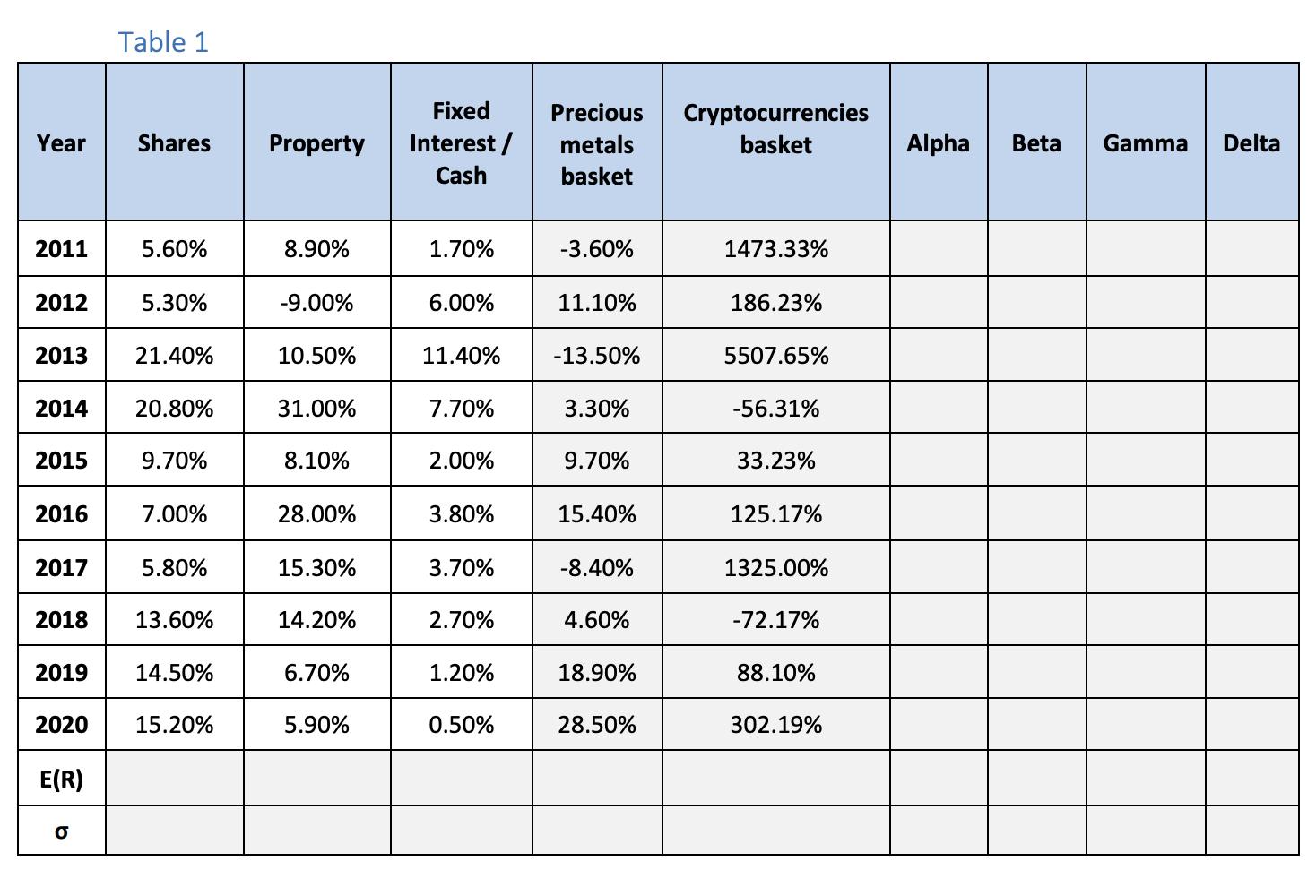

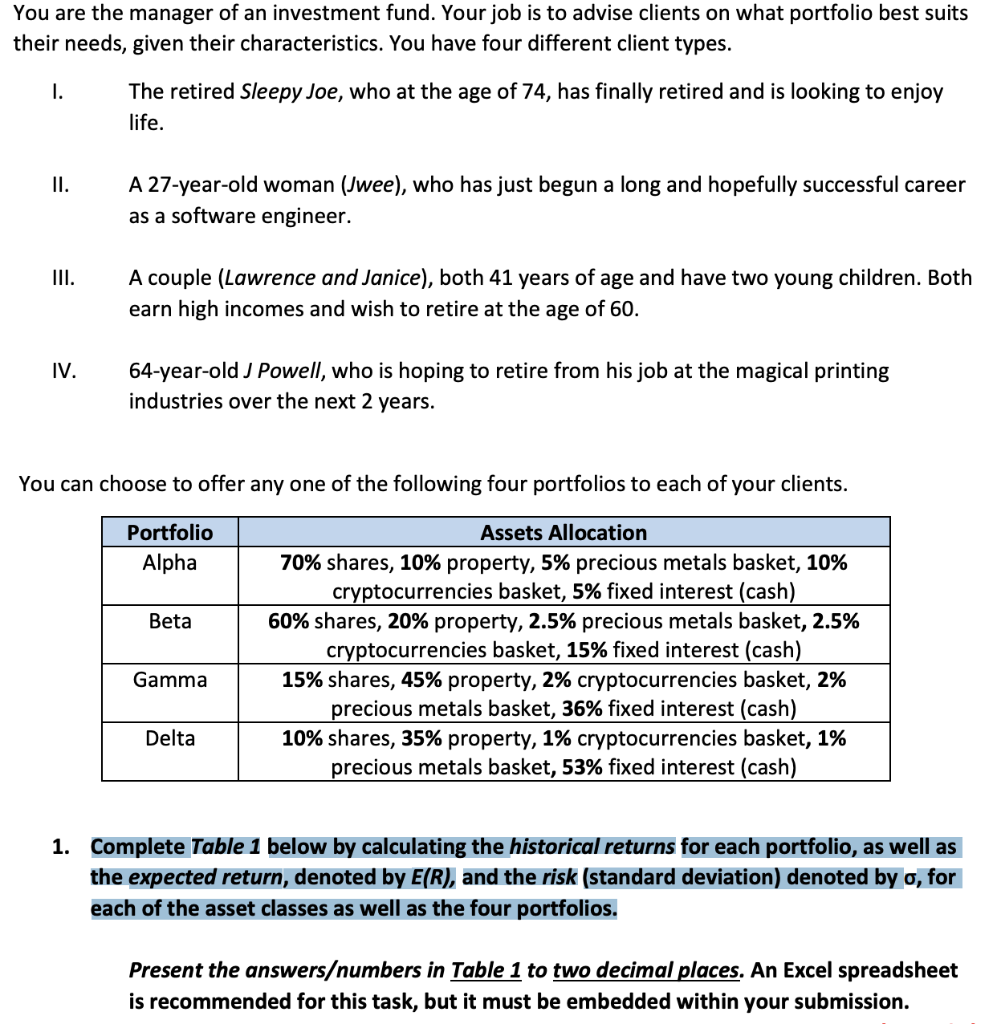

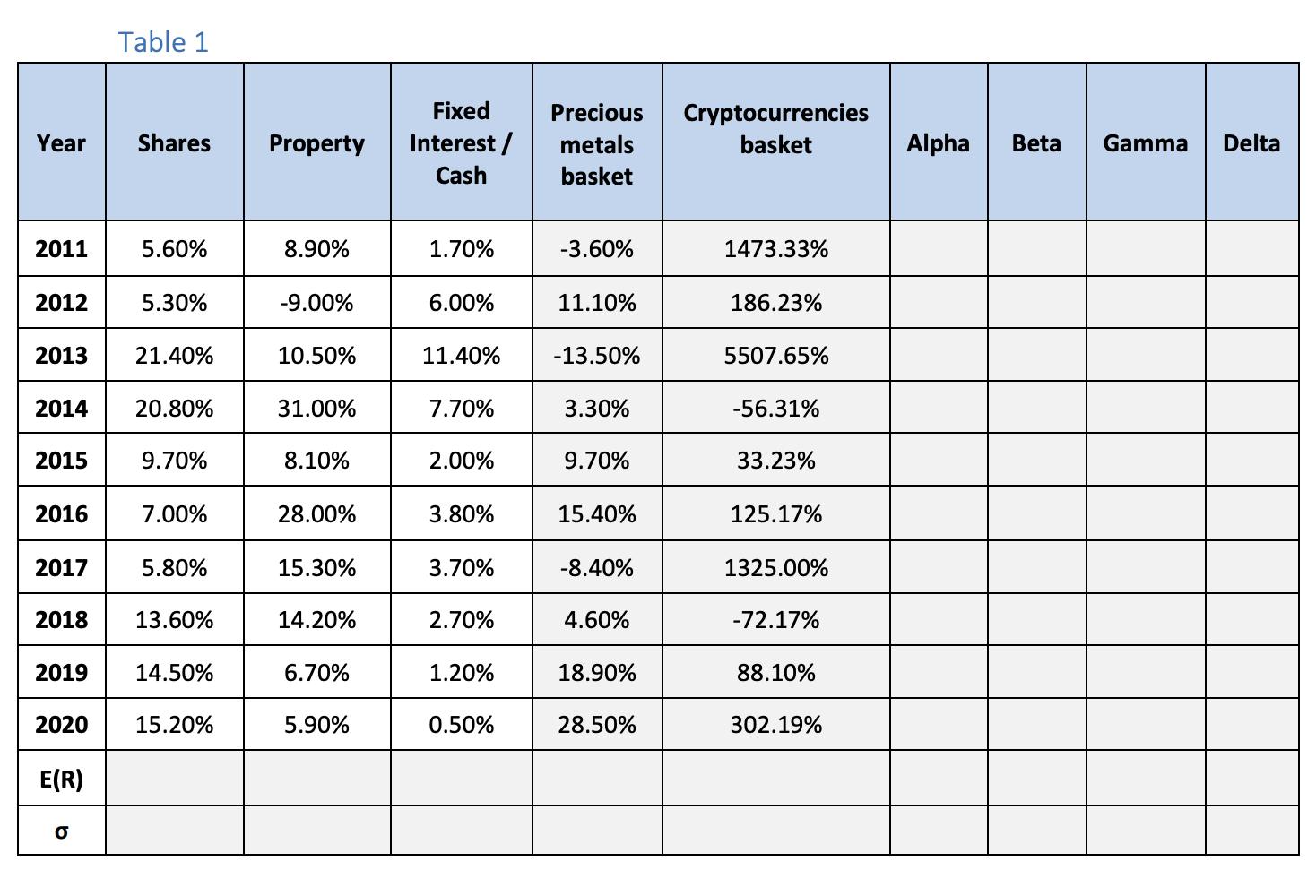

You are the manager of an investment fund. Your job is to advise clients on what portfolio best suits their needs, given their characteristics. You have four different client types. I. The retired Sleepy Joe, who at the age of 74, has finally retired and is looking to enjoy life. II. A 27-year-old woman (Jwee), who has just begun a long and hopefully successful career as a software engineer. III. A couple (Lawrence and Janice), both 41 years of age and have two young children. Both earn high incomes and wish to retire at the age of 60. IV. 64-year-old J Powell, who is hoping to retire from his job at the magical printing industries over the next 2 years. You can choose to offer any one of the following four portfolios to each of your clients. Portfolio Assets Allocation Alpha 70% shares, 10% property, 5% precious metals basket, 10% cryptocurrencies basket, 5% fixed interest (cash) Beta 60% shares, 20% property, 2.5% precious metals basket, 2.5% cryptocurrencies basket, 15% fixed interest (cash) Gamma 15% shares, 45% property, 2% cryptocurrencies basket, 2% precious metals basket, 36% fixed interest (cash) Delta 10% shares, 35% property, 1% cryptocurrencies basket, 1% precious metals basket, 53% fixed interest (cash) 1. Complete Table 1 below by calculating the historical returns for each portfolio, as well as the expected return, denoted by E(R), and the risk (standard deviation) denoted by o, for each of the asset classes as well as the four portfolios. Present the answersumbers in Table 1 to two decimal places. An Excel spreadsheet is recommended for this task, but it must be embedded within your submission. Table 1 Year Cryptocurrencies basket Shares Fixed Interest / Cash Property Precious metals basket Alpha Beta Gamma Delta 2011 5.60% 8.90% 1.70% -3.60% 1473.33% 2012 5.30% -9.00% 6.00% 11.10% 186.23% 2013 21.40% 10.50% 11.40% -13.50% 5507.65% 2014 20.80% 31.00% 7.70% 3.30% -56.31% 2015 9.70% 8.10% 2.00% 9.70% 33.23% 2016 7.00% 28.00% 3.80% 15.40% 125.17% 2017 5.80% 15.30% 3.70% -8.40% 1325.00% 2018 13.60% 14.20% 2.70% 4.60% -72.17% 2019 14.50% 6.70% 1.20% 18.90% 88.10% 2020 15.20% 5.90% 0.50% 28.50% 302.19% E(R) b