Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the manager of mutual fund, XTRA, an open-ended fund that includes the following three stocks: 200 shares of ARM @ $50 per share,

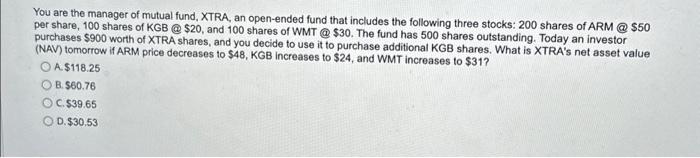

You are the manager of mutual fund, XTRA, an open-ended fund that includes the following three stocks: 200 shares of ARM @ $50 per share, 100 shares of KGB @ $20, and 100 shares of WMT @ $30. The fund has 500 shares outstanding. Today an investor purchases $900 worth of XTRA shares, and you decide to use it to purchase additional KGB shares. What is XTRA's net asset value (NAV) tomorrow if ARM price decreases to $48, KGB increases to $24, and WMT increases to $31? OA. $118.25 B.$60.76 OC. $39.65 O D. $30.53

You are the manager of mutual fund, XTRA, an open-ended fund that includes the following three stocks: 200 shares of ARM @ $50

per share, 100 shares of KGB @ $20, and 100 shares of WMT @ $30. The fund has 500 shares outstanding. What is XTRA's net asset value (NAV)?

A. $119

B. $30

O C.$37.6

O D.$61

Your company, Ohiobucks (OB), hires an investment bank to underwrite an issue of 10 million shares of OB stock on a best-effort basis.

The investment bank sells 8 million shares and charges OB $0.225 per share sold. The price of each share is $10.50. How much does

OB receive after the issuance?

A.$110.0 MM

B. $15.5 MM

O C. $82.2 MM

O D. $76.3 MM

TRD Warehouse Inc. (TRD) hires an investment bank to underwrite an issuance of 10 million shares of stock on a best-effort basis. If the bank sells 9.5 million shares for $11.20 per share and charges TRD $0.45 per share sold, How much is the bank's profit?

A. $102.125 MM

B. $106.40 MM

O C. $4.275 MM

D. $4.5 MM

TRD Warehouse Inc. (TRD) hirts an investment bank to underwrite an issuance of 10 million shares of stock on a best-effort basis. If the bank sells 9.5 million shares for $11.20 per share and charges TRD $0.45 per share sold, How much money does TRD receive?

A.$107.5 MM

B. $112.0 MM

C. $102.125 MM

D. $4.275 MM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started