Question

You are the marketing director of Proctor and Proctor Pharmaceuticals (P&P). You are trying to decide whether to run an advertising campaign for a

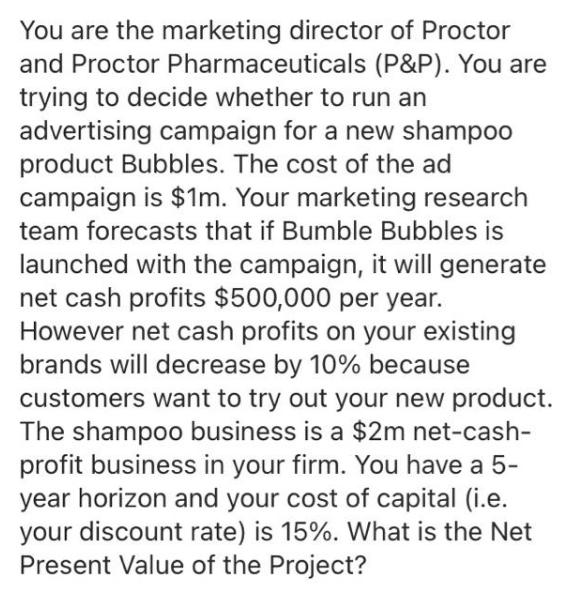

You are the marketing director of Proctor and Proctor Pharmaceuticals (P&P). You are trying to decide whether to run an advertising campaign for a new shampoo product Bubbles. The cost of the ad campaign is $1m. Your marketing research team forecasts that if Bumble Bubbles is launched with the campaign, it will generate net cash profits $500,000 per year. However net cash profits on your existing brands will decrease by 10% because customers want to try out your new product. The shampoo business is a $2m net-cash- profit business in your firm. You have a 5- year horizon and your cost of capital (i.e. your discount rate) is 15%. What is the Net Present Value of the Project?

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION STEP 1 NB Net cash flow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Stats Data And Models

Authors: Richard D. De Veaux, Paul D. Velleman, David E. Bock

4th Edition

321986490, 978-0321989970, 032198997X, 978-0321986498

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App