Answered step by step

Verified Expert Solution

Question

1 Approved Answer

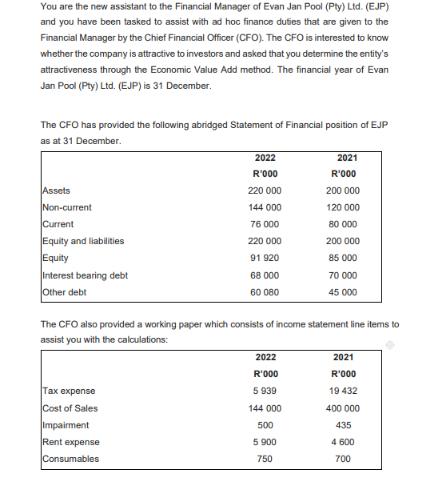

You are the new assistant to the Financial Manager of Evan Jan Pool (Pty) Ltd. (EJP) and you have been tasked to assist with

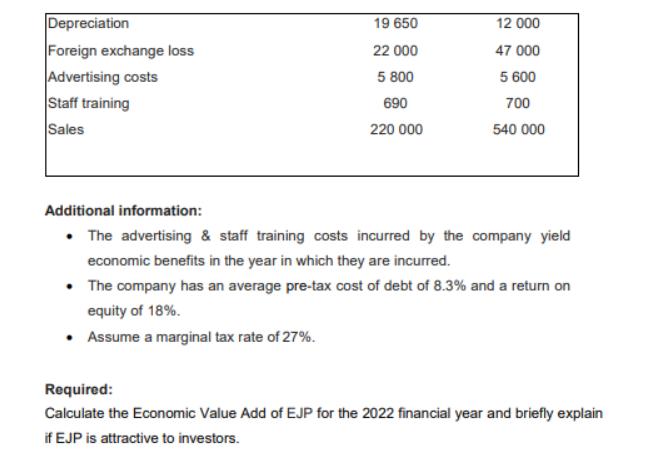

You are the new assistant to the Financial Manager of Evan Jan Pool (Pty) Ltd. (EJP) and you have been tasked to assist with ad hoc finance duties that are given to the Financial Manager by the Chief Financial Officer (CFO). The CFO is interested to know whether the company is attractive to investors and asked that you determine the entity's attractiveness through the Economic Value Add method. The financial year of Evan Jan Pool (Pty) Ltd. (EJP) is 31 December. The CFO has provided the following abridged Statement of Financial position of EJP as at 31 December. Assets Non-current Current Equity and liabilities Equity Interest bearing debt Other debt 2022 R'000 Tax expense Cost of Sales Impairment Rent expense Consumables 220 000 144 000 76 000 220 000 91 920 68 000 60 080 2021 R'000 2022 R'000 5 939 144 000 500 5.900 750 200 000 120 000 80 000 200 000 85 000 The CFO also provided a working paper which consists of income statement line items to assist you with the calculations: 70 000 45 000 2021 R'000 19 432 400 000 435 4.600 700 Depreciation Foreign exchange loss Advertising costs Staff training Sales 19 650 22 000 5 800 690 220 000 12 000 47 000 5 600 700 540 000 Additional information: The advertising & staff training costs incurred by the company yield economic benefits in the year in which they are incurred. The company has an average pre-tax cost of debt of 8.3% and a return on equity of 18%. Assume a marginal tax rate of 27%. Required: Calculate the Economic Value Add of EJP for the 2022 financial year and briefly explain if EJP is attractive to investors.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Economic Value Added EVA of Evan Jan Pool Pty Ltd EJP for the 2022 financial year w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started