Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the owner of a successful small designer shoe store that purchases from popular sports shoe suppliers and sells to distributors throughout Australia.

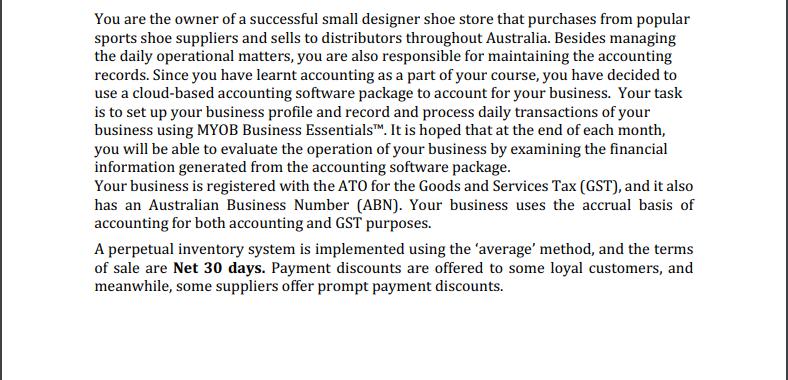

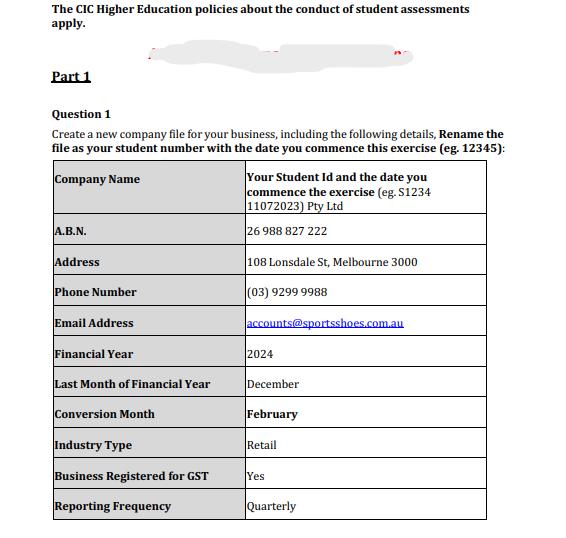

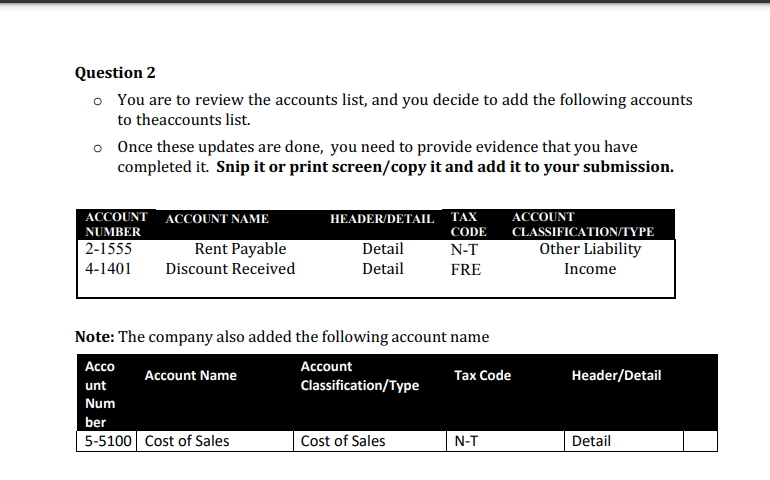

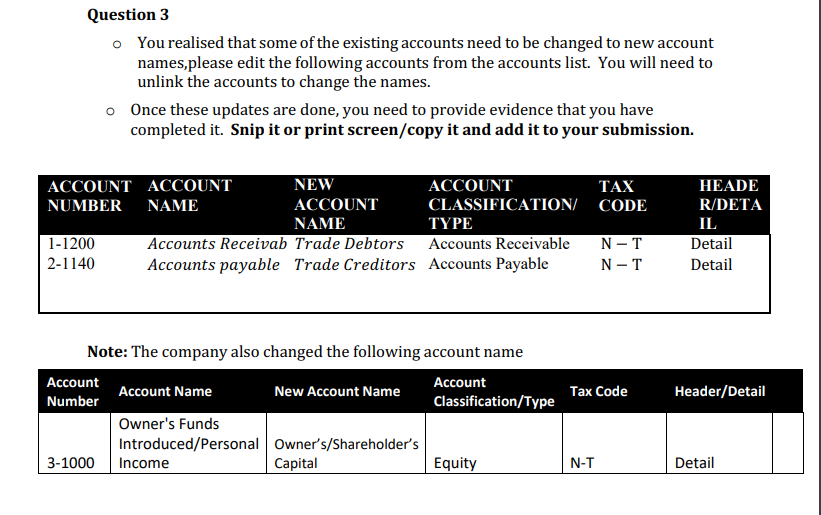

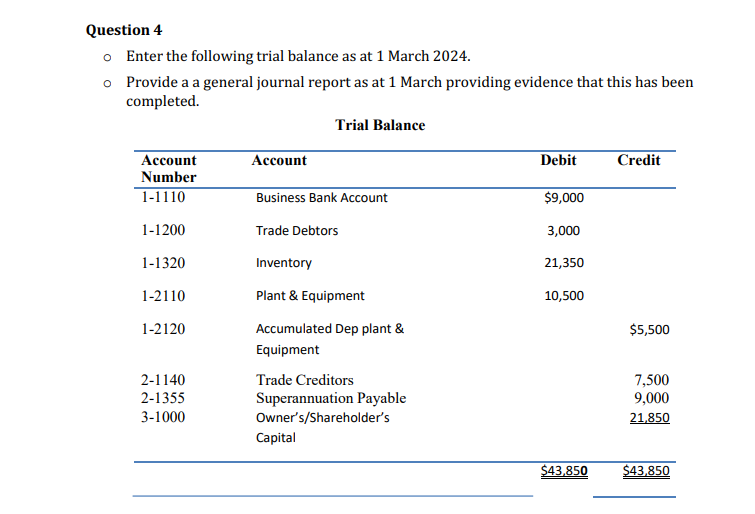

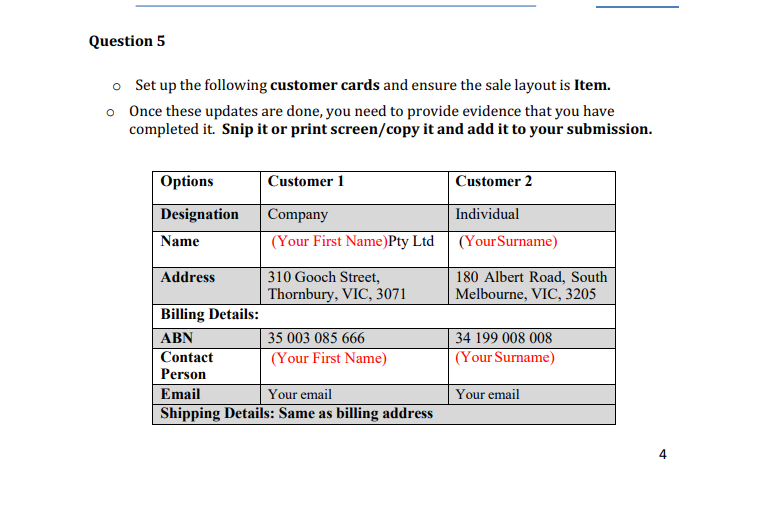

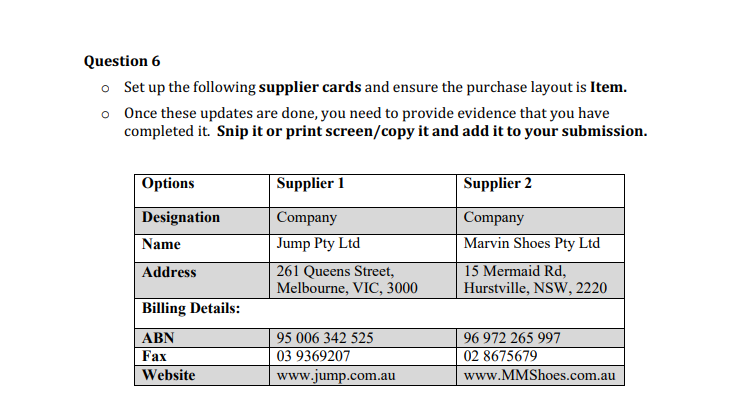

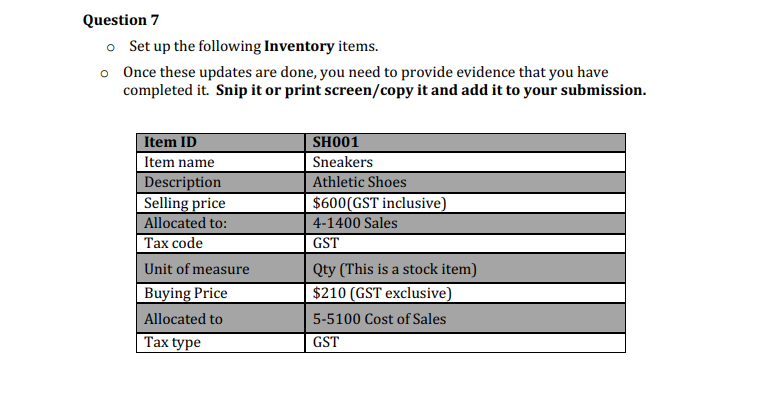

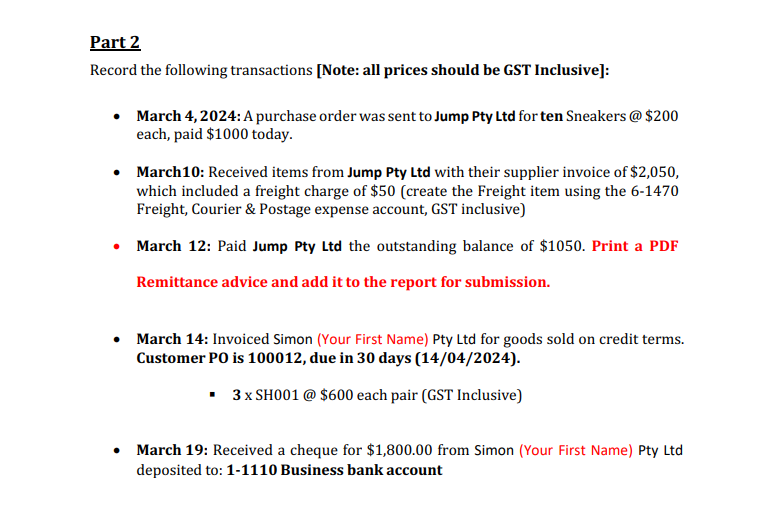

You are the owner of a successful small designer shoe store that purchases from popular sports shoe suppliers and sells to distributors throughout Australia. Besides managing the daily operational matters, you are also responsible for maintaining the accounting records. Since you have learnt accounting as a part of your course, you have decided to use a cloud-based accounting software package to account for your business. Your task is to set up your business profile and record and process daily transactions of your business using MYOB Business Essentials. It is hoped that at the end of each month, you will be able to evaluate the operation of your business by examining the financial information generated from the accounting software package. Your business is registered with the ATO for the Goods and Services Tax (GST), and it also has an Australian Business Number (ABN). Your business uses the accrual basis of accounting for both accounting and GST purposes. A perpetual inventory system is implemented using the 'average' method, and the terms of sale are Net 30 days. Payment discounts are offered to some loyal customers, and meanwhile, some suppliers offer prompt payment discounts. The CIC Higher Education policies about the conduct of student assessments apply. Part 1 Question 1 Create a new company file for your business, including the following details, Rename the file as your student number with the date you commence this exercise (eg. 12345): Company Name A.B.N. Address Phone Number Email Address Your Student Id and the date you commence the exercise (eg. S1234 11072023) Pty Ltd 26 988 827 222 108 Lonsdale St, Melbourne 3000 (03) 9299 9988 accounts@sportsshoes.com.au Financial Year 2024 Last Month of Financial Year December Conversion Month February Industry Type Retail Business Registered for GST Yes Reporting Frequency Quarterly Question 2 You are to review the accounts list, and you decide to add the following accounts to theaccounts list. Once these updates are done, you need to provide evidence that you have completed it. Snip it or print screen/copy it and add it to your submission. ACCOUNT ACCOUNT NAME NUMBER HEADER/DETAIL TAX ACCOUNT CODE 2-1555 Rent Payable Detail N-T 4-1401 Discount Received Detail FRE CLASSIFICATION/TYPE Other Liability Income Note: The company also added the following account name Acco Account Name unt Account Classification/Type Tax Code Header/Detail Num ber 5-5100 Cost of Sales Cost of Sales N-T Detail Question 3 You realised that some of the existing accounts need to be changed to new account names,please edit the following accounts from the accounts list. You will need to unlink the accounts to change the names. Once these updates are done, you need to provide evidence that you have completed it. Snip it or print screen/copy it and add it to your submission. ACCOUNT ACCOUNT NUMBER NAME NEW ACCOUNT NAME ACCOUNT TAX HEADE CLASSIFICATION/ CODE R/DETA TYPE IL 1-1200 2-1140 Accounts Receivab Trade Debtors Accounts payable Trade Creditors Accounts Receivable N-T Detail Accounts Payable N-T Detail Note: The company also changed the following account name Account Account Number Account Name Owner's Funds New Account Name Tax Code Header/Detail Classification/Type Introduced/Personal Owner's/Shareholder's 3-1000 Income Capital Equity N-T Detail Question 4 o Enter the following trial balance as at 1 March 2024. o Provide a a general journal report as at 1 March providing evidence that this has been completed. Trial Balance Account Account Debit Credit Number 1-1110 Business Bank Account $9,000 1-1200 Trade Debtors 3,000 1-1320 Inventory 21,350 1-2110 Plant & Equipment 10,500 1-2120 Accumulated Dep plant & $5,500 Equipment 2-1140 Trade Creditors 2-1355 Superannuation Payable 3-1000 Owner's/Shareholder's 7,500 9,000 21,850 Capital $43,850 $43,850 Question 5 Set up the following customer cards and ensure the sale layout is Item. Once these updates are done, you need to provide evidence that you have completed it. Snip it or print screen/copy it and add it to your submission. Options Customer 2 Individual (Your First Name)Pty Ltd (Your Surname) Customer 1 Designation Company Name Address 310 Gooch Street, Thornbury, VIC, 3071 Billing Details: ABN Contact Person Email Your email 35 003 085 666 (Your First Name) Shipping Details: Same as billing address 180 Albert Road, South Melbourne, VIC, 3205 34 199 008 008 (Your Surname) Your email 4 Question 6 Set up the following supplier cards and ensure the purchase layout is Item. Once these updates are done, you need to provide evidence that you have completed it. Snip it or print screen/copy it and add it to your submission. Supplier 2 Options Supplier 1 Designation Company Name Jump Pty Ltd Address Billing Details: ABN Fax Website 261 Queens Street, Melbourne, VIC, 3000 95 006 342 525 03 9369207 www.jump.com.au Company Marvin Shoes Pty Ltd 15 Mermaid Rd, Hurstville, NSW, 2220 96 972 265 997 02 8675679 www.MMShoes.com.au Question 7 Set up the following Inventory items. Once these updates are done, you need to provide evidence that you have completed it. Snip it or print screen/copy it and add it to your submission. Item ID Item name Description Selling price Allocated to: Tax code Unit of measure Buying Price Allocated to Tax type SH001 Sneakers Athletic Shoes $600(GST inclusive) 4-1400 Sales GST Qty (This is a stock item) $210 (GST exclusive) 5-5100 Cost of Sales GST Part 2 Record the following transactions [Note: all prices should be GST Inclusive]: March 4, 2024: A purchase order was sent to Jump Pty Ltd for ten Sneakers @ $200 each, paid $1000 today. March10: Received items from Jump Pty Ltd with their supplier invoice of $2,050, which included a freight charge of $50 (create the Freight item using the 6-1470 Freight, Courier & Postage expense account, GST inclusive) . March 12: Paid Jump Pty Ltd the outstanding balance of $1050. Print a PDF Remittance advice and add it to the report for submission. March 14: Invoiced Simon (Your First Name) Pty Ltd for goods sold on credit terms. Customer PO is 100012, due in 30 days (14/04/2024). 3x SH001 @ $600 each pair (GST Inclusive) March 19: Received a cheque for $1,800.00 from Simon (Your First Name) Pty Ltd deposited to: 1-1110 Business bank account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started