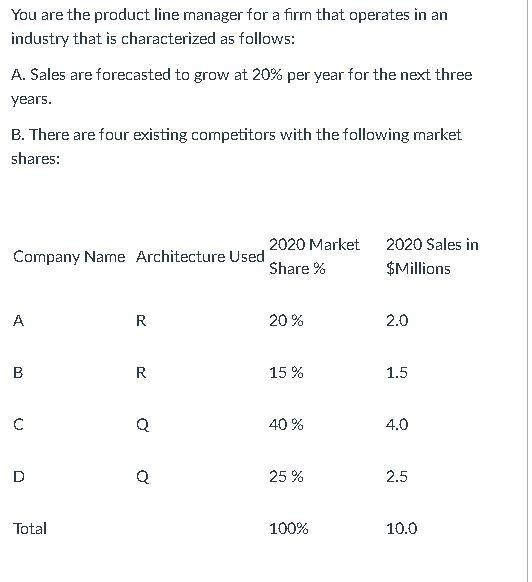

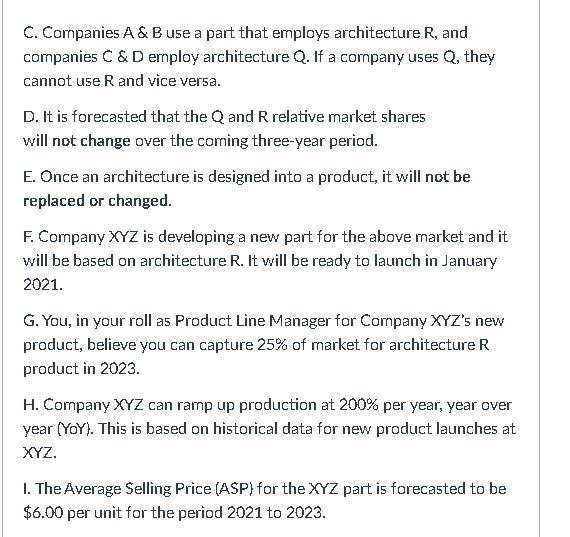

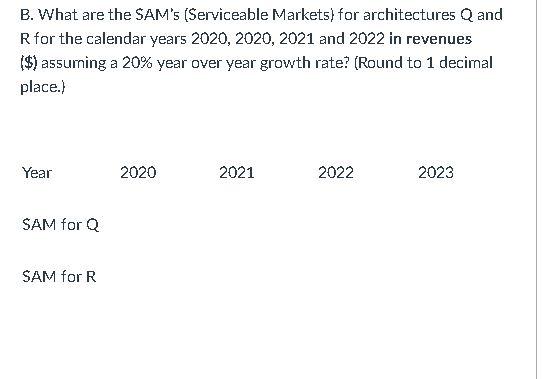

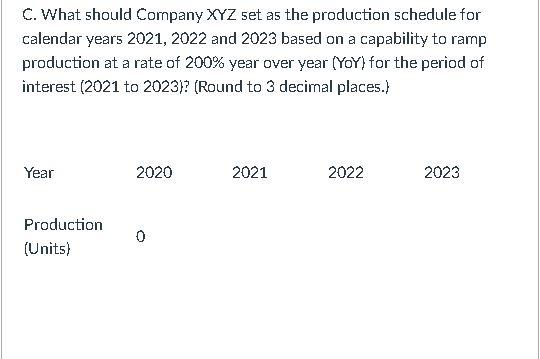

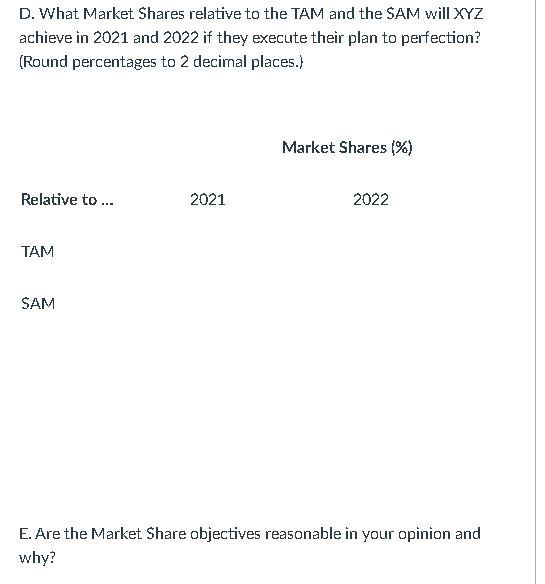

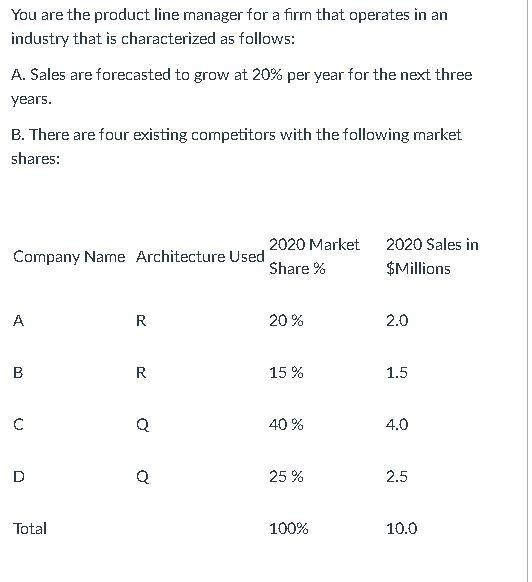

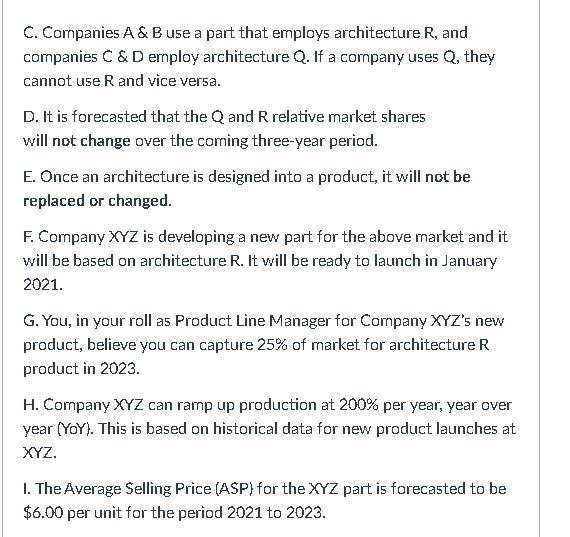

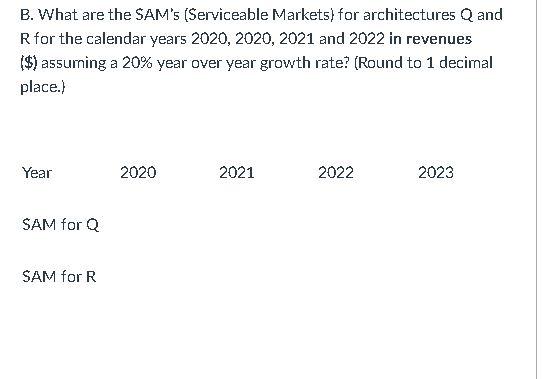

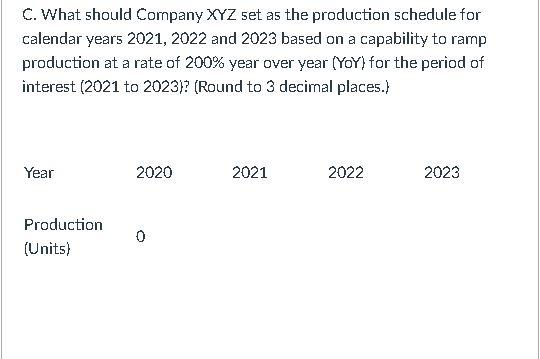

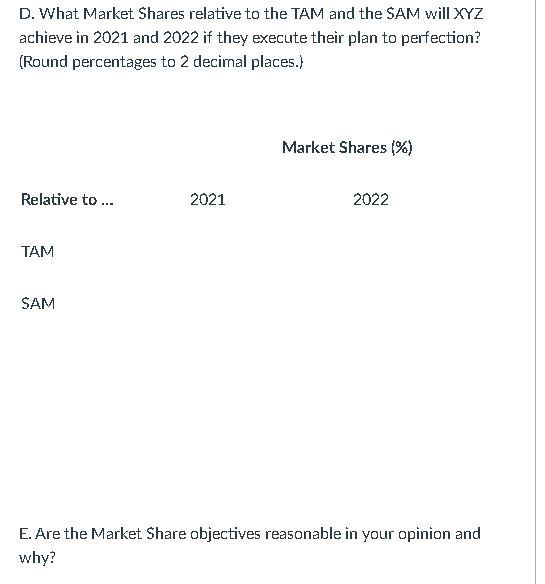

You are the product line manager for a firm that operates in an industry that is characterized as follows: A. Sales are forecasted to grow at 20% per year for the next three years. B. There are four existing competitors with the following market shares: 2020 Market Company Name Architecture Used Share % 2020 Sales in $Millions A R 20% 2.0 B R 15 % 1.5 C 40% 4.0 25 % 2.5 Total 100% 10.0 C. Companies A & B use a part that employs architecture R, and companies C&D employ architecture Q. If a company uses Q, they cannot use R and vice versa. D. It is forecasted that the Q and R relative market shares will not change over the coming three-year period. E. Once an architecture is designed into a product, it will not be replaced or changed. F. Company XYZ is developing a new part for the above market and it will be based on architecture R. It will be ready to launch in January 2021. G. You, in your roll as Product Line Manager for Company XYZ's new product, believe you can capture 25% of market for architecture R product in 2023. H. Company XYZ can ramp up production at 200% per year, year over year (YoY). This is based on historical data for new product launches at XYZ. 1. The Average Selling Price (ASP) for the XYZ part is forecasted to be $6.00 per unit for the period 2021 to 2023. A. What is the TAM (Total Available Market) for architectures Q and R (combined) for the calendar years 2021, 2022 and 2023 in revenues ($) assuming a 20% year over year growth rate? (Round to 1 decimal place.) Year 2020 2021 2022 2023 TAM $10M B. What are the SAM's (Serviceable Markets) for architectures Q and R for the calendar years 2020, 2020, 2021 and 2022 in revenues ($) assurning a 20% year over year growth rate? (Round to 1 decimal place.) Year 2020 2021 2022 2023 SAM for Q SAM for R C. What should Company XYZ set as the production schedule for calendar years 2021, 2022 and 2023 based on a capability to ramp production at a rate of 200% year over year (YoY) for the period of interest (2021 to 2023)? (Round to 3 decimal places.) Year 2020 2021 2022 2023 Production (Units) D. What Market Shares relative to the TAM and the SAM will XYZ achieve in 2021 and 2022 if they execute their plan to perfection? (Round percentages to 2 decimal places.) Market Shares (%) Relative to ... 2021 2022 TAM SAM E. Are the Market Share objectives reasonable in your opinion and why? You are the product line manager for a firm that operates in an industry that is characterized as follows: A. Sales are forecasted to grow at 20% per year for the next three years. B. There are four existing competitors with the following market shares: 2020 Market Company Name Architecture Used Share % 2020 Sales in $Millions A R 20% 2.0 B R 15 % 1.5 C 40% 4.0 25 % 2.5 Total 100% 10.0 C. Companies A & B use a part that employs architecture R, and companies C&D employ architecture Q. If a company uses Q, they cannot use R and vice versa. D. It is forecasted that the Q and R relative market shares will not change over the coming three-year period. E. Once an architecture is designed into a product, it will not be replaced or changed. F. Company XYZ is developing a new part for the above market and it will be based on architecture R. It will be ready to launch in January 2021. G. You, in your roll as Product Line Manager for Company XYZ's new product, believe you can capture 25% of market for architecture R product in 2023. H. Company XYZ can ramp up production at 200% per year, year over year (YoY). This is based on historical data for new product launches at XYZ. 1. The Average Selling Price (ASP) for the XYZ part is forecasted to be $6.00 per unit for the period 2021 to 2023. A. What is the TAM (Total Available Market) for architectures Q and R (combined) for the calendar years 2021, 2022 and 2023 in revenues ($) assuming a 20% year over year growth rate? (Round to 1 decimal place.) Year 2020 2021 2022 2023 TAM $10M B. What are the SAM's (Serviceable Markets) for architectures Q and R for the calendar years 2020, 2020, 2021 and 2022 in revenues ($) assurning a 20% year over year growth rate? (Round to 1 decimal place.) Year 2020 2021 2022 2023 SAM for Q SAM for R C. What should Company XYZ set as the production schedule for calendar years 2021, 2022 and 2023 based on a capability to ramp production at a rate of 200% year over year (YoY) for the period of interest (2021 to 2023)? (Round to 3 decimal places.) Year 2020 2021 2022 2023 Production (Units) D. What Market Shares relative to the TAM and the SAM will XYZ achieve in 2021 and 2022 if they execute their plan to perfection? (Round percentages to 2 decimal places.) Market Shares (%) Relative to ... 2021 2022 TAM SAM E. Are the Market Share objectives reasonable in your opinion and why