Question

You are the project manager for Eagle Golf Corporation. You are considering manufacturing a new golf wedge with a unique groove design. You have put

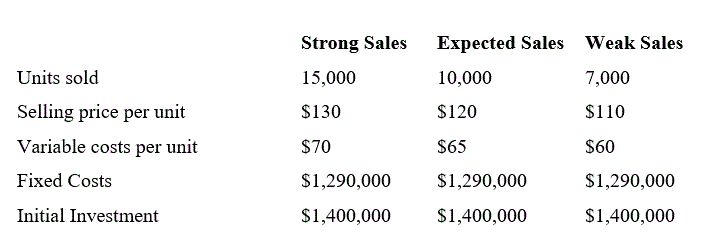

You are the project manager for Eagle Golf Corporation. You are considering manufacturing a new golf wedge with a unique groove design. You have put together the estimates in the following table about the potential demand for the new club, and the associated selling and manufacturing prices. You expect to sell the club for five years. The equipment required for the manufacturing process can be depreciated using straight-line depreciation over five years and will have a zero salvage value at the end of the projects life. No additional capital expenditures are required. No new working capital is needed for the project. The required return for projects of this type is 12 percent and the company has a 35 percent marginal tax rate. You estimate that there is a 50 percent chance the project will achieve the expected sales and a 25 percent chance of achieving either the weak or strong sales outcomes. What are the NPV, IRR, and payback of the new club? Should you recommend the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started