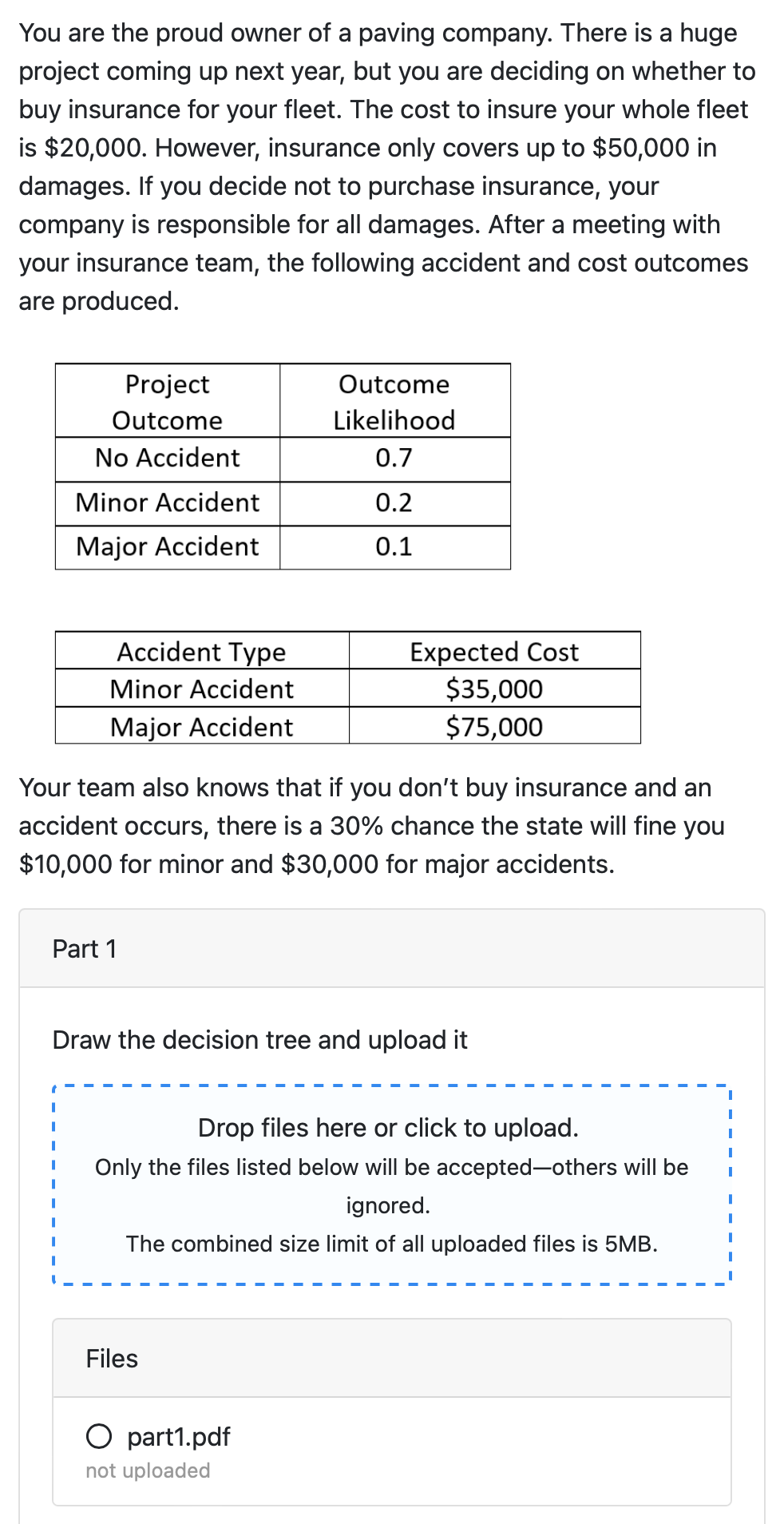

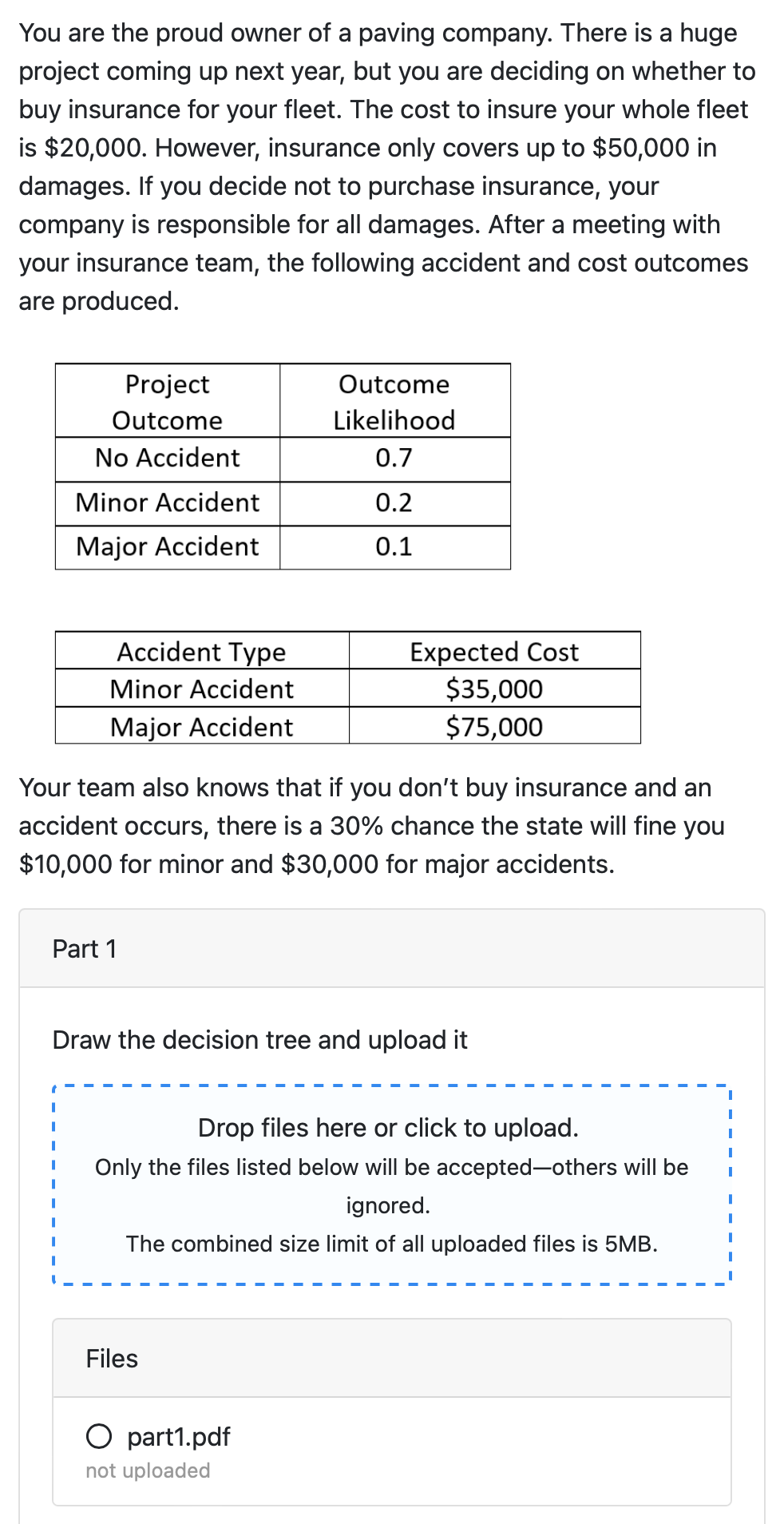

You are the proud owner of a paving company. There is a huge project coming up next year, but you are deciding on whether to buy insurance for your fleet. The cost to insure your whole fleet is $20,000. However, insurance only covers up to $50,000 in damages. If you decide not to purchase insurance, your company is responsible for all damages. After a meeting with your insurance team, the following accident and cost outcomes are produced. Your team also knows that if you don't buy insurance and an accident occurs, there is a 30% chance the state will fine you $10,000 for minor and $30,000 for major accidents. Part 1 Draw the decision tree and upload it Drop files here or click to upload. Only the files listed below will be accepted-others will be ignored. The combined size limit of all uploaded files is 5MB. Files part1.pdf not uploaded What are the expected cost for having no insurance? number ( rtol =0.01, atol =1e08) Part 3 What are the expected cost for having an insurance? number ( rtol =0.01, atol =1e0 Part 4 Pick the best option(s) among the two (a) No Insurance (b) Insurance You are the proud owner of a paving company. There is a huge project coming up next year, but you are deciding on whether to buy insurance for your fleet. The cost to insure your whole fleet is $20,000. However, insurance only covers up to $50,000 in damages. If you decide not to purchase insurance, your company is responsible for all damages. After a meeting with your insurance team, the following accident and cost outcomes are produced. Your team also knows that if you don't buy insurance and an accident occurs, there is a 30% chance the state will fine you $10,000 for minor and $30,000 for major accidents. Part 1 Draw the decision tree and upload it Drop files here or click to upload. Only the files listed below will be accepted-others will be ignored. The combined size limit of all uploaded files is 5MB. Files part1.pdf not uploaded What are the expected cost for having no insurance? number ( rtol =0.01, atol =1e08) Part 3 What are the expected cost for having an insurance? number ( rtol =0.01, atol =1e0 Part 4 Pick the best option(s) among the two (a) No Insurance (b) Insurance