You are the senior auditor with Roxbury University LLC CPAs and have been assigned to an inventory observation for the Accell Picnic Table Company, Inc., specifically for the Picnic Table inventory. Accell has two types of picnic tables, each with a different assigned inventory cost and description: (a) wooden picnic tables and (b) metal and composite plastic picnic tables.

Accell has a main location in Roxbury, CT where the picnic table parts are ordered and then the two types of picnic tables are assembled by Accells assemblers. The assemblers are full-time employees of Accell. Because the picnic tables are assembled continuously throughout the fiscal year, there is normally an inventory of parts on hand throughout the year.

Approximately 40% of the total value of the finished picnic tables are located in the Roxbury location, as well as the unassembled parts. Because of space limitations, however, the remaining 60% of the finished picnic tables are sent to three smaller shared warehouses located in Connecticut, New Hampshire and Pennsylvania. Accell staff plans to count inventory at all their locations on the same day at the companys fiscal year end. It appears the shared warehouses all have equal amounts of finished picnic tables. Youre concerned there is not enough audit staff at the Roxbury University to cover all the inventory observations at the four locations.

You have been provided with the following information at the audit planning meeting:

A detailed Picnic Table inventory record detailing all picnic tables expected to be at each location on the date of the inventory observation.

The clients Picnic Table manual describing the two types of tables, their descriptions and their standard costs. A map of each location showing the expected area where the inventories are located.

Required:(a) What evidence would you expect to find indicating that the observation of Accells physical count of inventory was well planned and that assistants were properly supervised? (b) What substantive procedures should you find in the audit documentation of Accell managements assertions about existence and completeness of inventory quantities at year end? You may use Appendix 9B of your textbook for the audit plans procedures. (c) If Roxbury University LLC does not have sufficient audit staff to observe inventories at all locations, what strategies could you use to possibly compensate for the shortfall in audit staffing?

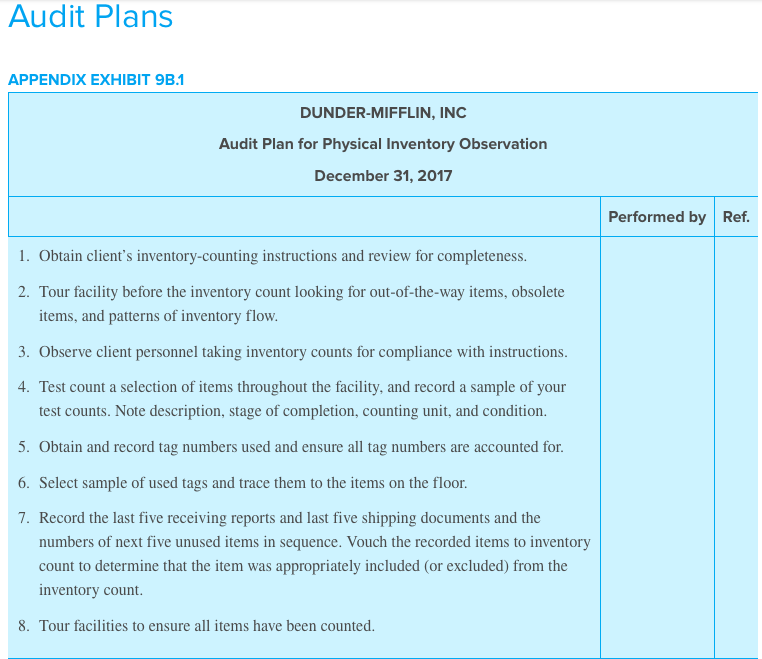

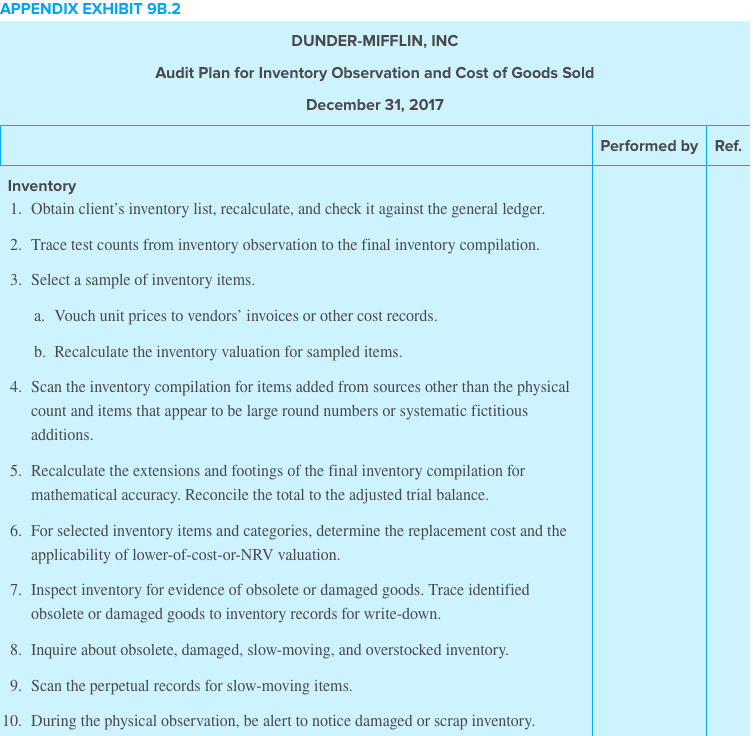

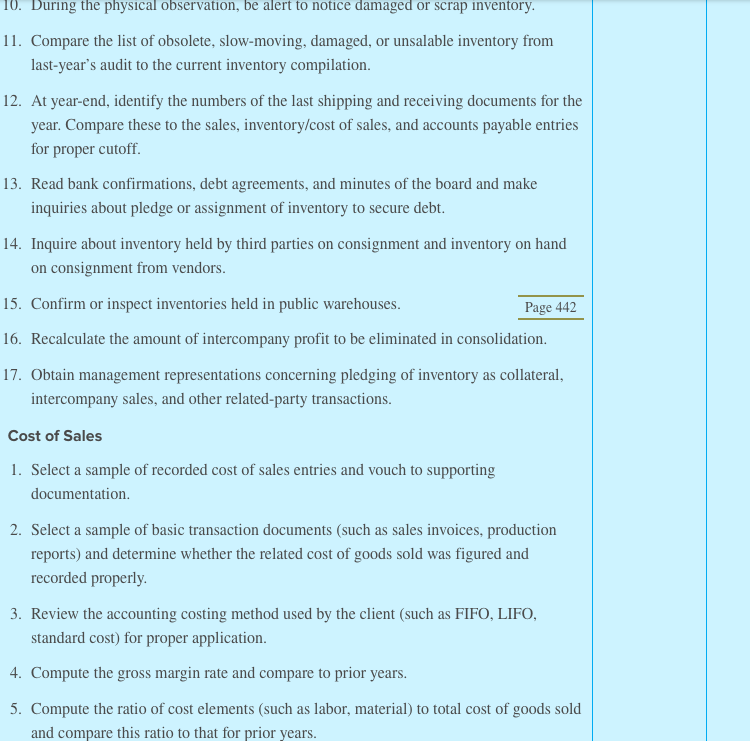

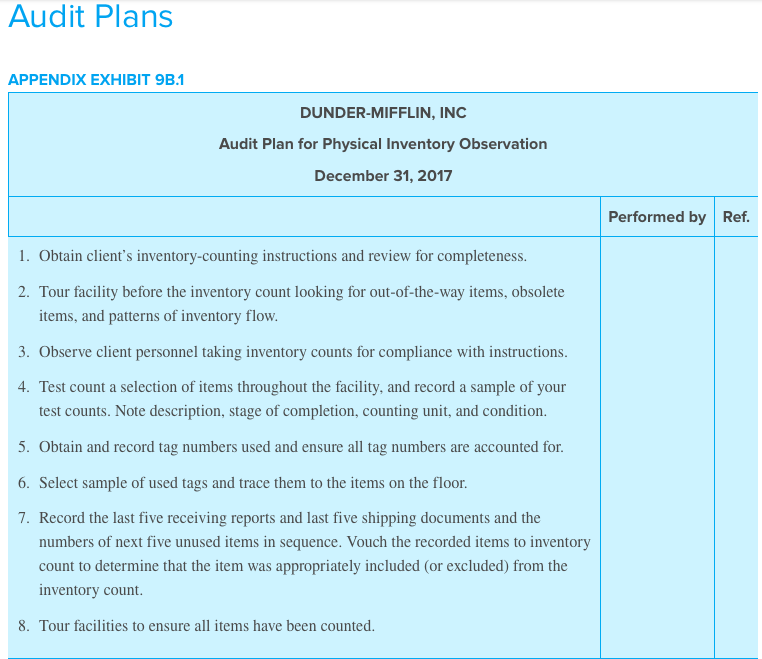

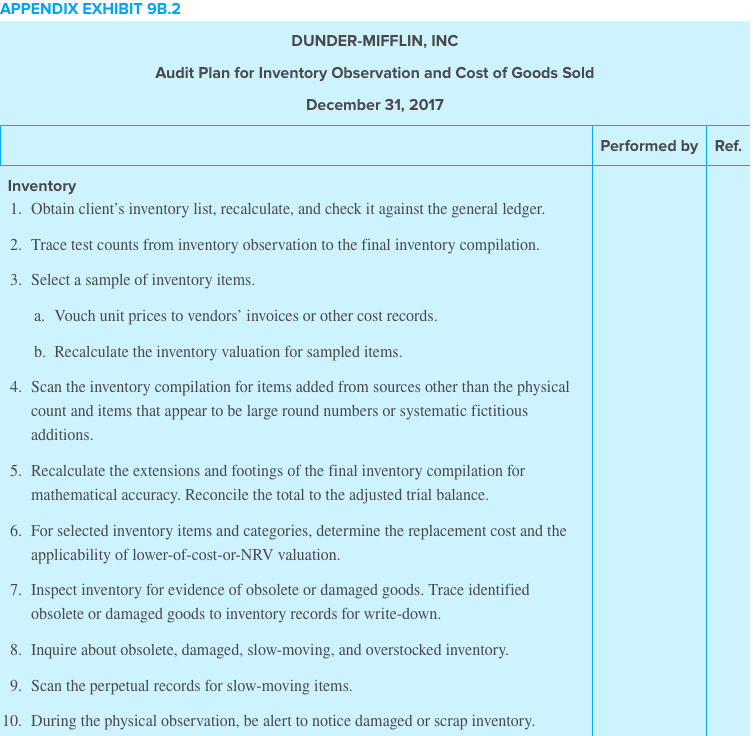

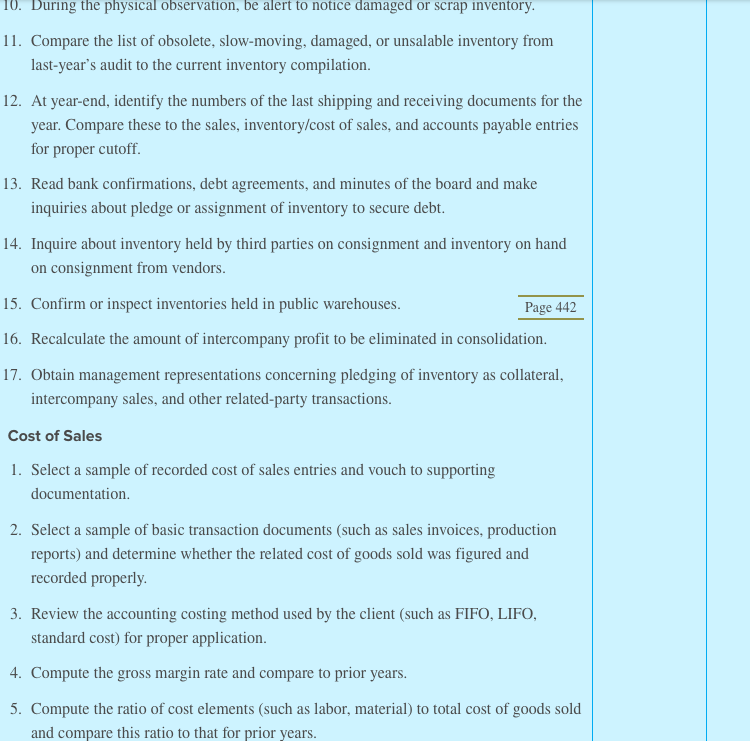

Audit Plans APPENDIX EXHIBIT 9B.1 DUNDER-MIFFLIN, INC Audit Plan for Physical Inventory Observation December 31, 2017 Performed by Ref. 1. Obtain client's inventory-counting instructions and review for completeness. Tour facility before the inventory count looking for out-of-the-way items, obsolete items, and patterns of inventory flow Observe client personnel taking inventory counts for compliance with instructions 4. Test count a selection of items throughout the facility, and record a sample of your test counts. Note description, stage of completion, counting unit, and condition 5. Obtain and record tag numbers used and ensure all tag numbers are accounted for 6. Select sample of used tags and trace them to the items on the floor 7. Record the last five receiving reports and last five shipping documents and the numbers of next five unused items in sequence. Vouch the recorded items to inventory t the item was appropriately included (or excluded from the inventory count 8. Tour facilities to ensure all items have been counted. APPENDIX EXHIBIT 9B.2 DUNDER-MIFFLIN, INC Audit Plan for Inventory Observation and Cost of Goods Sold December 31, 2017 Performed by Ref. Inventory 1. Obtain client's inventory list, recalculate, and check it against the general ledger 2 Trace test counts from inventory observation to the final inventory compilation. 3. Select a sample of inventory items. Vouch unit prices to vendors' invoices or other cost records. a. b. Recalculate the inventory valuation for sampled items Scan the inventory compilation for items added from sources other than the physical count and items that appear to be large round numbers or systematic fictitious additions 5. Recalculate the extensions and footings of the final inventory compilation for mathematical accuracy. Reconcile the total to the adjusted trial balance. 6. For selected inventory items and categories, determine the replacement cost and the applicability of lower-of-cost-or-NRV valuation. 7. Inspect inventory for evidence of obsolete or damaged goods. Trace identified obsolete or damaged goods to inventory records for write-down. 8. Inquire about obsolete, damaged, slow-moving, and overstocked inventory 9. Scan the perpetual records for slow-moving items 10. During the physical observation, be alert to notice damaged or scrap inventory to notice damaged or scrap inventory 10. During the physical observation, be alert l I. Compare the list of obsolete, slow-moving, damaged, or unsalable inventory from last-year's audit to the current inventory compilation 12. At year-end, identify the numbers of the last shipping and receiving documents for the year. Compare these to the sales, inventory/cost of sales, and accounts payable entries for proper cutoff. 13. Read bank confirmations, debt agreements, and minutes of the board and make inquiries about pledge or assignment of inventory to secure debt 14. Inquire about inventory held by third parties on consignment and inventory on hand on consignment from vendors. 15. Confirm or inspect inventories held in public warehouses. 16. Recalculate the amount of intercompany profit to be eliminated in consolidation 17. Obtain management representations concerning pledging of inventory as collateral, Page 442 intercompany sales, and other related-party transactions Cost of Sales 1. Select a sample of recorded cost of sales entries and vouch to supporting documentation. 2. Select a sample of basic transaction documents (such as sales invoices, production reports) and determine whether the related cost of goods sold was figured and recorded properly. 3. Review the accounting costing method used by the client (such as FIFO, LIFO, standard cost) for proper application 4. Compute the gross margin rate and compare to prior years. 5. Compute the ratio of cost elements (such as labor, material) to total cost of goods sold and compare this ratio to that for prior years. Audit Plans APPENDIX EXHIBIT 9B.1 DUNDER-MIFFLIN, INC Audit Plan for Physical Inventory Observation December 31, 2017 Performed by Ref. 1. Obtain client's inventory-counting instructions and review for completeness. Tour facility before the inventory count looking for out-of-the-way items, obsolete items, and patterns of inventory flow Observe client personnel taking inventory counts for compliance with instructions 4. Test count a selection of items throughout the facility, and record a sample of your test counts. Note description, stage of completion, counting unit, and condition 5. Obtain and record tag numbers used and ensure all tag numbers are accounted for 6. Select sample of used tags and trace them to the items on the floor 7. Record the last five receiving reports and last five shipping documents and the numbers of next five unused items in sequence. Vouch the recorded items to inventory t the item was appropriately included (or excluded from the inventory count 8. Tour facilities to ensure all items have been counted. APPENDIX EXHIBIT 9B.2 DUNDER-MIFFLIN, INC Audit Plan for Inventory Observation and Cost of Goods Sold December 31, 2017 Performed by Ref. Inventory 1. Obtain client's inventory list, recalculate, and check it against the general ledger 2 Trace test counts from inventory observation to the final inventory compilation. 3. Select a sample of inventory items. Vouch unit prices to vendors' invoices or other cost records. a. b. Recalculate the inventory valuation for sampled items Scan the inventory compilation for items added from sources other than the physical count and items that appear to be large round numbers or systematic fictitious additions 5. Recalculate the extensions and footings of the final inventory compilation for mathematical accuracy. Reconcile the total to the adjusted trial balance. 6. For selected inventory items and categories, determine the replacement cost and the applicability of lower-of-cost-or-NRV valuation. 7. Inspect inventory for evidence of obsolete or damaged goods. Trace identified obsolete or damaged goods to inventory records for write-down. 8. Inquire about obsolete, damaged, slow-moving, and overstocked inventory 9. Scan the perpetual records for slow-moving items 10. During the physical observation, be alert to notice damaged or scrap inventory to notice damaged or scrap inventory 10. During the physical observation, be alert l I. Compare the list of obsolete, slow-moving, damaged, or unsalable inventory from last-year's audit to the current inventory compilation 12. At year-end, identify the numbers of the last shipping and receiving documents for the year. Compare these to the sales, inventory/cost of sales, and accounts payable entries for proper cutoff. 13. Read bank confirmations, debt agreements, and minutes of the board and make inquiries about pledge or assignment of inventory to secure debt 14. Inquire about inventory held by third parties on consignment and inventory on hand on consignment from vendors. 15. Confirm or inspect inventories held in public warehouses. 16. Recalculate the amount of intercompany profit to be eliminated in consolidation 17. Obtain management representations concerning pledging of inventory as collateral, Page 442 intercompany sales, and other related-party transactions Cost of Sales 1. Select a sample of recorded cost of sales entries and vouch to supporting documentation. 2. Select a sample of basic transaction documents (such as sales invoices, production reports) and determine whether the related cost of goods sold was figured and recorded properly. 3. Review the accounting costing method used by the client (such as FIFO, LIFO, standard cost) for proper application 4. Compute the gross margin rate and compare to prior years. 5. Compute the ratio of cost elements (such as labor, material) to total cost of goods sold and compare this ratio to that for prior years