Question

You are the senior manager in charge of innovation at your company. Over the past several years you company has done, only OKAY, in terms

You are the senior manager in charge of innovation at your company. Over the past several years you company has done, only OKAY, in terms of developing a new-product development portfolio. After attending Trine University Innovation Days and listening to students discuss the importance of several strategies in selecting profitable projects through managing resources and making tough decisions on what projects live and what projects die, you have decided to take this approach to developing your companys portfolio.

After reviewing these strategies for new-product development with your director of R&D, he has decided to provide you with the necessary budget and man-power to revolutionize your companys new product portfolio. However, he noticed several interesting analysis tools based on your review of the Innovation Days, and has tasked you and your team with presenting four (4) scenarios for his review before moving forward with the go/kill decision point.

As luck would have it, your team has passed through Discovery and Scoping, and in the second screen you have already narrowed the number of projects to nine (9). You are in Stage Two (2): Building the business case. The scenarios your director has provided you are as follows:

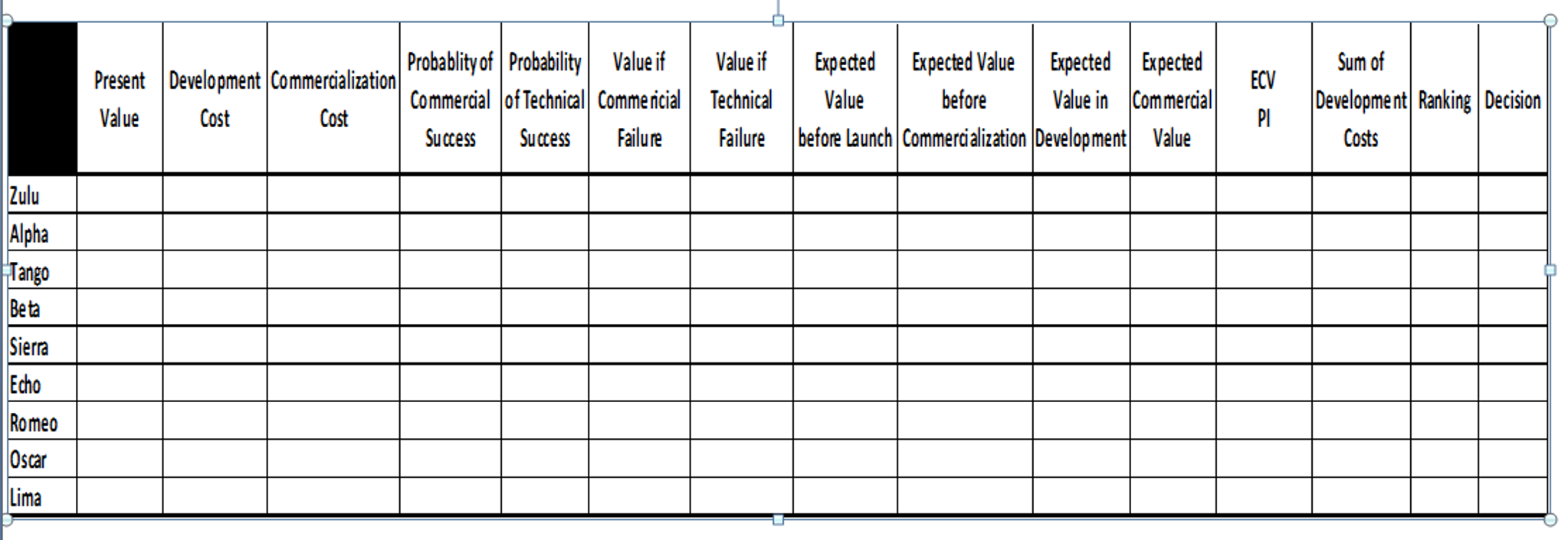

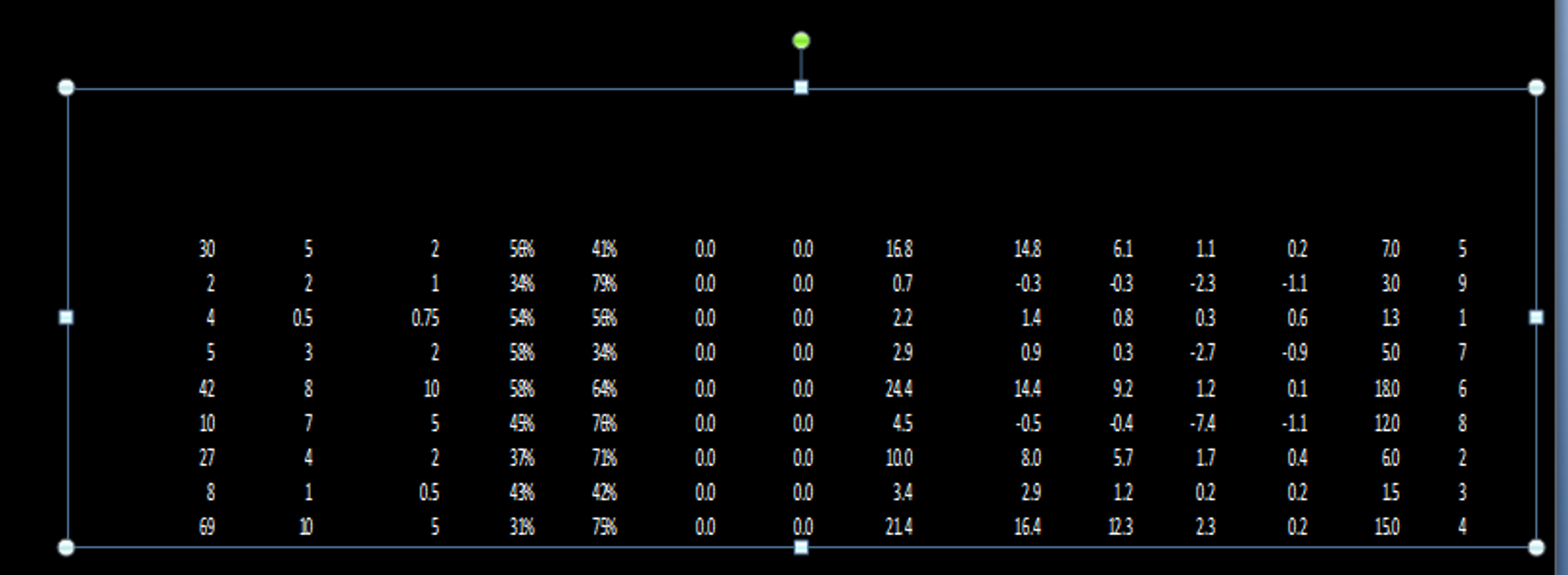

Scenario 4 ECV PI, A Trimmed Budget, and Modified Risk

$17.5M Budget, Minimize Risk

Your director, given the ability to implement risk into the decision process, wants to evaluate one additional scenario. The VP mention in his staff meeting last week that the market is changing and he may be implementing a 30% reduction in budgets across the company. Assuming this information to be true, your team has created a scenario based on the changing market that has updated rick assessments forboth the probability of commercial and technical success. Using this information, prepare a report analyzing the ECV PI of each project, rank those projects, and provide a Go/Kill recommendation for each, maintaining your $25M development budget. Maximize the ECV of your portfolio using this method and new data.

The values for the box is given in the below box

The values for the box is given in the below box

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started